Business

Manila is unlikely to push back against higher US tariffs if Republicans win

By means of Kyle Aristophere T. Atienza, News reporter

THE ASIA-PACIFIC region faces the risk of an abrupt change in United States trade policy in the event of a Republican victory in November’s US presidential election, as a looming flat 10% tariff on all US imports slows growth threatens because imports to the US are more expensive, according to Moody’s Analytics.

But the country expects “minimal retaliation” from the Philippines at potentially higher US tariffs, given its strong defense ties with Washington.

“This would reduce shipping volumes and hurt business confidence,” Moody’s Analytics said of the rate increase in a report released Wednesday.

It expects minimal retaliation against higher US tariffs from most Asia-Pacific economies, excluding China.

It noted that China is applying reciprocal tariffs broadly in line with the US, following the outcomes of the 2018 trade war.

“But for the rest of the region, retaliation will be limited because so many economies rely heavily on the US for trade and security, whether through formal treaties (particularly Japan, South Korea, Thailand and Australia), defense partnerships (such as the Philippines and Singapore), or implied warranties (such as the Taiwan Relations Act),” the report said.

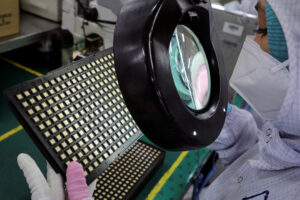

It expects Japan and South Korea to impose minimal tariffs on goods such as cars, as well as cheap electronics and machinery.

“But no tariffs will be imposed on energy and food imports as both countries need to import these raw materials,” the report said. “Medium to high-end electronics are also exempt to protect IT-related economic security cooperation.”

George N. Manzano, who teaches political economy at the University of Asia and the Pacific, said the Philippines would be hit by across-the-board US tariffs.

“If the US decides to impose a tariff on all exporters, countries that have an existing free trade agreement with the US will benefit,” he said in a Viber message.

The Philippines is pushing for a free trade deal with the US, but domestic politics are preventing Washington from pursuing new agreements.

Democrat Senator Christopher Coons told Philippine media in May that there were “strong opponents in both the Republican and Democratic Parties” to new free trade deals.

Emy Ruth S. Gianan, who teaches economics at the Polytechnic University of the Philippines, said it would be difficult for Philippine manufacturers to enter the U.S. market once tariffs rise, which “could also increase the price of imported goods that our local markets are sold. ”

“A large portion of our imports and exports are food and retail goods, which further affects inflation,” she said in a Facebook Messenger chat.

A tit-for-tat trade sanction between the US and China would also impact Philippine markets as “we are highly dependent on these two economies,” she added.

The US, a key defense ally that has backed the Philippines in the maritime conflict with China, is the largest destination for Philippine exports and the fifth-largest source of imports.

On Tuesday, the US Defense Department said the Philippines would receive US$500 million ($29.3 billion) in military aid from Washington.

The aid will be financed by a national security package that the US Congress passed in April to boost the security of US partners, the report said.

“Unless we guarantee stronger exports and domestic production to reduce imports, we will benefit less from these measures,” Ms. Gianan said.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said China could further strengthen economic ties with its neighbors such as the Philippines if the trade war with the United States intensifies.

“Higher US tariffs on Chinese imports and possibly on imports from other countries would lead to some increase in sales/diversion to other Asian countries such as the Philippines, especially if a new trade war between the US and China leads to slower growth for China and the world economy. as seen in the first Trump administration,” he said via Messenger chat.

Moody’s Analytics said policies likely to be adopted in a potential Republican victory “would result in sharply lower output across the region,” while policies adopted in a Democratic sweep scenario “would result in better growth.”

It said most of the decline in output would occur in goods-producing industries such as electronics, machinery and automobiles. The services sector would also suffer, albeit to a lesser extent.