Finance

3 Artificial Intelligence (AI) Stocks Making Screaming Buys in April

Artificial intelligence (AI) has captivated the tech world over the past year, sending countless stocks skyrocketing. However, AI is by no means a new concept. You may be wondering: why did it suddenly explode?

Although computers are excellent at numerical tasks and data processing, they have not always been capable of natural human capabilities such as language, visual processing and various generative tasks. However, AI bridges this gap by using machine learning to perform tasks that would normally require a human.

As a result, advances in AI can potentially benefit a wide range of markets, including consumer technology, autonomous vehicles, healthcare, education and more. And with the market and technology still in their infancy, it seems the sky’s the limit for AI.

In fact, the AI sector is expected to grow at a compound annual growth rate of 37% through 2030, which would give it a valuation of nearly $2 trillion. The market’s significant potential suggests that it is not too late to invest in and benefit from AI tailwinds well into the future.

So here are three AI Stocks those screaming purchases in April.

1. Intel

It wasn’t easy to get one Intel (NASDAQ: INTC) investor in recent years, with the stock down 27% since 2022. However, the company has made significant changes to its business model over the past year, which could make it an attractive option to invest in AI in the long term.

Intel is expanding in the market by launching its new line of Gaudi 3 AI graphics processing units (GPUs). The chips were released earlier this month and claim to have 50% better inference and 40% better energy efficiency than comparable offerings from Nvidia.

Furthermore, Intel is using its longstanding dominance and expertise in central processing units (CPUs) to secure a top position in AI by expanding the AI capabilities of its processors.

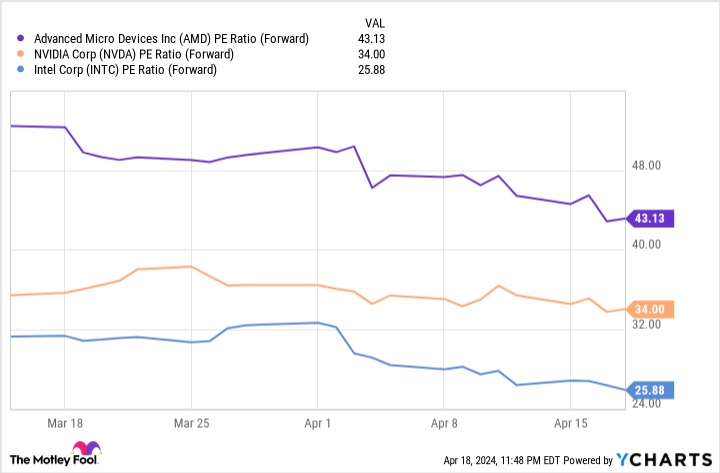

It will take some time for Intel to develop its AI business and catch up with rivals like Nvidia AMD. However, the chart above shows that Intel is potentially the best-valued AI chip stock. Intel has the lowest price-to-earnings (P/E) ratio of these companies, making it a relative bargain.

The company is on an exciting growth path and is too good to pass up now.

2. Apple

Apple (NASDAQ: AAPL) has been quieter on the AI front than many of its peers. However, the company is known for taking its time with new technology. Apple isn’t necessarily known for its groundbreaking innovations, but for perfecting established technology with its own design language and then rising to dominate the industry by attracting billions of users.

Markets such as Bluetooth headphones, smartwatches and tablets were each led by different companies before Apple arrived on the scene. However, the launch of products like AirPods, the Apple Watch and the iPad have made competitors almost a distant memory. As a result, it’s not too concerning that Apple isn’t one of the top dogs in AI right now.

The tech giant appears to be quietly honing its AI technology. Meanwhile, its leading market shares in multiple areas of consumer technology could see it drive the industry and become a key growth driver in getting AI into the hands of average consumers.

Apple shares rose slightly on April 11 when Bloomberg reported that the company was overhauling its entire Mac lineup to expand its AI capabilities and meet rising demand for such hardware. Meanwhile, the tech company has been gradually adding new AI features to its product lineup, including improvements to the iPhone’s Siri and new gestures for the Apple Watch.

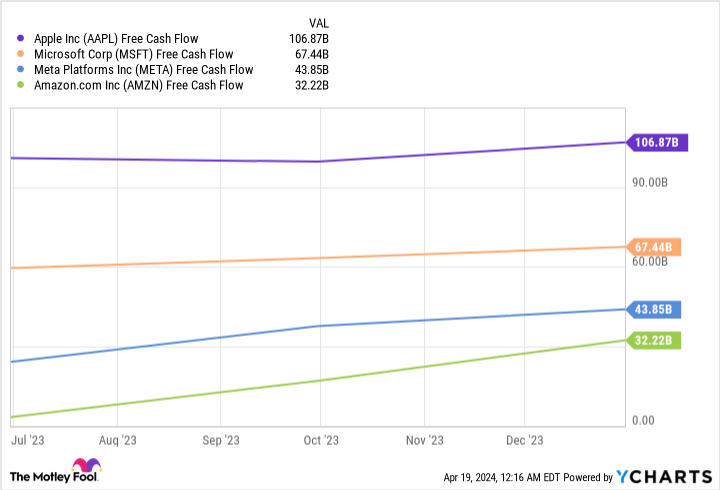

Last year, Apple generated nearly $107 billion in free cash flow, significantly more than some of the most prominent players in AI, including Microsoft, MetaplatformsAnd Amazon. This figure suggests that Apple is well equipped to expand in the burgeoning AI market and keep up with its rivals in the long term.

Apple’s stock trades at 25 times forward earnings, making it a reasonable buy and an exciting way to invest in AI.

3. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has been somewhat overshadowed in the field of AI in the past year by cloud rivals Microsoft and Amazon. However, the company is easily one of the most exciting AI stocks for long-term gains.

The company has a long list of powerful brands, including Google, Chrome, Android and YouTube. These services regularly attract billions of users, giving Alphabet ample opportunity to showcase its AI offering.

As a result, the company’s recent pivot into the lucrative market is promising. Earlier this year, Alphabet launched Gemini, the most advanced AI model to date. The debut wasn’t perfect, with the model making some mistakes in its launch presentation, forcing the company to temporarily pause its image generation services.

However, Alphabet is moving forward in its AI development. The company recently announced plans to consolidate its Deep Mind and Research teams to drive efficiencies in its AI division. Alphabet will move its AI-focused Responsible AI teams to Deep Mind, where the models are built.

Like Intel and Apple, Alphabet stock is a bargain compared to other AI stocks. The price-earnings ratio is currently an attractive 23, considerably lower than that of Microsoft (34) and that of Amazon (43).

Alphabet stock is a screaming buy this month, and one you won’t want to miss.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel, long January 2026 $395 calls to Microsoft, short January 2026 $405 calls to Microsoft, and short May 2024 $47 calls to Intel. The Motley Fool has one disclosure policy.

3 Artificial Intelligence (AI) Stocks Making Screaming Buys in April was originally published by The Motley Fool