Finance

1 Great Artificial Intelligence (AI) Stocks to Buy in May

Artificial intelligence (AI) is a new tool for most businesses, but not for Lemonade (NYSE:LMND). It has been using the technology to transform the insurance industry since 2015, and it is resonating with consumers fed up with traditional practices.

Lemonade uses AI to autonomously write quotes, process claims, calculate premiums, and even determine where to invest its marketing dollars. The end result is an insurance platform that is both more convenient and (in many cases) cheaper for customers.

The stock is trading 89% below its all-time high during the 2021 tech frenzy. The valuation was a bit irrational at the time, but since then the company has grown significantly in every sense. After it recently reported financial results for the first quarter of 2024, the stock immediately fell 10% in after-hours trading.

Here’s why Lemonade could continue that momentum through the rest of May – and beyond.

Recreating the insurance experience with AI

Lemonade had nearly 2.1 million customers at the end of the first quarter, an increase of 12.9% compared to the same period last year. Research shows it is incredibly popular among younger consumers, including those who may be buying insurance for the first time. However, the company is also pulling many of its customers away from traditional, entrenched insurance giants, underscoring the push for change.

Adoption has been rapid, as Lemonade was only founded nine years ago and operates in just five countries: the United States, Germany, France, the United Kingdom and the Netherlands. Lemonade also currently offers only five products, including renters insurance, homeowners insurance, life insurance, pet insurance and car insurance. In other words, there is plenty of room for this company to expand both its product portfolio and its geographic footprint.

As I said at the top, AI is a big believer in its success thus far. Lemonade’s AI chatbot, Maya, can present a quote to a potential customer in less than 90 seconds, and the other AI bot, Jim, can pay claims in three minutes without human intervention. It’s a welcome change from the traditional claims process, which often involves multiple phone calls and long wait times.

But Lemonade’s use of AI goes much deeper than the customer experience. The company launched its Lifetime Value 6 (LTV 6) model in 2022, which predicted things like customer churn, the likelihood of a claim and the likelihood that a customer would buy multiple policies to more accurately determine premiums. Additionally, it analyzed product and geographic market performance to help Lemonade adapt its marketing strategies more quickly. The company now uses LTV 9, with each new version being more accurate than the last.

AI also helps Lemonade manage core metrics such as the Loss Adjustment Expense (LAE) ratio, which measures the cost of managing claims. A 10% LAE is common in the insurance industry, but Lemonade’s is just 7.6%, thanks in part to its highly automated claims process. Lemonade was even able to reduce its workforce by 11% last year even as its insurance portfolio grew by 22%, which is a testament to the power of AI.

Growing earnings and decreasing losses are a recipe for happy investors

Lemonade’s prevailing premiums (the total value of all active policies) reached a record high of $794 million in the first quarter, up 21.5% year over year. At the same time, the gross loss ratio fell eight percentage points to 79%, and the company is on a clear trajectory toward the company’s long-term target of 75%.

The gross loss ratio measures how much Lemonade pays out in claims as a percentage of the premiums it receives, and 75% or less is typically the sweet spot for a thriving insurance business. There will be bumps in Lemonade’s journey toward that goal as it enters new countries and launches new products, because it takes time to achieve scale.

Lemonade’s average premium per customer also reached a record high of $379 in the first quarter, and has risen consistently in recent years as more customers opt for multiple policies.

All of the above translated into record revenue of $119.1 million in the first quarter, representing a growth of 25.1% compared to the first quarter of 2023. Since the company’s operating costs only increased by 2.7%, Lemonade managed to reduce its net loss by 28.1% to just $47.3 million. .

Achieving profitability has been a focus for Lemonade’s investors, and management now expects cash flow could be positive by the end of 2024. That was brought forward from previous guidance that suggested the first quarter of 2025, and it’s a big reason why Lemonade shares fell 10% after its earnings report. This milestone ensures that the company can stand on its own two feet without the need for further capital injections.

Why Lemonade Stocks are Buy Now

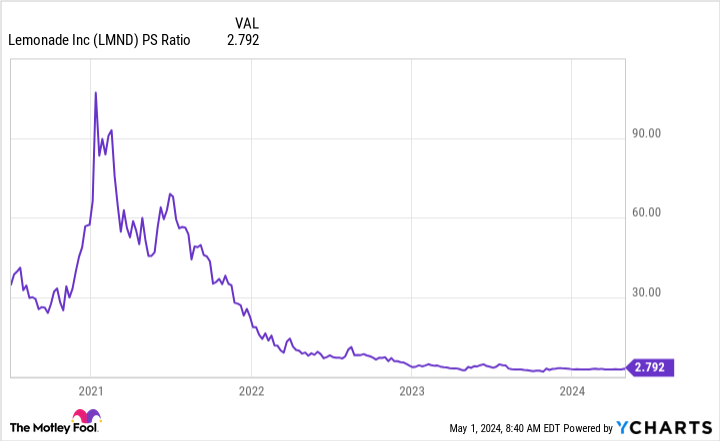

As I previously touched on, Lemonade stock is down 89% from its all-time high of $164. Investors took valuation to unrealistic heights in 2021 amid a frenzy in the tech sector, but the subsequent decline could be a golden opportunity given strong progress in the company’s underlying businesses.

Moreover, Lemonade’s opportunities in the insurance sector are huge. The U.S. auto insurance industry alone is expected to generate $364.9 billion in revenue by 2024, so the company has barely scratched the surface of its addressable market.

Based on Lemonade’s trailing-twelve-month revenue of $453.7 million and its current market cap of $1.3 billion, the stock trades at a price-to-sales ratio (P/S) of just 2.8. That is almost the cheapest level since the company went public four years ago:

Insurance is a product that most people buy forever, and Lemonade’s focus on technology attracts younger customer groups that could have the highest lifetime value. Furthermore, the company has barely penetrated the markets it currently operates in, and there are so many other markets it has not even entered yet.

As a result, Lemonade stock could be a great buy right now, especially after its strong first-quarter report.

Should You Invest $1,000 in Lemonade Right Now?

Before you buy shares in Lemonade, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Lemonade wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Lemonade. The Motley Fool has one disclosure policy.

1 Great Artificial Intelligence (AI) Stocks to Buy in May was originally published by The Motley Fool