Finance

3 growth stocks Wall Street may sleep through the night, but I don’t

Even the best growth stocks are seeing their shares retreat. But just because their stock price has fallen, that doesn’t necessarily mean the stock is falling for good. In reality, Amazon lost 90% of its value over a two-year period in the early 2000s, only to grow into the nearly $2 trillion company it is today.

Let’s look at three consumer goods growth shares they are down, but certainly not out.

1. elf Beauty

Nearly 30% lower than the recent high, elf Beauty (NYSE: ELF) remains one of the best growth stories in consumer goods. By using influencers and creating accurate copies of popular prestige cosmetic products, the company has been able to gain shelf space and gain a large share of the mass market cosmetic category. In fact, according to consumer surveys, it has become the No. 1 cosmetic brand among teens.

While growth may slow from the breakneck pace of the past few years, Elf still has a long road of growth ahead of it. It has made a strong first step by expanding internationally, but this is still only the case in a few markets. The company has over-indexed with the Latin American community in the US, so Latin America could be a big future opportunity.

Meanwhile, the company recently entered skin care. With only a 2% market share in skin care in the US, the potential to gain market share in this category is a huge opportunity. Given the company’s performance in cosmetics in recent years, there’s no reason to believe it won’t have the same success in skin care.

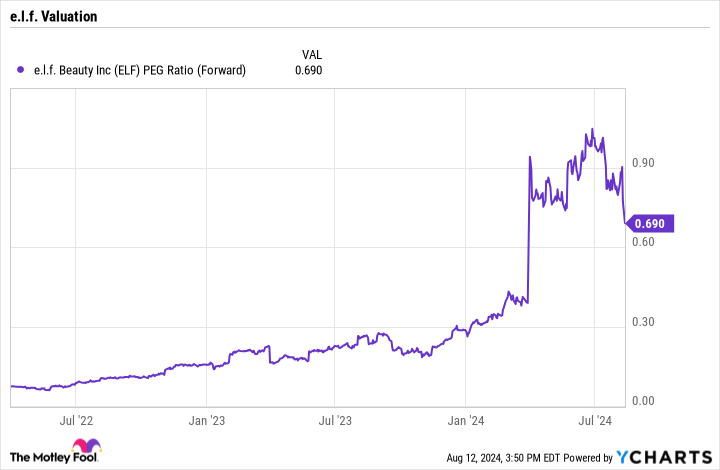

Trading at one price/earnings-growth ratio (PEG ratio) With a price below 0.7, this growth share is very attractively priced after the recent sell-off. A PEG of less than 1x is generally considered attractive, but for a growth stock it puts eleven in the bargain bin.

2. Nike

After reporting a revenue increase of just 1% at constant exchange rates for the 2024 fiscal year, which ended in May, and an indication of a single-digit revenue decline in the 2025 fiscal year, it might be best to call Nike (NYSE:NKE) a former growth stock. After all, there has not been much growth lately.

However, following the stock’s most recent sell-off, investors can buy the iconic brand at one of the cheapest valuations in a long time, at a price-to-earnings ratio of less than 20.

But let’s not discount Nike just yet. One of the best ways for a management team to get a stock back on track is to provide extremely conservative guidance and then sprint and jump over the low bar that has been set. Nike seems poised to do just that.

One reason for this is that the company should get an Olympic boost, spending more money on the event than ever before. Nike also launched a number of new products around the event.

Meanwhile, research firm Zekereweb showed that Nike’s strategy paid off with a huge spike in website visits and solid conversions to sales. In China, which is a trouble spot, the company has seen an increase in sales of custom T-shirts from gold medal tennis player Zheng Qinwen, which it sponsors.

Given the valuation and low expectations, this could be the time to ‘just do it’ and add Nike to your portfolio as it looks to return to a growth company.

3. Dutch Brothers

Shares of Dutch Brothers (NYSE: BROS) was crushed after the coffeehouse operator told investors that new store openings would come in at the lower end of its expectations this year as it looked to optimize its real estate strategy. However, the long-term prospects for the company remain intact as there is still a long line of expansion opportunities ahead.

The company’s store format is on the small side, typically ranging from 800 square feet to 1,000 square feet, with multiple drive-thru lanes and a pickup window. This small size allows for a relatively inexpensive expansion program while creating solid throughput, as evidenced by its average unit volume (AUV) of $2.0 million, which measures the average revenue of its stores.

With just 912 locations at the end of the second quarter (612 of which are company-owned), the popular coffee chain that started in Oregon is still primarily in the Western US, although there are some locations in places like Florida, Kentucky and Tennessee. This makes it a nice regional-to-national expansion story.

The company is also just getting started with initiatives like mobile ordering, which should be a nice boost to sales. This also shows that the company is still in its infancy and is benefiting from technological improvements that many other chains have already implemented. This creates future growth opportunities.

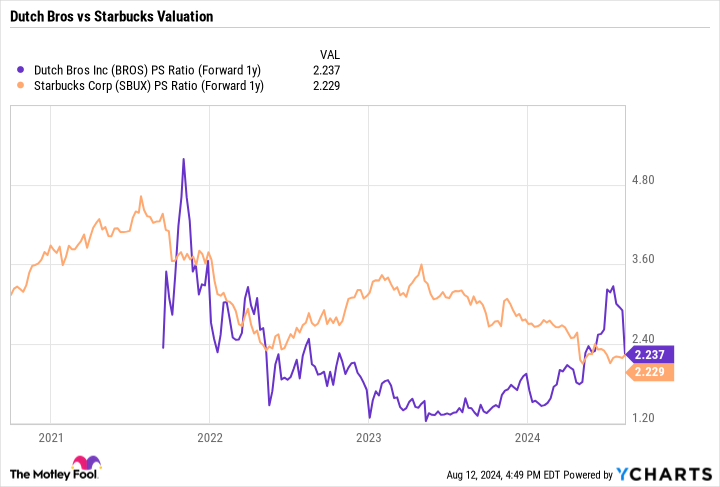

Dutch Bros trades at a similar price-to-sales (P/S) multiple as competitors Starbucks but should show much more growth as it is still in the early days of expansion. This would make me a buyer of the stock due to recent weakness.

Should You Invest $1,000 in Nike Now?

Consider the following before buying shares in Nike:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 12, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Amazon, Nike, Starbucks, and Elf Beauty. The Motley Fool recommends the following options: Long calls of $47.50 in January 2025 on Nike. The Motley Fool has one disclosure policy.

3 growth stocks Wall Street may sleep through the night, but I don’t was originally published by The Motley Fool