Finance

3 cheap tech stocks to buy now

When people say a stock looks cheap, it can mean several things. Today I’ll show you three examples of what people mean by “cheap stocks” in the tech sector, with one common quality: these stocks are affordable in a good wayand they should be on your shortlist for further research if you’re in the mood to buy shares.

Block: Modest valuation for a growth stock

Let’s start with Block (NYSE:SQ)a well-known provider of financial services with a modern twist.

The stock has a market cap of $40.7 billion and trades at lofty valuation ratios such as 51 times current earnings and 75 times free cash flow. But those ratios don’t tell the whole story, because Block is also a high-octane growth stock.

The company has grown its revenue at a compound annual growth rate (CAGR) of 51% over the past five years. Trailing profits are up 91% year over year. Your average analyst expects this profit increase to be followed by a CAGR of 28% over the next half decade. Credit card processors like Visa (NYSE:V) or MasterCard (NYSE:MA) can’t keep up with any of these growth rates. Even digital payment services peer PayPal (NASDAQ:PYPL) looks slow by comparison.

And if you choose valuation metrics that take into account expected growth, block shares suddenly look incredibly affordable. The shares change hands by a factor of 15 times the expected earnings forecast. And its price-to-earnings-growth (PEG) ratio is a modest 0.81 – lower than PayPal’s 0.85 and much lower than Mastercard’s 1.9 or Visa’s 2.3. A value near 1.0 indicates a fair valuation, and lower scores make the stock more affordable.

In other words, Block’s rapid business growth is leaving many investors and analysts with their feet on the ground. Block’s shares give you access to innovative payment services and business tools, with a touch of cryptocurrency expertise like the company possesses Bitcoin (CRYPTO: BTC) worth $470 million at today’s prices. The stock may look pricey in terms of traditional value ratios, but it’s cheap when you take into account Block’s massive business growth.

Roku: Well below previous highs

Then there is Roku (NASDAQ: ROKU)a veteran of media streaming technology and services.

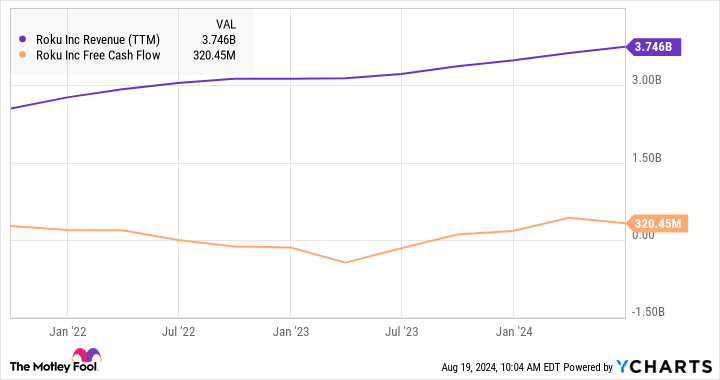

This stock is not on this list due to a low valuation ratio. Roku is currently unprofitable in terms of pre-tax profits and operating income. Free cash flows are negative again after plunging into red-ink territory in 2022 and 2023, but Roku stock isn’t a bargain compared to cash earnings either.

So how did it end up on my list of low-priced tech stocks? You see, this stock is down 44% since November of last year and down 87% from its all-time high of July 2021. A price correction was probably in order from the previous peak, but this plunge goes too far.

Roku is a leading name in a fast-growing industry with global business opportunities. It is a large market with many future expansions. According to Statista, more than 40% of potential users subscribe to streaming services in mature markets such as North America and Western Europe. Developing countries such as Indonesia and India have not even exceeded 10%. In other words, most of the world is still getting used to online streaming services, and Roku is benefiting as adoption of these services grows.

Meanwhile, Roku’s stock is priced for absolute disaster. Yes, the earnings numbers are modest at best and negative in many cases, but the company is doing better over time. The upward trend should continue as Roku’s global footprint expands and the digital advertising sector rebounds after a few years of inflation-ridden troubles. In a few years, it should make sense to talk about Roku’s profit-based metrics again.

I mean, do these healthy financial lines belong on the same chart as Roku’s crashing stock price? I don’t think they do:

So Roku may not be cheap in most aspects of that phrase, but I view it as a deeply misunderstood growth story that deserves a richer appreciation. It may take years before it reaches the lofty heights of 2021 again, and that’s okay. Roku’s stock is a direct bet on the long-term future of media streaming services, and you don’t even have to pick a winning content platform.

SoundHound AI: a solid financial foundation

Finally, you should consider a voice control specialist SoundHound AI (NASDAQ: SOUND). With a uniquely capable voice interpretation technology and a growing list of high-profile customers, I’m looking at another long-term growth story that isn’t getting the market love it deserves.

Like Roku, SoundHound AI is currently unprofitable. Like Roku, this company is achieving tremendous revenue growth. Sales figures have almost tripled in two years. And it’s easy to overlook how robust SoundHound AI’s financial foundation is.

The backlog of order bookings and future sales in subscription contracts currently stands at $723 million, up 113% from the same period last year. That’s a lot of guaranteed revenue for a company that currently reports annual revenue of about $55 million. And the backlog balance continues to skyrocket as the company adds more customers with long-term contracts.

Furthermore, SoundHound AI’s balance sheet is virtually debt-free, with as much as $200 million in cash reserves.

I understand if you’re walking away after taking one look at SoundHound AI’s negative earnings and rising price-to-sales ratio. However, that could be a mistake. The share is modestly priced if you take into account the generous (and growing) order book, not to mention the rock-solid balance sheet. This small company is prepared to boom in the long run.

Should you invest $1,000 in Block now?

Before purchasing shares in Block, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Block wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 12, 2024

Anders Bylund has positions in Bitcoin, Roku and SoundHound AI. The Motley Fool has positions in and recommends Bitcoin, Block, Mastercard, PayPal, Roku and Visa. The Motley Fool recommends the following options: January 2025 long calls of $370 on Mastercard, January 2025 short calls of $380 on Mastercard, and September 2024 short calls of $62.50 on PayPal. The Motley Fool has one disclosure policy.

3 cheap tech stocks to buy now was originally published by The Motley Fool