Business

Net inflows of foreign direct investment fall to the lowest level in ten months in April

By means of Luisa Maria Jacinta C. Jocson, News reporter

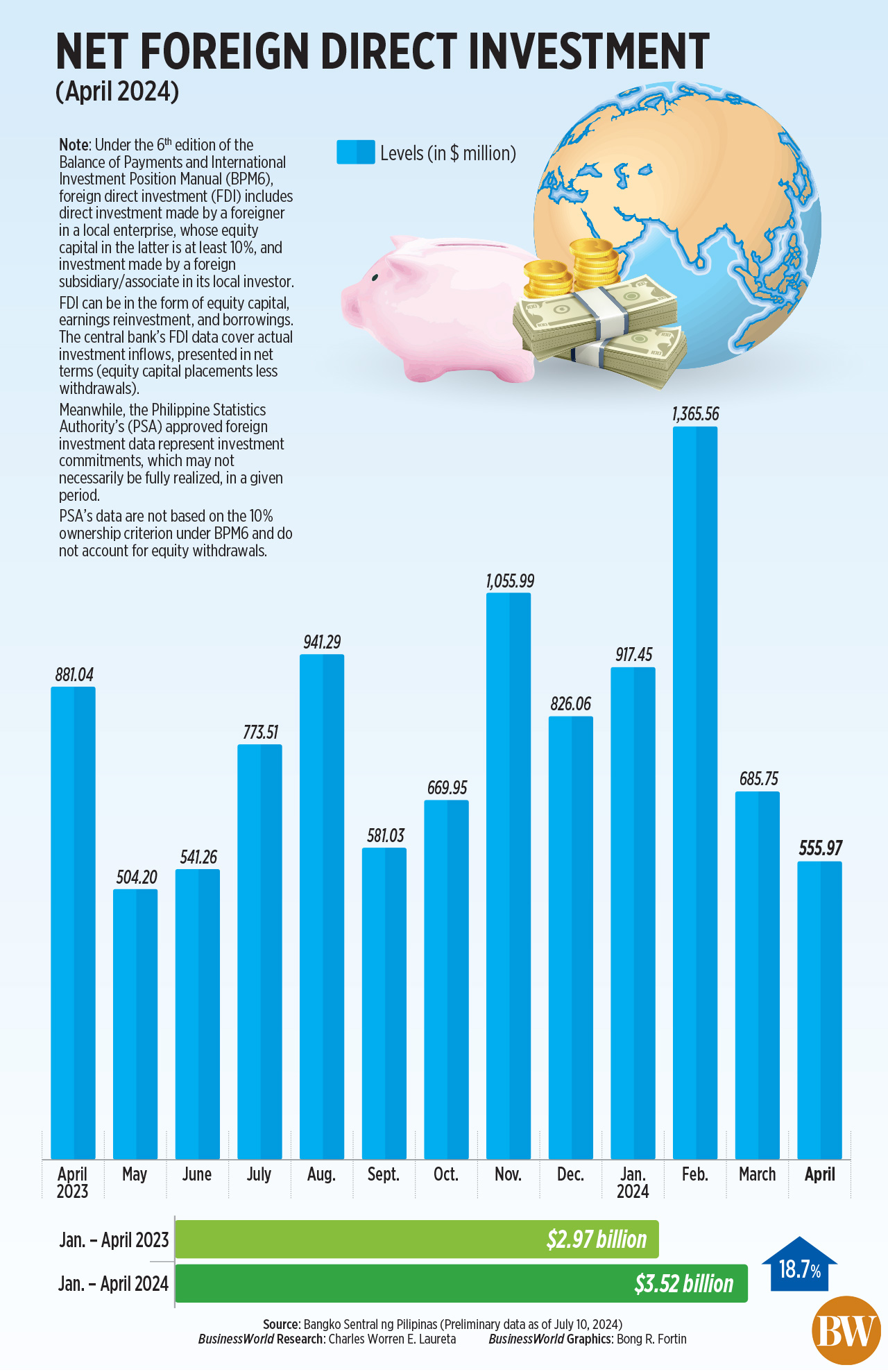

The Philippines Abroad Net direct investment (FDI) inflows fell to a 10-month low in April, the Bangko Sentral ng Pilipinas (BSP) said on Wednesday.

Preliminary data from the BSP shows net inflows of foreign direct investmentFThe lows fell 36.9% to $556 million in April, compared to $881 million in the same period a year ago.

This was the lowest level of monthly foreign direct investmentF10-month lows or since $541 million in June 2023.

Month after month, net inFThe lows fell 19% from $686 million in March.

Central bank data show non-residents’ net investment in debt instruments fell 38.8% to $407 million in April, compared with $665 million in the same month a year ago.

The net investments in debt instruments consist mainly of loans between foreign direct investors and their subsidiaries, orffaccording to the BSP in the Philippines.

Net equity investment, excluding reinvestment of profits, fell 48.1% to $68 million in April, compared to $132 million a year ago.

Broken down, equity placements fell 47% to $84 million, while withdrawals fell 41.7% to $16 million.

Earnings reinvestment fell 4.2% to $81 million in April, compared to $84 million a year ago.

Investments in stocks and mutual fund shares fell 30.9% to $149 million in April, compared to $216 million in the same month in 2023.

By source, equity placement investments came mainly from Japan (47%), followed by the United States (21%), Malaysia (11%) and Singapore (9%).

These were mainly invested in manufacturing (36%), real estate (26%), wholesale and retail (13%) and Ffinancial and insurance sectors (10%).

IMPROVED TRUST

Net foreign direct investments arrived in the January-April periodFThe lows rose 18.7% to $3.525 billion, compared to $2.971 billion in the same period a year earlier.

“This improvement concernsFInvestor consultationFIdentity in the Resilience of the Philippine Economy Amid Global Uncertainties,” the BSP said.

Central bank data shows foreign investment in debt instruments fell 1.4% to $2.237 billion in the four-month period, compared with $2.268 billion a year ago.

Investments in equities and mutual fund shares rose 83.2% to $1.288 billion in the January to April period, compared to $703 million last year.

Net foreign equity investment more than doubled in the four-month period to $978 million, while placements rose 126.8% to $1.213 billion, while withdrawals rose 65.2% to $235 million.

Earnings reinvestment fell 0.1% to $310 million in the four-month period.

At the end of April, the Netherlands was responsible for the largest share (63%) of total net direct foreign investmentsFlows. This was followed by Japan (22%) and the United States (6%).

This is where investments were mainly made Fthe financial and insurance sector (67%), the manufacturing sector (18%) and the real estate sector (7%).

“Global economic uncertainty, characterized by inFMixed policy rate news and geopolitical tensions have dampened investor confidence,” said Security Bank Corp. Chief Economist Robert Dan J. Roces. in a Viber message.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said net foreign direct investment inflows fell in April “at the height of risk aversion, largely driven by the geopolitical risks in light of the unprecedented direct attacks between Iran and Israel.”

Mr Roces said foreign direct investment has fallen below pre-pandemic levels due to rising prices and high interest rates.

The Monetary Board has kept the policy rate at a more than 17-year high of 6.5% since October 2023. Headline inflation accelerated from 3.7% in March to 3.8% in April. The central bank expects inflation to average 3.3% this year.

“Sector-specific performance, probably inFcaused by a slowdown in manufacturing or the services sector could also have contributed to the decline,” Mr Roces added.

For the coming months, Mr. Ricafort said foreign direct investment will flow inFThe lows may improve as the BSP is widely expected to cut rates.

BSP Governor Eli M. Remolona Jr. has said the central bank is on track to start easing policy in August, with a possible cut of 25 basis points (bps). He previously said the BSP could cut rates by a total of 50 basis points this year.

The central bank last cut the policy rate in November 2020, when the benchmark rate was cut by 25 basis points to a record low of 2%. At the time, the economy was struggling with the coronavirus (COVID-19) pandemic and the aftermath of typhoons.

“Improving the business environment, promoting key sectors and strengthening diplomatic ties will be critical to attracting more foreign direct investment and boosting economic growth, especially as better economic data emerges and the BSP signals interest rate cuts in August,” Mr Roces added.

The BSP expects to end the year with net foreign direct investment of $9.5 billionFlows.

Net income in 2023FThe lows fell 6.6% to $8.9 billion from $9.5 billion in 2022.