Finance

Best stocks to buy now: Amazon vs. Apple

Shares of a number of companies reached new all-time highs on Friday, July 5, including technology giants Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), MicrosoftAnd Metaplatforms. As a result, the S&P500 And Nasdaq Composite increased by 1% and 2% respectively over a 24 hour period.

The rally followed news that unemployment had reached its highest level since 2021. Wall Street expects a rebound in unemployment to push interest rates lower, which often fuels growth in the stock market as companies benefit from lower borrowing costs. As a result, now could be an excellent time to expand your position in “Big Tech” before it’s too late.

Amazon and Apple are two attractive options, benefiting from the enormous brand loyalty of their customers and the money to expand into emerging sectors such as artificial intelligence (AI). Let’s examine these consumer-favorite companies and determine whether Amazon or Apple are the better stocks to buy this month.

Amazon

Amazon shares are up 53% in the past twelve months, boosted by several quarters of impressive profit growth and expansion into some of the fastest-growing tech sectors. One of the most attractive aspects of its business is its diversification.

The company has come a long way since it started as an online bookstore 30 years ago. It has vastly expanded its product range and has become the biggest name in e-commerce lucrative positions in cloud computingvideo streaming, digital advertising and now AI.

Amazon has growth catalysts in technology, making it potentially one of the most reliable long-term investments. For example, an economic downturn in 2022 has hit the company hard, causing profits in the retail segments to plummet.

However, Amazon remained profitable during the challenging year, thanks to its cloud platform Amazon Web Services (AWS). Meanwhile, the company has since achieved an impressive turnaround in its retail business, demonstrating its ability to successfully navigate market headwinds.

In the first quarter of 2024, Amazon’s revenue rose 13% year over year to $143 billion. The North American and International divisions posted revenue increases of 12% and 10%, respectively, while AWS revenue rose 17%. In addition, Amazon’s operating income has more than tripled to more than $15 billion.

Amazon is on a promising growth trajectory as sales continue to rise and it continues to invest in its business. This makes the share an attractive option at the moment.

Apple

Apple shares hit a record high this week after rallying. The stock price is up 17% since the Worldwide Developer Conference (WWDC) on June 10.

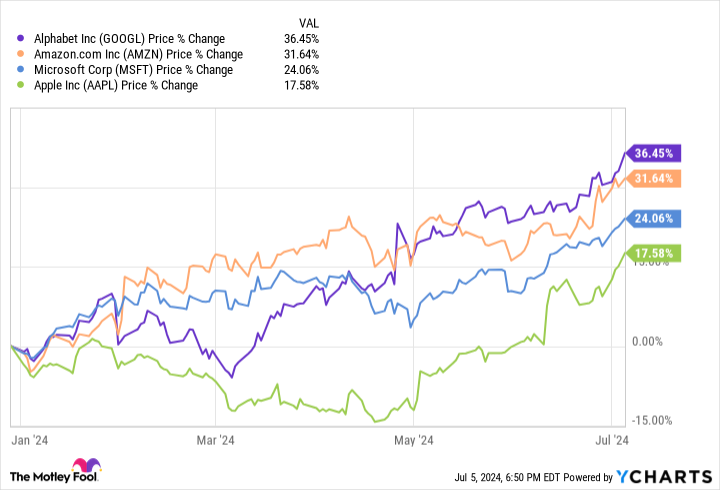

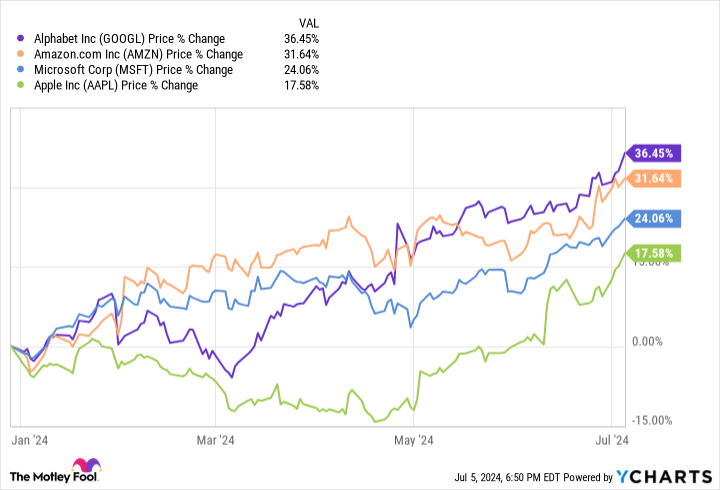

Declines in product sales and a delayed start to AI have worried investors over the past year. This has been reflected in a stock that has risen more slowly than many of its peers this year (as seen in the chart above). However, the WWDC provided a glimpse into Apple’s plan to boost product sales and play a lucrative role in AI in the long run.

At its June conference, Apple unveiled a new AI platform it calls Apple Intelligence that will bring generative features to its product lineup. However, consumers will need to upgrade to the company’s newer devices to access Apple Intelligence.

iPhone users need a 15 Pro or higher. Meanwhile, only Macs and iPads with Apple’s specially developed Apple Silicon chips can use the new AI tools. The company hopes the new features will encourage shoppers to upgrade their devices to access the upcoming features.

Apple revealed in its Q1 2024 earnings report that it had more than 2 billion active devices worldwide. The company’s reach in the consumer market is enormous, and its deep economic position is driven by a walled garden of products and a reputation for quality. Apple generated $102 billion free cash flow (what’s left of the cash flow after capital expenditures), so I wouldn’t bet on the company thriving in the long run.

Is Amazon or Apple the Better Buy?

Amazon and Apple have become household names worldwide. Both companies can seemingly do no wrong and are succeeding in almost every new market they enter. However, Amazon’s quick recovery from macro headwinds in 2022 and its arguably more diverse business model make its stock potentially more reliable and worth considering versus Apple.

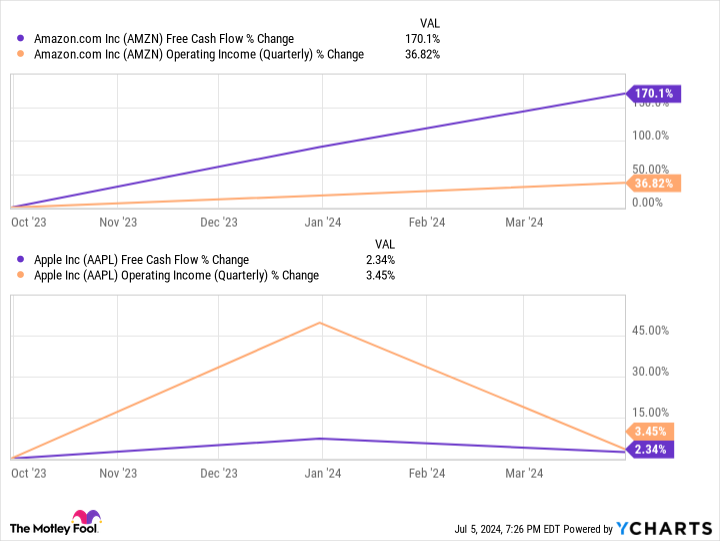

This chart shows that Amazon’s financial growth has become smaller than Apple’s over the past year. The retail giant is making profits in all parts of its activities. Meanwhile, many questions remain about whether Apple’s AI expansion will actually boost profits.

In addition to Amazon’s price-to-sales ratio of 3.5, compared to Apple’s 9.3, the e-commerce company’s stock is the better, no-brainer buy this year.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $771,034!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns July 8, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, Apple, Meta Platforms and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has one disclosure policy.

Best stocks to buy now: Amazon vs. Apple was originally published by The Motley Fool