Finance

Amid a 14% sell-off, Nvidia just hit investors with a rude awakening. What should investors do?

The capital markets have made an energetic start to 2024 S&P500 And Nasdaq Composite have given back some of their gains over the past month or so as shares have seen some pronounced selling activity. At the time of writing this article, the shares of artificial intelligence (AI) honey Nvidia (NASDAQ: NVDA) have fallen by almost 14% in the past month.

While some of the decline can be attributed to a selloff in the broader market, Nvidia recently hit investors with disappointing news. Should investors be concerned about this dilemma, or is this a rare opportunity to buy the dip in AI’s hottest stocks?

What’s going on with Nvidia stock?

There are many factors influencing the recent price action of Nvidia stock.

For starters, the unemployment rate unexpectedly rose to 4.3% in July – the highest level in more than two years. Moreover, recent comments from the Federal Reserve continue to leave economists wondering whether or not a rate cut is in the offing.

All told, the bleak macroeconomic picture, coupled with typical election volatility, has certainly caused some investors to sell stocks and hoard cash amid a pool of uncertainty. Unfortunately, this is only one side of the equation for Nvidia investors. Perhaps most worrying of all is that Nvidia’s long-awaited Blackwell graphics processing unit (GPU) is experiencing delays due to design flaws, according to several media outlets.

Considering that companies of all sizes and industries are doubling down on their investments in generative AI, Nvidia’s reprieve in Blackwell doesn’t exactly inspire confidence. Still, I don’t think this is necessarily a reason for investors to press the panic button just yet.

Why Blackwell’s postponement isn’t a big deal

Although estimates vary, public research shows that Nvidia owns at least 80% of the AI chip market. So while a delay to the Blackwell launch may be a low point, it’s extremely unlikely that Nvidia will lose significant market share as a result of this design blunder.

Chief Investment Officer of Harvest Portfolio Management Paul Meeks recently expressed a similar sentiment during an interview on CNBC. He makes a good point in saying that demand for Nvidia’s GPUs is so high that the company won’t have any real problem selling the Blackwell chips once they actually hit the market – regardless of the delay.

“I just need to see these stocks stabilize at some sort of bottom for a few sessions.”

Co-CIO of Harvest Portfolio Management, Paul Meeks, keeps a close eye on the technical aspects as he discusses why he’s not buying the dip in technology yet: pic.twitter.com/XqsOM9qABO

— Money Movers (@moneymoverscnbc) August 5, 2024

Additionally, each of the “Magnificent Seven” companies has reported profits this season except Nvidia. One of the common threads that ties the megacaps together is that spending on AI-powered products and services has risen steadily over the past year. In particular, capital expenditures (capex) have increased at mega-cap tech as demand for cloud computing infrastructure, data center services and semiconductor chips increases.

Considering that most of Nvidia’s revenue growth currently comes from hardware operations in chips and data centers, I think the rising capex investments among major tech companies represent a compelling secular story around Nvidia’s bright future.

Buy the dip like there’s no tomorrow

When investors are faced with troubling news, it’s always important to zoom out and consider all the variables.

Back in 1997, Apple almost filed for bankruptcy. Today, Apple is the largest company in the world by market capitalization. Even the best companies hit speed bumps every now and then. What is more important is how management is currently dealing with these challenges.

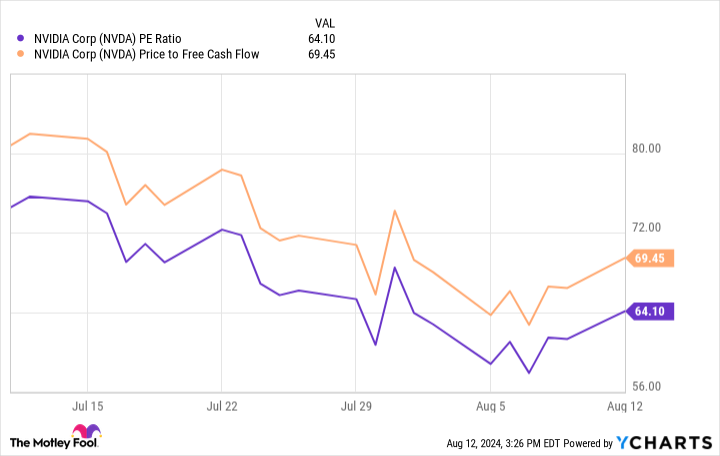

The chart below illustrates Nvidia’s price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) ratios over the past month. While a 14% drop in Nvidia stock may not seem like much in the grand scheme of things, the compression this drop has put on valuation multiples in such a short time frame shouldn’t be overlooked.

Beyond its GPUs, the company is quietly building a software platform to complement its core chip business. In addition, the company has made a number of strategic investments in areas such as robotics to further diversify its AI ecosystem.

I don’t see any of these initiatives as priced into Nvidia stock at this point. In fact, I don’t think much of what Nvidia does outside of GPUs is fully understood yet. For these reasons, I think the reaction to Blackwell’s delay has been overdone and view the recent sell-off as a no-brainer opportunity to buy Nvidia stock now as further gains appear to be in store in the long term.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 12, 2024

Adam Spatacco has positions in Apple and Nvidia. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool has one disclosure policy.

Amid a 14% sell-off, Nvidia just hit investors with a rude awakening. What should investors do? was originally published by The Motley Fool