Business

5.9% GDP growth in the second quarter

THE PHILIPPINE ECONOMY According to First Metro Investment Corp. (FMIC) and the University of Asia and Paci could see government spending grow faster in the second quarter, putting it on track to reach the lower end of the government’s full-year target.Fic (UA&P).

“We expect GDP (gross domestic product) to accelerate to 5.9% in the second quarter and end the full year at 6% with a mild upward trend,” FMIC and UA&P said in the Market Call report published Wednesday .

If achieved, GDP growth of 5.9% in the second quarter would be faster than the 5.7% in the second quarter Ffirst quarter and the 4.3% a year ago.

The Philippine Statistics Authority will release second-quarter GDP data on August 8.

FMIC and UA&P’s 6% growth forecast for the full year is at the lower end of the government’s GDP growth target of 6-7%.

“We maintain nuanced optimism regarding an acceleration that should begin in (the second) quarter and continue through the remainder of 2024,” they said.

“We base this on high employment levels, Fiscal space that should allow the government to accelerate spending, especially in infrastructure.”

After weaker-than-expected GDP growth in the first quarter, Arsenio M. Balisacan, secretary of the National Economic and Development Authority, said earlier that GDP growth will need to average 6.1% in the next three quarters to meet the targets of the government to comply.

The FMIC and UA&P said they do not expect a repeat of the “disappointing” situation. Fgrowth in the first quarter.

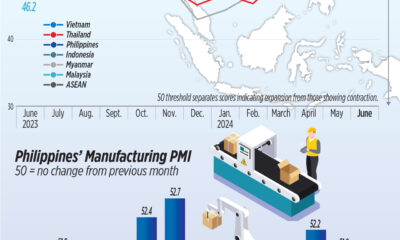

“We think GDP growth will accelerate for the remainder of the year, boosted by robust employment growth, stronger manufacturing and manufacturing gains and improved agriculture as the heat of El Niño passes,” they said.

FMIC and UA&P said a potential 25 basis points (bps) rate cut by the Bangko Sentral ng Pilipinas (BSP) in the third quarter would also boost domestic demand.

The Monetary Board kept its benchmark interest rate at a 17-year high of 6.5% earlier this month Fif it is a direct meeting. However, the BSP signaled a possible interest rate cut in August.

Head inFInflation would also likely accelerate towards the upper end of the central bank’s 2-4% target in July, before cooling slightly to 3% in August due to easing in rice and crude oil prices, FMIC and UA&P.

“Good” employment levels and faster government spending, especially on infrastructure, would also help boost GDP growth, FMIC and UA&P said.

However, the peso could remain under pressure in the July to September period due to high trade deficits and a stronger US dollar, they said.

The local unit closed at P58.42 per dollar on Wednesday, weakening 45 centavos from P57.97 FThis was evident from data from the Bankers Association of the Philippines on Tuesday.

This was the peso’s worst performance in more than 18 months or since its closing rate of P58.58 per dollar on November 7, 2022.

“While April did not boost risk-taking on bonds and equities, the recovery in May is likely due to the expected cut in the BSP policy rate in August and a first quarter profit that is well above expectations, predicts a more promising second half of the year,” said FMIC and UA&P. — Beatriz Marie D. Cruz