Finance

2 incredibly cheap dividend stocks to buy now

Cheap stocks have become cheap for a reason, and that’s one of the hard truths of value investing. Normally, you should be willing to go against the grain and buy stocks out of favor, despite the market’s concerns. Straight away Rexford Industrial (NYSE: REXR) And Toronto Dominion Bank (NYSE:TD) are lurking, but that means they both have historically high dividend yields. Now is the time to act. This is why.

Rexford focuses on an attractive market

When it comes to warehouses, Southern California is quite unique. It is the largest industrial market in the United States. If you were to break it away from the broader United States, it would be the fourth largest industrial market in the world, and is more than twice the size of the second largest US market, New York and New Jersey.

Despite its size, it has a lower vacancy rate than the other major US markets. Supply is limited, with demand for housing often leading to older industrial assets being converted into houses or apartments, among other things. And if that weren’t enough, there is limited new construction of industrial assets. Overall, Southern California is a very attractive place to own industrial assets, which is why Rexford Industrial is focusing on the region.

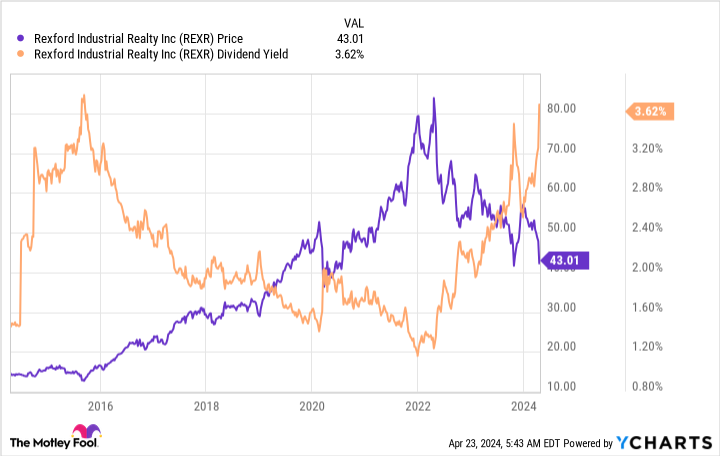

The real estate investment fund (REIT) just announced solid results for the first quarter of 2024, with funds from operations up 20.3%. However, investors are concerned that rent increases are starting to slow after the blistering pace of the past few years. The company slightly raised its full-year guidance, but shares still fell, sending yields soaring to a 10-year high.

This is a buying opportunity for long-term investors. In particular, Rexford believes that the redevelopment and repositioning of existing properties will be the key drivers of growth between 2024 and 2026. That’s already built into the portfolio, so there’s no reason to believe the REIT can’t get this done. While the dividend yield While the dividend is modest at 3.8%, the dividend has increased by around 15% annually over the past decade, with higher growth rates in more recent years. If you’re a dividend growth investor, Rexford looks both cheap and attractive today.

Toronto-Dominion Bank is facing some headwinds

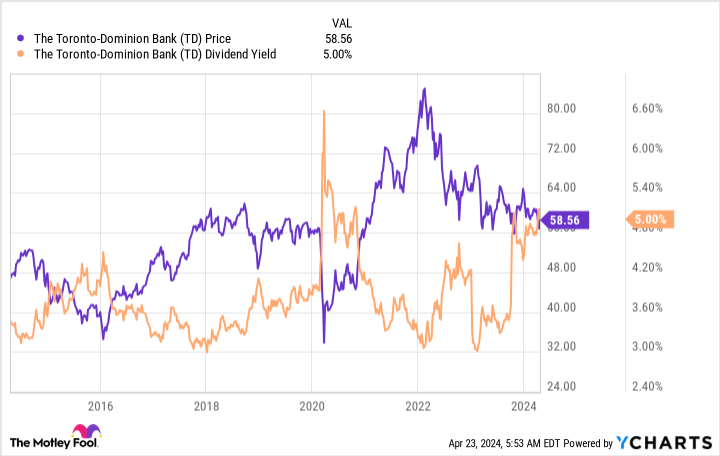

TD Bank is the sixth-largest bank in North America by assets, and the second-largest bank in Canada for that matter. It is an industry giant that competes with American companies such as bank of America (NYSE: BAC) And Citi Group (NYSE:C). But there’s one thing dividend investors should keep in mind: During the Great Recession, Bank of America and Citi both cut their dividends. TD Bank did not. If dividend consistency is important to you, take a look at TD Bank and its historically high 5.1% yield.

There are of course issues to consider. For example, the Canadian housing market is cooling down after a big run-up. Add to that the rapid rise in interest rates and investors are concerned that the mortgage industry is slowing, and the bank is likely to see an increase in credit problems as well. So far that hasn’t materialized, but at the end of the fiscal first quarter, TD Bank had the second-highest Tier 1 capital ratio in Canada (and the third-highest in North America), meaning they’re better off is prepared for setbacks than most of his peers. Even if there are problems on the housing front in Canada, the bank should muddle through it quite well.

Then there’s the U.S. market, where TD Bank was forced to abandon a takeover because regulators were concerned about the bank’s anti-money laundering controls. A fine is likely to follow and it will likely take some time to resolve concerns and regain regulators’ trust. That means acquisition-led growth in the US is likely off the table for now. While that’s not good because it will mean slower growth in the short term, TD Bank can still open new branches on its own. And eventually it should be able to get back on the acquisition track. This is a temporary roadblock.

All in all, if you can tolerate a little near-term uncertainty, this well-respected bank looks attractive today.

Buy when others are afraid

There’s no way around it: if you want to buy cheap stocks, you’ll have to get used to investing in stocks with some warts. Rexford and TD Bank are both a bit out of favor right now, for legitimate, if perhaps temporary, reasons, pushing their returns to near-decade highs. If you’re looking for attractive dividend stocks, both should be on your radar right now.

Should you invest $1,000 in Rexford Industrial Realty now?

Before purchasing shares in Rexford Industrial Realty, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Rexford Industrial Realty wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Ruben Gregg Brouwer has positions in Toronto-Dominion Bank. The Motley Fool holds and recommends Bank of America and Rexford Industrial Realty. The Motley Fool has one disclosure policy.

2 incredibly cheap dividend stocks to buy now was originally published by The Motley Fool