Finance

3 Artificial Intelligence (AI) Stocks to Buy Right Now

Nvidia has been the artificial intelligence (AI) stocks owned over the past year and a half. However, the expectations built into the stock are mind-boggling and could spell disaster in the future.

Still, AI is here to stay, and if you’re looking to invest in this sector, I’d consider these stocks before considering Nvidia.

Taiwanese semiconductor

Taiwanese semiconductor manufacturing (NYSE: TSM) makes many of the chips that go into all the devices that power the incredible AI technology in use today. Now that Nvidia’s GPUs are packed with TSMC products, it is also benefiting from its performance.

Another major customer is Apple, which recently announced that its AI offering was only available on the latest generation of phones. This could trigger a major wave of innovation, from which Taiwan Semi could benefit enormously.

Regardless, management expects AI-related revenue to grow at a compound annual rate of 50% over the next five years, while it expects this segment to account for more than 20% of total revenue. Over the long term, management expects total revenue growth of 15% to 20%, which would result in massive market outperformance.

While Taiwan Semi’s shares have had an excellent performance this year (up over 75%), I believe this rise can continue for years to come as its products are integrated into a world that has barely scratched the surface of AI possibilities.

Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is the parent company of Google, which has long been an advocate of AI. Although it seemed overwhelmed by the influx of people generative AI popularity in late 2022The recent launches corrected that blunder and the Gemini model emerged as a top choice.

Alphabet has also integrated AI into several advertising products, helping advertisers create effective campaigns and ensure internal models match the right ad with viewers. While these releases haven’t directly translated into a huge revenue boost, they have solidified Alphabet’s top spot among where advertisers should spend money.

While Alphabet won’t be as high-profile an investment as Nvidia, it will steadily outperform the market by a few percentage points per year thanks to its dividend, aggressive share buyback plan, and steady growth.

The stock trades at around 25 times forward earnings, so it isn’t cheap historically, but it is significantly less pricey than many of its peers.

Sales team

Sales team (NYSE: CRM) is a bit of a backdoor choice considering it’s a customer relationship management software company. However, the company is pushing its AI model heavily to its customers as a way to improve their businesses. It can be integrated internally to provide employees with the best possible information when completing a sale, thanks to its heavy reliance on internal customer data. It can also create AI chatbots that provide better customer service interactions than previously available.

With Salesforce’s market position, getting this AI offering right is critical to maintaining market dominance. It also provides a new growth engine for the company as it begins to mature, with sales only growing in the high single digits.

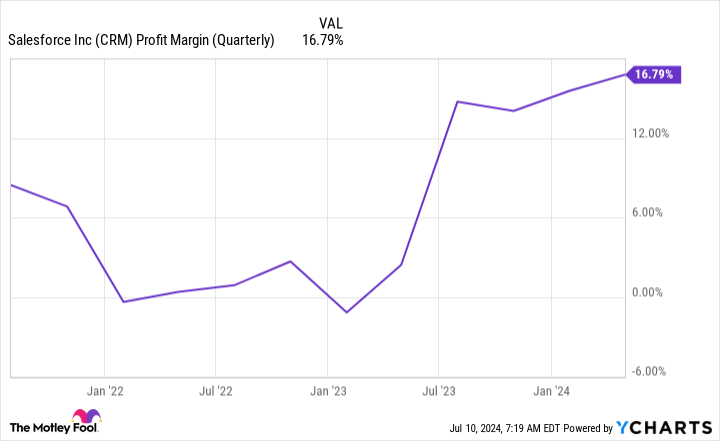

However, it recently initiated a dividend and still has a long way to go before it reaches the maximum profit margins of software companies (the gold standard is Adobe‘s 30% margin).

All of this means there’s plenty of growth ahead for the stock, and it could be a market beater in the long run.

All three companies are more stable than Nvidia, which has shown a cyclical nature throughout its existence. Choosing Alphabet, Taiwan Semiconductor, and Salesforce is a smart idea if you’re looking for more reasonably priced stocks with strong growth potential.

Should You Invest $1,000 in Semiconductor Manufacturing in Taiwan Now?

Consider the following before buying shares in Taiwan Semiconductor Manufacturing:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns July 8, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Adobe, Alphabet, Salesforce and Taiwan Semiconductor Manufacturing. The Motley Fool holds positions in and recommends Adobe, Alphabet, Apple, Nvidia, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool has one disclosure policy.

Forget Nvidia: 3 Artificial Intelligence (AI) Stocks to Buy Right Now was originally published by The Motley Fool