Finance

2 historically cheap energy stocks with ultra-high returns that are now begging to be bought

For more than a century, Wall Street has been a wealth-building machine. Today, investors can choose from thousands of publicly traded companies and exchange-traded funds when they want to put their money to work.

But among the countless strategies that can be employed to grow your savings on Wall Street, few have been more successful over the past half century than buying and holding high-quality stocks. dividend stocks.

In recent weeks, Hartford Funds analysts have refreshed many of the data sets published in a report (“The Power of Dividends: Past, Present, and Future”) released last year in partnership with Ned Davis Research. Specifically, the duo examined the average annual returns of dividend payers versus non-payers over the past half-century (1973-2023), and compared how volatile income stocks were relative to non-payers.

Hartford Funds found that publicly traded companies with no dividends generated a modest average annual return of 4.27% over 50 years and were 18% more volatile than the benchmark S&P500. On the other hand, dividend payers the average annual return of non-payers more than doubled (9.17%), despite being 6% less volatile than the widely followed S&P 500.

One sector known for its juicy dividends is the energy sector. The energy sector includes oil and gas drilling, midstream and refining companies, O&G equipment suppliers, and a handful of coal and uranium producers.

Of the nearly 200 energy stocks with a market cap of at least $300 million, 50 support an ultra-high yield dividend, that is, a dividend at least four times the return of the S&P 500. Among these 50 energy income stocks are two historically cheap companies with an average yield of 9.87% that are now begging to be bought by opportunistic investors.

Time to Strike: Enterprise Products Partners (7.27% return)

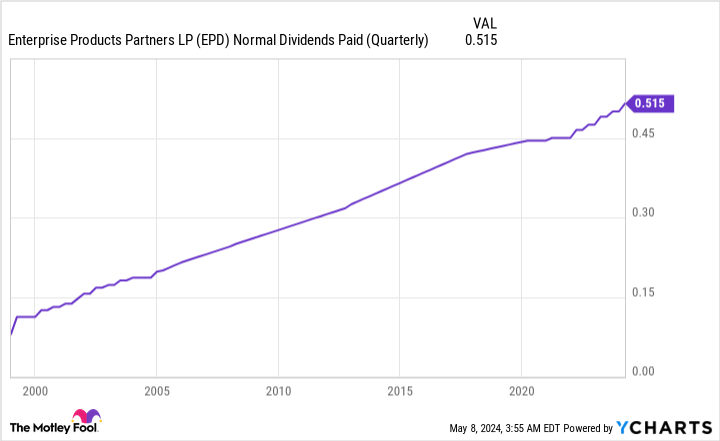

The first supercharged energy dividend stock that should have investors ready to pounce is none other than Partners for business products (NYSE:EPD). Enterprise has a market yield of 7.3% and has consistently increased its annual base benefit over the past 25 years.

For some investors, the idea of putting their money to work in O&G stock is troubling, given what happened to energy commodities four years ago. In April 2020, during the early stages of the COVID-19 pandemic, crude oil futures briefly fell to negative $40 a barrel.

However, Enterprise Products Partners was able to avoid this operational roller coaster. That’s because it’s not a drill. It is one of America’s largest midstream O&G companies.

Midstream companies are best viewed as energy intermediaries. They enter into contracts with upstream (drilling) energy companies and provide the transport and storage of oil, natural gas, natural gas liquids and refined products. Enterprise oversees more than 50,000 miles of transmission pipelines and can store more than 300 million barrels of liquids and 14 billion cubic feet of natural gas.

The “secret sauce” of Enterprise Products Partners is the contracts. It negotiates long-term agreements with upstream energy companies, which have predominantly fixed fees. Fixed fee contracts remove the effects of inflation and spot price volatility from the equation, resulting in highly predictable operating cash flow year after year.

Being able to accurately predict operating cash flow is critical when it comes to spending capital on additional acquisitions and new projects. The company’s management team has allocated approximately $6.9 billion to major projects, many of which are aimed at expanding natural gas liquids capacity. These projects should increase operating cash flow incrementally over time.

I would also like to add that the company’s transparent and predictable cash flow ensured that distribution was never in danger of being reduced or halted during the height of the pandemic. While a distribution coverage ratio (DCR) – the amount of distributable cash a company brings in divided by what it pays out to its investors – of 1 or lower would signal an unsustainable payout, Enterprise’s DCR never fell below 1.6 during the pandemic. .

Macroeconomic catalysts can also drive growth for Enterprise Products Partners. Several years of reduced capital spending by major energy companies during the pandemic have limited the global supply of oil. As long as supply remains tight, the spot price of crude oil should rise. In other words, it will likely encourage domestic drillers to ramp up production, which could in turn help Enterprise win more lucrative, long-term, fixed-fee contracts.

Enterprise Products Partners looks particularly cheap at a multiple of roughly seven times estimated 2025 cash flow.

Time to Strike: Alliance Resource Partners (12.46% return)

The other historically cheap, ultra-high return energy stock now begging to be bought is the coal company Alliance Resource Partners (NASDAQ: ARLP). Although Alliance Resource buckled under the pressure of a historic demand cliff for energy commodities in the early stages of the pandemic, it has since reintroduced and significantly expanded its quarterly distribution. Currently, it fetches a 12.5% return for its investors.

The obvious concern about coal stocks is that they are yesterday’s news. At the start of this decade, it was widely expected that utilities and businesses would invest aggressively in clean energy solutions, such as wind and solar, leaving the coal industry to slowly wither away. However, the pandemic changed everything.

As global energy companies have cut back on capital expenditure, the coal industry has been the only one able to take the initiative and pick up the slack. Alliance Resource and its peers have experienced a resurgence in demand for coal, as well as an all-time high selling price per tonne.

The Federal Reserve’s aggressive monetary policy was also inadvertently positive for Alliance Resource Partners. Undertaking clean energy projects costs a lot of money. With interest rates rising at the fastest pace in forty years, the returns on investments in solar and wind energy projects are no longer so compelling.

On the other hand, Alliance Resource Partners’ management team has done an excellent job of expanding production conservatively while keeping debt service costs manageable. The company ended the March quarter with net debt of $297.1 million and generated nearly $210 million in net cash flow from its operating activities. A higher interest rate environment is not really a concern for Alliance Resource.

The company’s management team also deserves credit for the way it generates predictable cash flow year in, year out. The not-so-subtle trick is the willingness to price and commit production up to four years in advance. Based on an average of 34.9 million tons of expected coal production in 2024, the company has already priced and committed 32.6 million tons this year, along with 16.3 million tons next year. Capturing these commitments at per-ton prices well above their historical norm is a stroke of genius that has led to the generation of transparent cash flows.

Something else to note about Alliance Resource Partners is that it has diversified its business by purchasing royalty interests from O&G. Simply put, if the spot price of crude oil or natural gas rises, chances are the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) will rise as well.

Finally, the rating is very meaningful. An earnings multiple of six over the next year is a cheap price for a leading coal company operating at full capacity.

Should you invest $1,000 in Enterprise Products Partners now?

Before purchasing shares in Enterprise Products Partners, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has one disclosure policy.

Time to Strike: 2 Historically Cheap, Ultra-High Yield Energy Stocks That Are Now Begging to Be Buy was originally published by The Motley Fool