Finance

1 stock I wouldn’t touch with a 10-foot pole, even after the market sell-off lowered its price

Even Apple (NASDAQ: AAPL) Shares fell during last week’s sell-off to nearly 12% below the 2024 high (as of late Tuesday), which wasn’t enough to make me want to buy it.

So why am I sour on a stock that so many others are bullish on? It all has to do with it valuation.

Apple’s growth has been poor

If you live in the US, chances are you either own an iPhone or another Apple product, or know someone who does. Apple is slightly less dominant worldwide, but still a very recognizable and popular brand.

Because Apple’s business focuses primarily on high-end electronics, it is more sensitive to demand cycles than companies that sell lower-priced electronics. As inflation has taken its toll, Apple’s sales have struggled.

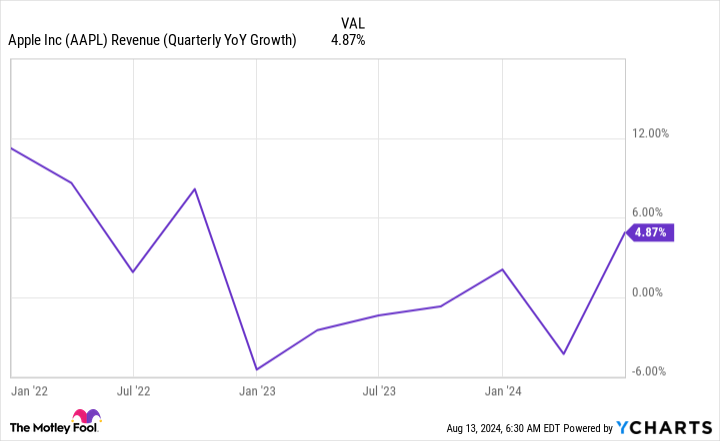

Since the start of 2022, Apple has struggled to achieve double-digit revenue growth and even had a few quarters where revenue declined compared to the same period a year ago. In the last quarter, sales rose year over year, but sales of its flagship product, the iPhone, fell slightly year over year.

The past two and a half years would have been much worse for Apple if it weren’t for the services division. This includes revenue from advertising, the App Store, cloud services and digital content such as Apple TV and Apple Music. Unlike hardware revenues, which fluctuate, Services has more of a subscription model feel, which is great for balancing the more cyclical side of the business.

But is that enough to justify purchasing the shares?

The numbers don’t add up for the shares

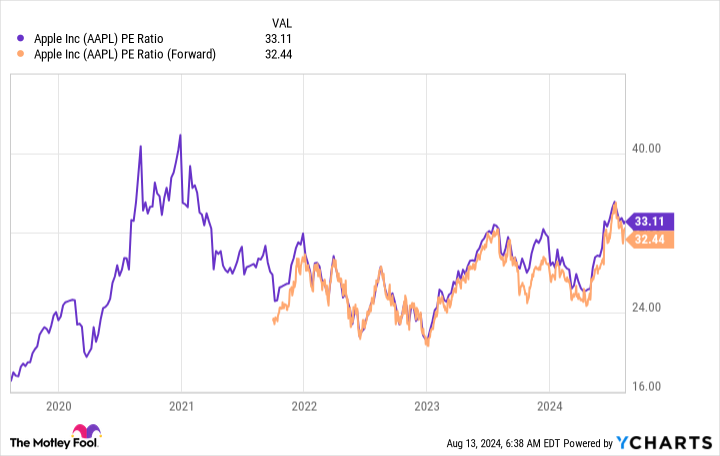

Premium companies trade for premium valuations. Some companies have such high execution that investors are willing to pay for it. Apple has been in this position for a while, but I’d like to challenge that idea.

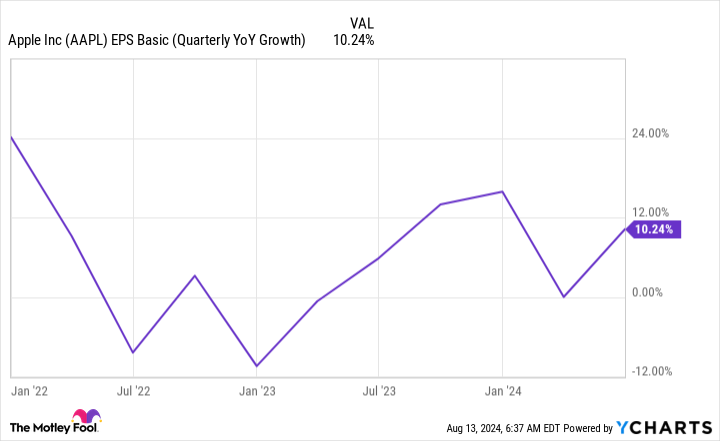

Revenue growth has been poor, and while earnings growth has somewhat kept pace with the overall market, it is still struggling to deliver double-digit increases.

As Apple approaches three years of uninspiring results, I’m convinced it doesn’t deserve its premium.

At 32 times forward earnings estimates and 33 times trailing earnings, the stock is as expensive as it was at the beginning of 2021. At the time, sales were up 50%, while profits doubled year over year. Apple was worth the premium investors paid at the time, but today’s Apple is not.

The investors are latching on to the idea that Apple Intelligence, the company’s generative AI product, will be a must-have and ensure consumers upgrade to the latest iPhone. Since this feature can only be done on the latest generation of phones, it could trigger an upgrade wave. But that’s not guaranteed and, barring a one-time wave of demand, wouldn’t mean much for the stock.

There are much better technology investments. Microsoft trades at almost the same valuation, yet has consistently delivered double-digit revenue and profit growth. Or you could watch Metaplatforms, which is cheaper and growing incredibly quickly (raising sales by 22% in the second quarter and profits by 75%).

Apple is simply too expensive and doesn’t perform as well as it needs to to justify its valuation. At these prices there are far too many better companies to invest in, I think investors should put their money there.

Should You Invest $1,000 in Apple Right Now?

Before you buy shares in Apple, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 12, 2024

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in metaplatforms. The Motley Fool holds positions in and recommends Apple, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has one disclosure policy.

1 stock I wouldn’t touch with a 10-foot pole, even after the market sell-off lowered its price was originally published by The Motley Fool