Finance

1 Unstoppable stock that joins Nvidia, Apple and Microsoft in the $3 Trillion Club

The US economy has a centuries-long history of producing the world’s most valuable companies:

-

American steel became the first company in the world to be valued at $1 billion in 1901.

-

General engines was part of the auto manufacturing boom, becoming the first company to be valued at $10 billion in 1955.

-

General Electric built a conglomerate that sold a wide range of products, from aircraft engines to home appliances, and in 1995 became the world’s first company to be valued at $100 billion.

-

Apple achieved a $1 trillion valuation in 2018 after the incredible success of devices like the iPhone.

Microsoft, Nvidia, Amazon, MetaplatformsAnd Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) have since joined Apple in the trillion dollar club.

In fact, Apple, Microsoft and Nvidia have each reached the ultra-exclusive $3 trillion level, but I think another company will join them.

Alphabet is the technology conglomerate behind Google, YouTube, Waymo, DeepMind and numerous other subsidiaries. It is a recognized leader in the fast-growing artificial intelligence (AI) space, which could be the ticket to a $3 trillion valuation by the end of 2025.

Alphabet is currently valued at $2.3 trillion, so investors who buy the stock today could enjoy a 32% gain if it joins the likes of Apple, Microsoft and Nvidia.

Alphabet is transforming its traditional businesses with AI

Alphabet is at a crossroads. The company generates more than half of its revenue from Google Search, which has a 91% market share in the Internet search industry. However, AI Chatbots like ChatGPT provide an easier way to access and produce information directly. Microsoft even struck a deal with OpenAI last year to use ChatGPT in its Bing search engine in an effort to disrupt Google.

But Google Search has been the window to the Internet for decades, so Alphabet arguably has more valuable data to build with AI models than any other tech giant. Last year it launched its own chatbot called Bard, which grew into a family of multimodal models called Gemini. They can interpret and produce text, images, videos and even computer code.

Additionally, Alphabet just introduced AI summaries to the traditional Google search experience. They are text-based answers that appear at the top of search results, saving users from having to scroll through web pages to find answers to their questions. Alphabet says its referral links in AI listings receive more clicks than those appearing in traditional search results, which could generate more ad revenue and ease concerns about Google losing its dominance.

Additionally, the Gemini models create several other AI monetization opportunities. Google Workspace users can now add Gemini for an additional monthly subscription fee, increasing their productivity in applications like Google Docs, Sheets and Gmail.

Additionally, the Gemini models are now available on Google Cloud, so developers can use them (along with over 130 others from third parties) to build their own AI applications. This is a major cost savings for companies compared to creating a large language model (LLM) from scratch, which takes time, truckloads of data and significant financial resources.

Solid financial growth

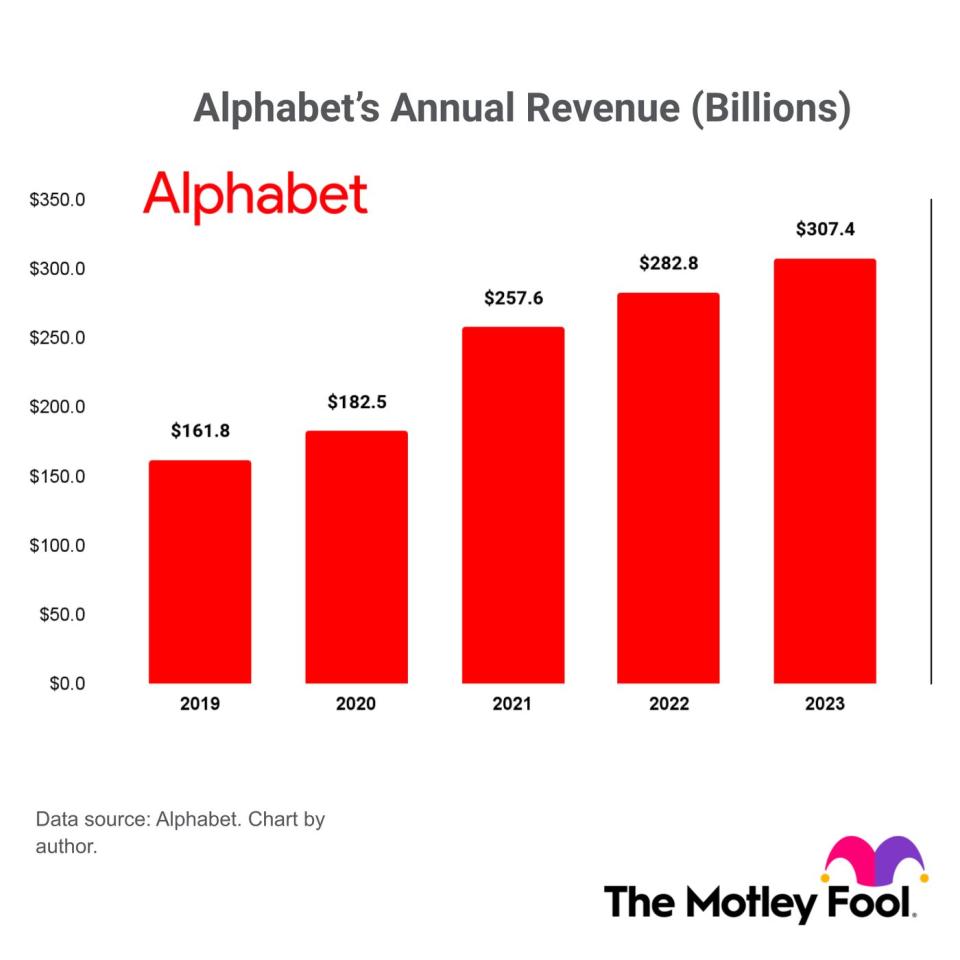

In the five years between 2019 and 2023, Alphabet’s revenue grew at a compound annual rate of 13.7%, bringing in a record $307.4 billion last year alone:

The company started 2024 with revenue up 15% above trend in the first quarter (year-over-year). Google Search revenue alone rose 14.3%, the fastest pace in almost two years. YouTube’s revenue growth accelerated to 20.8%, and Google Cloud remained the fastest growing part of the business, with revenue up 28.4%.

Improved market conditions helped enormously, following a painful slump in the advertising industry in 2022 and 2023 due to uncertain economic conditions. But Alphabet could experience even faster growth in the second half of this year as the US Federal Reserve is expected to cut interest rates three times in the coming months. It could push companies to spend more money on marketing as they try to reach a consumer with more money in their pockets.

Alphabet’s (mathematical) path to the $3 trillion club

Alphabet generated earnings per share of $6.52 over the last four quarters, and based on the current share price of $185.01, it exceeds a price-to-earnings (P/E) ratio of 28.3.

That is cheaper than the price-earnings ratio of 32.7 Nasdaq-100 index, which makes Alphabet technically undervalued compared to its peers in the technology sector.

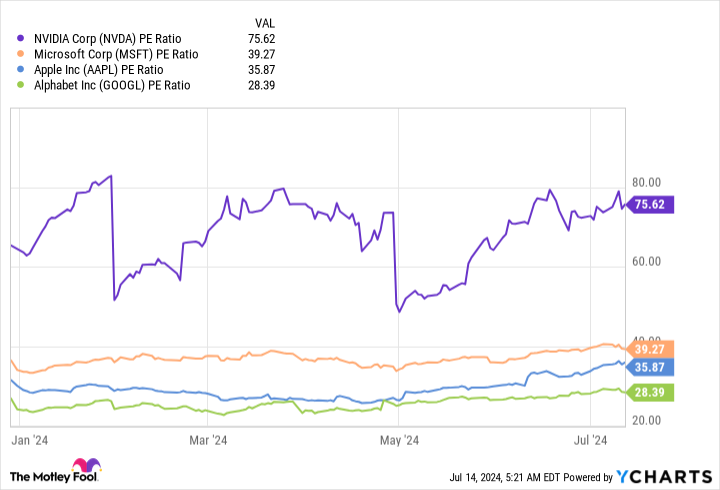

It also makes Alphabet much cheaper than all three members of the $3 trillion club, which trade at an average price-to-earnings ratio of 50.2 (which is heavily distorted by Nvidia’s high valuation):

I don’t think it would be appropriate for Alphabet’s price-to-earnings ratio to rise to 50.2, but if it did, it would value the company at well over $4 trillion. But it could be rise to the average price-to-earnings ratio of Apple and Microsoft (37.6), which would be enough to put Alphabet in the $3 trillion club.

But even if Alphabet doesn’t experience any expansion (an increase in its price-to-earnings ratio), it could join the $3 trillion club within the next 18 months based solely on the growth of its business.

How? Wall Street expects the company to post earnings per share of $8.61 in 2025, putting Alphabet’s forward price-to-earnings ratio at 21.5. That means shares need to rise 32% between now and then to hold their ground current Price/earnings ratio of 28.3. Those profits will be enough to value the company at $3 trillion.

I’m not the only one who thinks Alphabet is great value at its current price. The company expanded its share buyback program earlier this year by as much as $70 billion, meaning it will periodically buy chunks of its own stock to return cash to shareholders.

In summary, Alphabet has more than one entry into the exclusive $3 trillion club, and investors who buy the stock today can make a nice profit along the way.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $787,026!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns July 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors, long January 2026 $395 calls on Microsoft, and short January 2026 $405 calls on Microsoft. The Motley Fool has one disclosure policy.

1 Unstoppable stock that joins Nvidia, Apple and Microsoft in the $3 Trillion Club was originally published by The Motley Fool