Business

Inflation accelerates to a nine-month high

By means of Luisa Maria Jacinta C. Jocson, News reporter

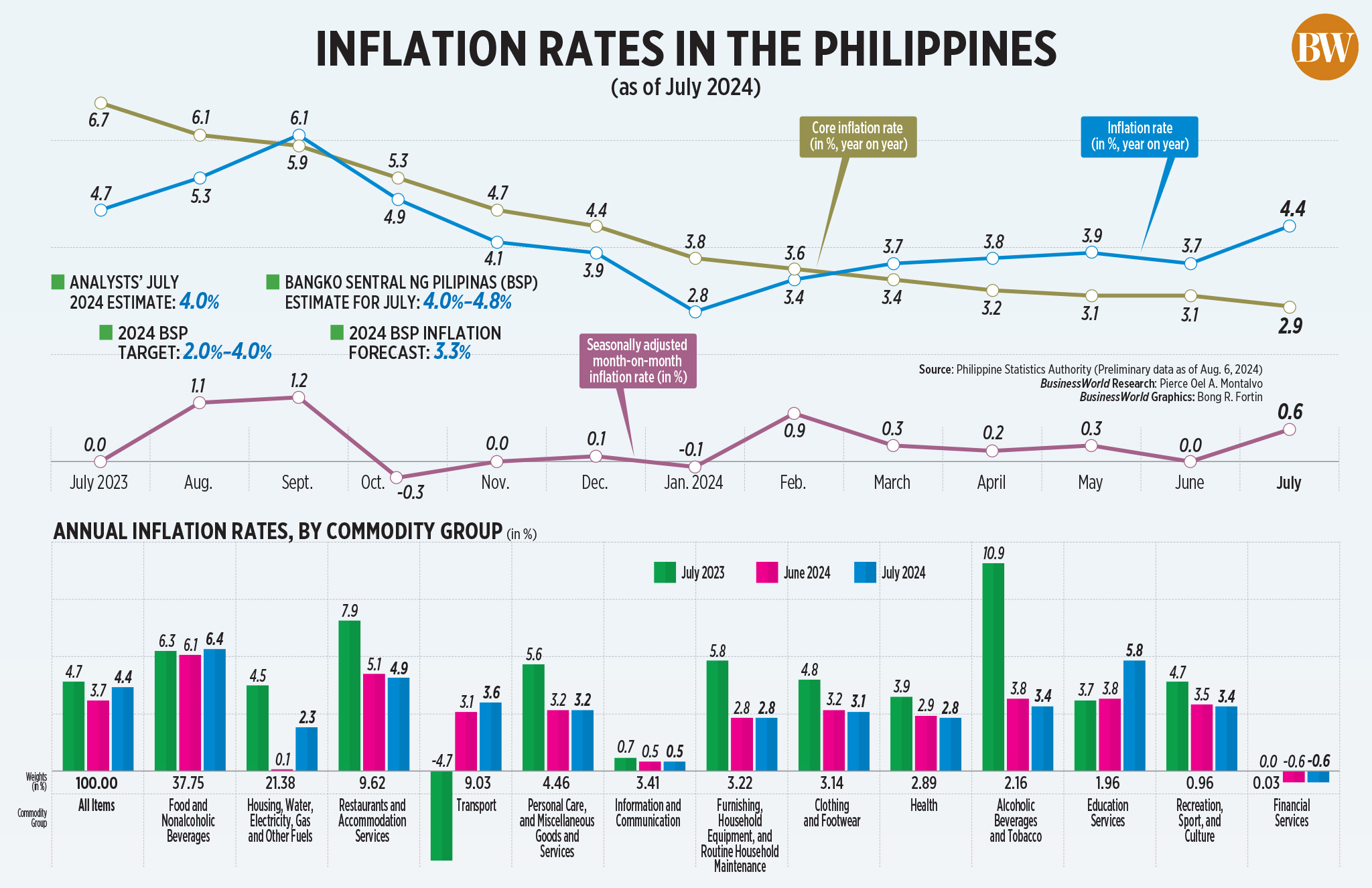

HEADLINE INFLATION accelerates to a nine-month high in July, mainly due to a spike in electricity rates and food costs, data from the Philippine Statistics Authority (PSA) showed.

The consumer price index accelerated to 4.4% year-on-year in July from 3.7% in June, falling within the Bangko Sentral ng Pilipinas (BSP) 4%-4.8% forecast.

It was higher than the average estimate of 4% in a Business poll among 15 analysts conducted last week.

July’s print was also the fastest in nine months or since the 4.9% clip in October 2023.

July also ended seven consecutive monthsFsettlement within the central bank’s target bandwidth of 2-4%. Inflation remained within target from December 2023 to June 2024.

In the FOver the first seven months of the year, headline inflation averaged 3.7%, above the central bank’s 3.3% full-year forecast.

Core in itFInflation, which excludes volatile food and fuel prices, fell sharply to 2.9% in July from 6.7% a year ago. Core in itFIn the United States the average was 3.3% Ffirst seven months.

“The last one inFThe result is in line with the BSP’s latest estimate that inflation will temporarily rise above the target range in July 2024, mainly due to higher electricity rates and positive base rates.Fis likely to follow a general downward trend starting in August 2024,” the central bank said in a statement.

National statistician Claire Dennis S. Mapa said the main source of faster inFIn July, the index for housing, water, electricity, gas and other fuels rose from 0.1% in June to 2.3% in July.

“We really expected that for electricity because Meralco (Manila Electric Co.) adjusted the rates in July. There we saw a signiFimportant contribution to inFlation”, Mr. Mapa said in mixed English and Filipino.

In July, Meralco increased rates by P2.1496 per kilowatt hour (kWh) to bring the total rate for an average household to P11.6012 per kWh.

InFlation of liqueurFPetroleum gas (LPG) produced rose to 20.2% in July from 14.7% in the previous month, while LPG prices increased by P0.55 per kilogram.

Mr Mapa also points to the heavily weighted food and non-alcoholic drinks index, which rose to 6.4% in July from 6.1% a month earlier and 6.3% a year ago.

Food inflation accelerated to 6.7% from 6.5% in June. This was mainly driven by higher prices for meat and other parts of slaughtered terrestrial animals (4.8% in July, compared to 3.1% in June) and fruit and nuts (8.4% compared to 5.6%).

Meanwhile, rice inflation fell further to 20.9% in July from 22.5% a month earlier, marking the fourth straight month of slower rice in July.Flat.

PSA data showed that the average price of common milled rice fell from P51.10 in June to P50.90 per kilogram in July; while well-milled rice dropped to P55.85 per kilo from P55.96 in June.

While it is possible that Typhoon Carina hurt food prices in July, Mr Mapa said its impact is very likely to be reflected in August inflation.

“It is possible that the impact of the storm has begun. Normally, the prices of vegetables increase after a typhoon based on our historical data. That is the expectation we have, that this could increase in August.”

Agricultural damage from Typhoon Carina and the southwest monsoon, which hit Metro Manila and nearby provinces in late July, amounted to P3.04 billion.

Indoor transportationFThe economy was also one of the main factors behind the rebound in JulyFling, said Mr Mapa.

Transport in JulyFInflation rose from 3.1% a month ago to 3.6%.

“This increase was driven by rising global oil prices due to the unexpected large drawdown of US gasoline supplies, optimistic fuel demand forecasts and ongoing geopolitical tension in the Middle East,” the National Economic and Development Authority said in a statement .

In July, adjustments to pump prices amounted to a net increase of P1.30 per liter for gasoline. Diesel and kerosene saw a net decline of P0.90 and P1.70 per liter, respectively.

Meanwhile, the inFThe interest rate for the bottom 30% of households with income rose from 5.5% in June to 5.8% in July and 5.2% a year ago to 5.8% in July.

In the seven months to July the inFThe percentage for the bottom 30% averaged 4.9%.

In the National Capital Region (NCR), inFInflation fell from 5.6% a year earlier to 3.7% in July. InFin areas outside NCR the average was 4.6%, faster than 4.4% a year ago.

OUTLOOK

The BSP said there are risks to the inFThe outlook for this and next year is downward, mainly due to the tariFf cuts in rice imports.

President Ferdinand R. Marcos Jr. signed an executive order in June lowering tariffs on rice imports through 2028 to 15% from the previous 35%.

“Nonetheless, higher prices for food items other than rice, as well as higher transportation and electricity costs, continue to pose upside risks to the economy.Flation,” the central bank added.

Treasury Secretary Ralph G. Recto said the rebound in JulyFlation is only temporary.

“InFThe inflation rate is expected to stabilize and remain within target for the remainder of the year as the impact of government interventions, in particular reduced rice ratesFfs will be more pronounced from August onwards,” he said in a statement.

PSA’s Mr Mapa said rice inflation could continue to decline in coming months, which would support slower headlinesFlat.

He said the reduction in tariffs on rice imports was “signiFicant” bring down rice prices in August. Rice in itFGrowth could possibly be slower than 20% in August, he added.

TARIFF REMOVED FROM TABLE?

The BSP said it will consider the latest newsFduring the August 15 meeting.

“Going forward, the BSP will ensure that monetary policy settings remain aligned with its primary mandate of ensuring price stability conducive to sustainable economic growth,” the report said.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said the “bigger than expected jump” inFThis could prompt the BSP to hold rates steady next week.

“In terms of the outlook for monetary policy, the July breach of the BSP targets, while well within the (central) bank’s projected outcomes, likely means that an August rate cut is now no longer possible.Ff the table,” he said in an email note.

Emilio S. Neri, Jr., chief economist of the Bank of the Philippine Islands, said in a report that the likelihood of a rate cut in August has decreased, as inFlation has exceeded the target band.

On Tuesday, BSP Governor Eli M. Remolona Jr. said the central bank is “slightly less likely” to cut rates at its August meeting because inflation was “slightly worse than expected.”

“It would be extremely strange if BSP were to cut rates next week, although we don’t believe we will have to wait too long before any cuts are on the horizon,” said ING Regional Head of Research for Asia-Paci.Fic Robert Carnell said in a note.

Meanwhile, Mr Neri said the BSP easing cycle is still “on the horizon” as core inflation eases and second quarter GDP data is “significant”.Fmisses the predictions grossly.”

“A big upside miss compared to today FFigures could undermine the BSP’s ambitions to cut rates in August. But with the (peso) gaining some support as the USD weakens due to current market volatility, a cut in August remains a possibility,” ING Bank said in a note.

Mr Chanco said cuts of 75 basis points were still possible this year, given expectations of the US Federal Reserve’s easing cycle in early September.

“Accordingly, our revised base case for the BSP is a 25 basis point cut in October, followed by a 50 basis point cut in December. “Certainly, if we are right about a likely big miss in Thursday’s second-quarter GDP report, then an August cut could quickly come back into the discussion,” Mr Chanco added.

Mr Neri ruled out “aggressive” rate cuts in the coming months, given domestic and external headwinds.

“The BSP is likely to prioritize domestic data in its policy decision on August 15, but it may also take global developments into account,” he said.

“Any signals from the Federal Reserve pointing to a substantial rate cut in September could increase the chances of a rate cut by the BSP at the next policy meeting.”

After August 15, the remaining policy-setting meetings of the Monetary Board this year are on October 17 and December 19.