Finance

2 stocks that will be worth more than Apple in ten years

In the world of finance, 10 years is the blink of an eye. Do you want proof? Take a closer look at the table below:

|

Company |

Market capitalization 2014 (in billions) |

Market capitalization 2024 (in billions) |

|---|---|---|

|

IBM |

$182 |

$178 |

|

Nvidia |

$10 |

$2,965 |

In August 2014, IBM‘s market capitalization was about 18 times larger than that of Nvidia‘S (NASDAQ: NVDA). But oh, how the tables have turned. Today, Nvidia has a market cap of about $3 trillion — about 17 times bigger than IBM.

So looking forward to the next one 10 years, what are the companies that could surpass Apple‘s huge market capitalization? Here are two that could make it.

Microsoft

If a company wants to surpass Apple in the next decade, it will need a massive market capitalization. Even if we assume that Apple’s market capitalization remains stable, that would mean a company would one market capitalization of $3.4 trillion to get Apple.

That’s quite a task, and there are only so many companies That could do it. Microsoft (NASDAQ: MSFT) is one of them.

For starters, Microsoft already has a market cap of $3.1 trillion as of this writing. If recently in June, Microsoft had a market capitalization larger than Apple. In addition, Microsoft has a number of competitive advantages that should eventually ensure that the company’s market capitalization surpasses Apple.

First, Microsoft has a more diversified business. The company has its hands in cloud computing, gaming, advertising, hardware, software, social networking and artificial intelligence (AI). In short, Microsoft has many paths to success. Apple, on the other hand, it has traditionally benefited from its excellent hardware innovation. And while Apple services and AI could boost the company’s revenue, stagnant iPhone sales could pose a real challenge for Apple over the next decade.

In my view, that means an advantage for Microsoft.

Nvidia

I have reservations about Nvidia at this point. The sky-high valuation makes it vulnerable to a nasty correction if the company’s sales reflect this each signs of slowdown. That said, this article is about what could happen in the next decade. And in that case I think Nvidia is well positioned to surpass Apple.

That’s because Nvidia’s core business — making graphics processing units (GPUs) that will power cutting-edge AI systems over the next decade — is on a long-term growth trajectory that Apple Ordinary cannot match.

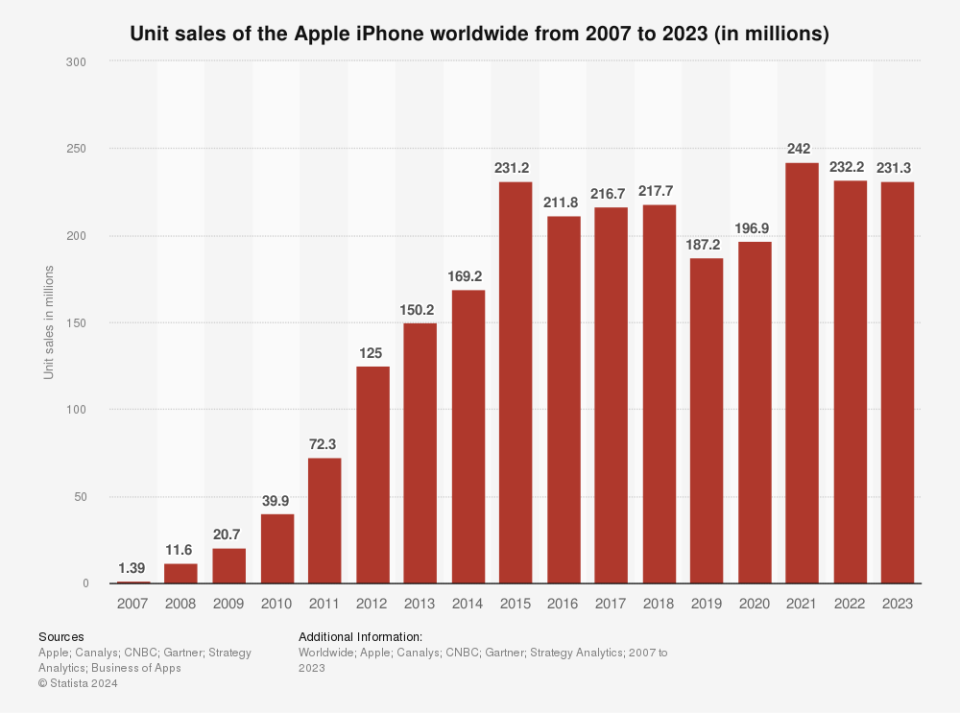

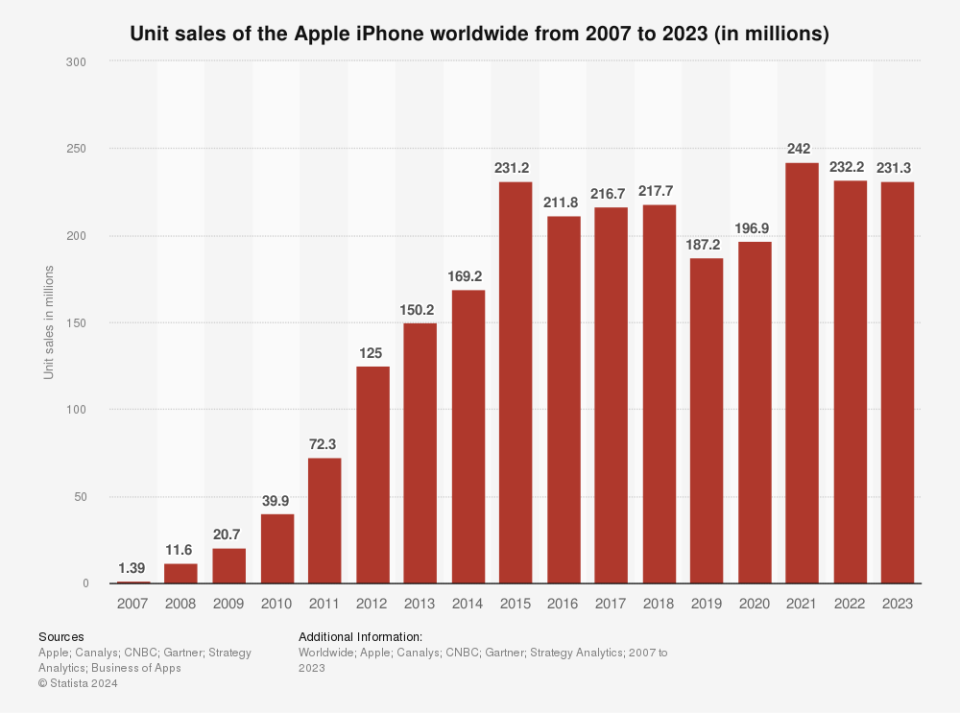

Sales of Apple’s signature product – the iPhone – grew every year between 2007 and 2015, but have remained flat since then.

Nvidia, on the other hand, is still growing. Over the past two years, the company has tripled its revenue as GPUs sold like hotcakes. That growth is not probably slowly in the coming years. Most analysts expect Nvidia’s revenue to double again to about $160 billion by 2026.

Sure, there will likely be some bumps in the road as competitors take some of Nvidia’s market share in the red-hot AI chip market. But even if Nvidia’s revenue growth slows, the company could easily close the $500 billion market cap gap between Nvidia and Apple over the next decade.

Should You Invest $1,000 in Microsoft Now?

Before you buy shares in Microsoft, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 22, 2024

Jake Lerch has positions in International Business Machines and Nvidia. The Motley Fool holds positions in and recommends Apple, Microsoft and Nvidia. The Motley Fool recommends International Business Machines and recommends the following options: long calls for $395 in January 2026 at Microsoft and short calls in January 2026 for $405 at Microsoft. The Motley Fool has one disclosure policy.

Prediction: Two stocks that will be worth more than Apple in ten years was originally published by The Motley Fool