Finance

2 top artificial intelligence (AI) stocks to buy before the Nasdaq soars higher

The Nasdaq-100 The index is up 10% so far in 2024, which is not surprising as it has benefited from the solid growth reported by its key components, which are benefiting from increasing demand for artificial intelligence (AI) and cloud computing .

The good thing is that the Nasdaq-100 could continue to climb higher as the year progresses. German Bank estimates the index could rise 19% in 2024 based on cooling inflation and solid US economic growth. Meanwhile, the proliferation of AI will likely remain one of the most important drivers for the economy. technology stocks in 2024, and it could play a central role in boosting the Nasdaq-100.

Let’s take a closer look at two Nasdaq-100 components — Nvidia (NASDAQ: NVDA) And Qualcomm (NASDAQ: QCOM) — that deliver excellent results through the adoption of AI. We’ll see why it makes sense to buy these two AI stocks before the Nasdaq posts more gains.

1. Nvidia

Nvidia’s stunning 121% gain through 2024 has played a pivotal role in sending the Nasdaq-100 higher. And the stock’s excellent rally appears to be here to stay. Analysts have raised their earnings expectations for the chipmaker following its latest quarterly report.

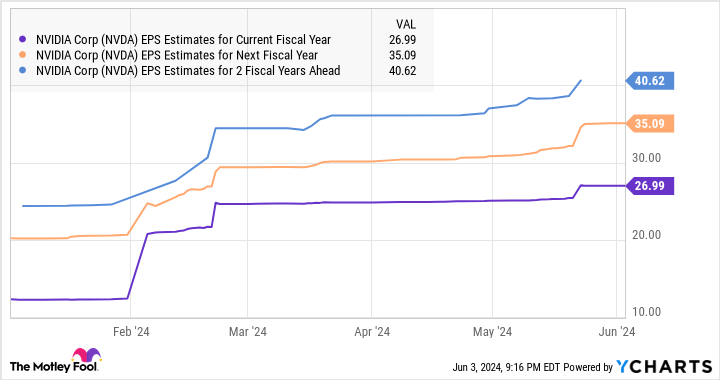

Over the past thirty days, 47 analysts have increased their earnings per share (EPS) estimates for fiscal 2025, while 44 have done the same for fiscal 2026. Nvidia’s improving EPS expectations are shown in the following chart.

There are two reasons why analysts expect Nvidia to post stronger profits. First, the company has maintained its stranglehold on the AI chip market. It ended 2023 with a 94% share of the AI server market. As a result, revenue from data center chip sales in the first quarter of fiscal 2025 (which ended April 28) shot up a remarkable 427% year over year to a record $22.6 billion.

Nvidia’s peers like AMD And Intel reported data center revenue of $2.3 billion and $3 billion respectively in the first quarter of 2024. More importantly, Nvidia can maintain its dominance in the AI chip market with the arrival of a new generation of chips that widen the technological gap it enjoys more than rivals. The upcoming chips based on the Blackwell architecture are touted to be four times faster than the current chips based on the Hopper architecture.

Nvidia points out that demand for its Blackwell chips is so high that it will have difficulty meeting it in 2025. So the company’s AI lead appears to be here to stay, and that should allow the company to ship more units of its AI graphics cards.

The second reason why analysts are optimistic about Nvidia’s net growth is because of its enormous pricing power in AI chips. According to Raymond James, it could cost Nvidia $6,000 to manufacture one Blackwell B200 accelerator. Since each processor is expected to sell for $30,000 to $40,000, it could make a hefty profit on its new chips.

Overall, the long-term growth of the AI chip market will be a big boost for Nvidia for the reasons discussed above. Therefore, there is a good chance that this AI stock could rise further after the excellent gains it has posted. already clocked in 2024.

2.Qualcomm

Qualcomm has achieved impressive momentum in 2024 with a 41% gain so far, and this Nasdaq-100 stock appears built for more upside potential due to the AI-related tailwinds in the smartphone and personal computer (PC) markets that seem likely to bring about a turnaround in the market. fortunes.

Qualcomm’s revenue in fiscal 2023 (which ended last September) fell 19% to $35.8 billion. Adjusted earnings also fell 33% to $8.43 per share.

However, revenue in the first six months of fiscal 2024 increased 3% year over year to $19.3 billion. It also reported a 13% year-over-year increase in adjusted earnings to $2.44 per share in the second quarter of fiscal 2024.

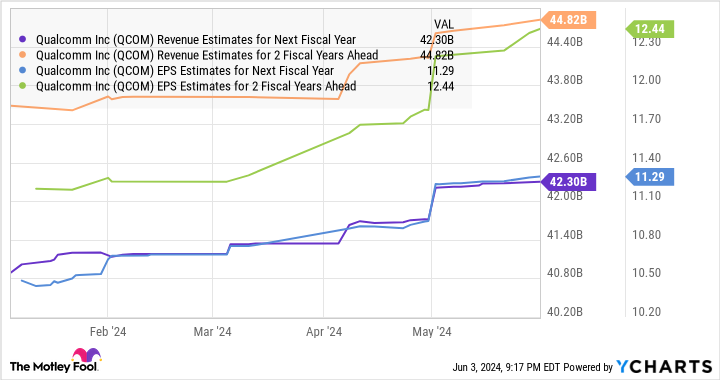

Analysts expect Qualcomm’s revenue to rise 7% to $38.3 billion this fiscal year, while earnings are expected to rise 18% to $9.91 per share. More importantly, as the following chart indicates, Qualcomm is expected to deliver growth in the coming fiscal years as well.

But there’s a good chance that Qualcomm’s growth will be stronger than expected as demand for AI-enabled smartphones will boom, and Qualcomm is expected to be a major beneficiary of this market.

Counterpoint Research predicts that a total of 1 billion AI-enabled smartphones will be launched between 2024 and 2027. The researcher expects Qualcomm’s chips to power more than 80% of generative AI-enabled smartphones in the coming years, which isn’t surprising since the chips are already powering Samsung‘s flagship, AI-enabled Galaxy smartphones.

Furthermore, Qualcomm’s strategy to deploy AI in mid-range smartphones could ensure that Qualcomm can remain the top player in this market in the long run. At the same time, the company is also starting to make headway in the AI-enabled PC market. Microsoft recently announced new AI personal computers powered by Qualcomm chips.

The company said that all leading original PC equipment manufacturers will soon launch AI PCs powered by the Snapdragon chips. This likely opens up another solid opportunity for Qualcomm as shipments are expected to grow 44% annually through 2028, Canalys said.

All of this suggests that Qualcomm’s growth could eventually accelerate. Therefore, it would be a good idea to buy the stock while it is trading at just twenty times forward earnings, a discount to the Nasdaq-100’s forward earnings of 27.

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 3, 2024

Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, and Qualcomm. The Motley Fool recommends Intel and recommends the following options: long January 2025 calls of $45 on Intel, long January 2026 calls of $395 on Microsoft, short August 2024 calls of $35 on Intel, and short calls in January 2026 from $405 on Microsoft. The Motley Fool has one disclosure policy.

2 top artificial intelligence (AI) stocks to buy before the Nasdaq soars higher was originally published by The Motley Fool