Finance

Eli Lilly’s next big blockbuster has arrived

In recent years, the pharmaceutical industry has been taken over by glucagon-like peptide-1 (GLP-1) agonists. Even if you’re not familiar with that terminology, I’m willing to bet you’re well aware of diabetes and obesity medications like Ozempic, Wegovy, and Mounjaro – all GLP-1 medications.

Currently based in Denmark Novo Nordisk (NYSE: NVO) dominates the GLP-1 market, thanks to its extensive range of treatments, including Ozempic, Wegovy, Rybelsus and Saxenda. However, Novo Nordisk’s main weight loss rival should not be slept on.

Eli Lilly (NYSE: LLY)the developer of Mounjaro, has proven that it can compete at a high level with Novo Nordisk. Additionally, Mounjaro’s treatment, Zepbound, has been off to a blistering start since its approval last November to promote weight loss. With sales of more than $1.2 billion in the three months ending in June, Zepbound has already achieved “blockbuster drug” status, given to drugs that sell more than $1 billion in a year.

It’s almost enough to make someone ‘forget’ Mounjaro.

Let’s take a look at how Zepbound is helping Lilly transform and assess what the long-term picture could be.

Zepbound seems unstoppable

When a new drug receives approval from the Food and Drug Administration (FDA), approval is often granted to treat only one condition.

For example, Ozempic is technically only approved for the treatment of diabetes. However, losing weight is often a byproduct of taking diabetes medications. But because Ozempic is not formally approved for chronic weight management, Novo Nordisk has released a separate drug called Wegovy that is specifically aimed at obesity care. It is important to note that Ozempic and Wegovy share the same primary compound, semaglutide.

Eli Lilly has followed a similar template to that of Novo Nordisk. Mounjaro is Lilly’s response to Ozempic and is used to treat diabetes.

Last year was Mounjaro’s first full calendar year on the market. The diabetes drug earned Lilly annual sales of $5.2 billion in 2023, making it the second-largest source of revenue for the company. gain.

While Mounjaro was undoubtedly a huge success, Lilly was also working on something else in the background. Like Novo Nordisk, Lilly developed an alternative version of its diabetes drug – Zepbound – which aims to treat obesity and also shares its key ingredient, tirzepatide, with Mounjaro.

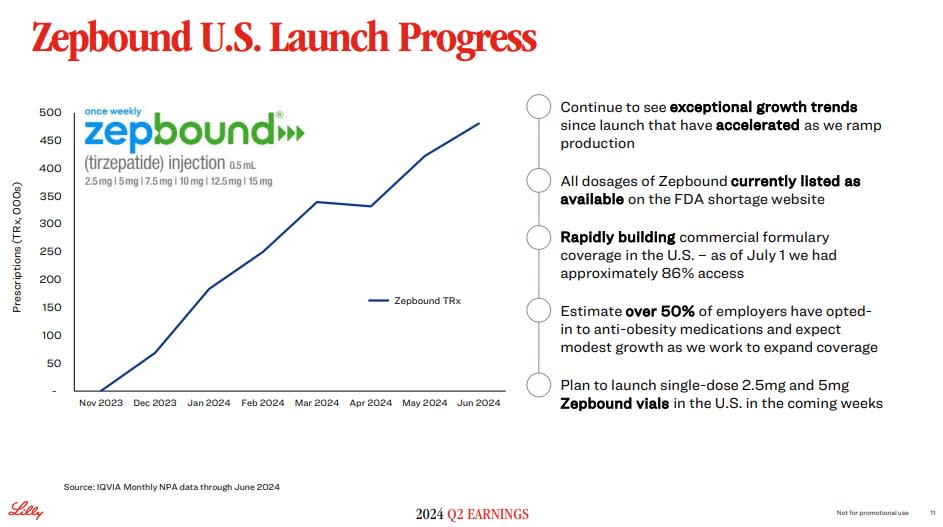

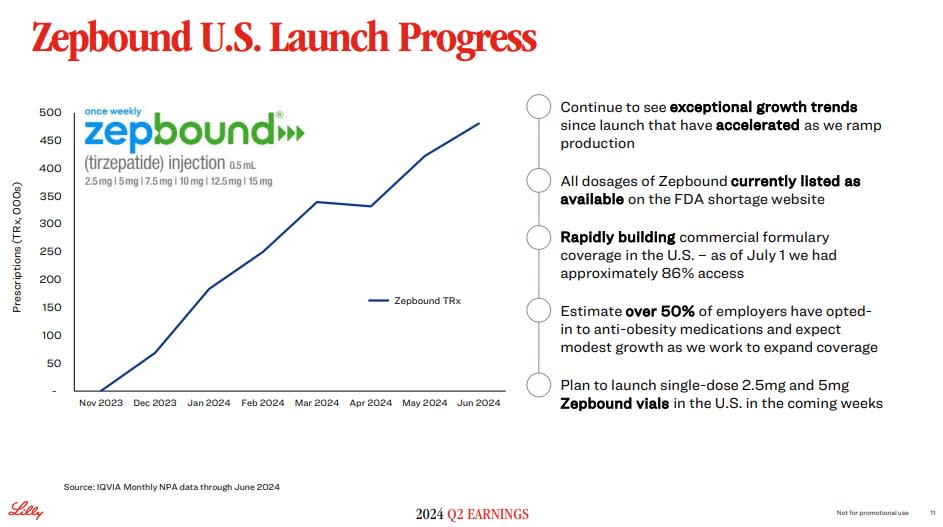

Zepbound received FDA approval in November 2023 and has been nothing short of a success since launch:

During the first quarter of 2024, Zepbound generated $517 million in revenue, which equates to an annual run rate of approximately $2 billion. But according to Lilly’s second-quarter earnings report, Zepbound has already lowered its run-rate forecast.

For the quarter ended June 30, Zepbound reported sales of $1.2 billion, making it a blockbuster drug that has been on the market for less than a year.

The best part? The journey seems to have only just begun.

The ride is just beginning

This is evident from research published by Goldman Sachsthe total addressable market for drugs to treat obesity could reach $100 billion by 2030. Since the World Health Organization (WHO) estimates that more than 1 billion people worldwide live with obesity, I tend to think this estimate is conservative.

Considering that the obesity care market is fragmented – with Novo Nordisk and Eli Lilly as the two main players – Lilly’s growth prospects for the coming years appear robust.

Additionally, Lilly management has taken some important steps to ensure that supply and demand dynamics don’t cause any hiccups. Namely, Lilly has acquired a manufacturing facility from Nexus Pharmaceuticals earlier this year to combat possible shortages of weight-loss drugs. I think this was a wise decision and puts Lilly in a good position for the future.

Are Eli Lilly shares a bargain?

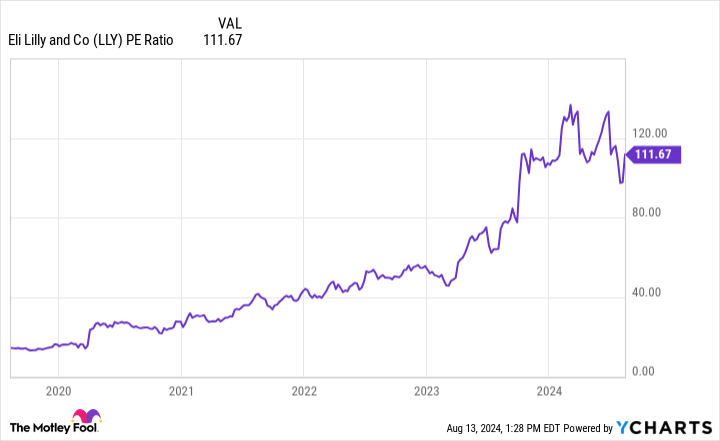

The chart below illustrates Lilly’s price-to-earnings (P/E) ratio over the past few years. Clearly, Lilly has seen quite a few valuation increases, especially over the past eighteen months.

While this may indicate that Lilly stock is overvalued, I think there is more to it. Please note that the S&P500 is up over 40% since January 2023. While Lilly has consistently shown impressive financial performance, I think the stock has likely seen some melt-up activity thanks to broader market conditions.

Additionally, Lilly recently received approval for a new treatment for Alzheimer’s disease called donanemab, and it’s likely that some of the anticipation surrounding donanemab’s approval was priced into the stock.

Despite the pricey valuation, I still see Eli Lilly as an extremely attractive opportunity for long-term investors. Both Mounjaro and Zepbound are already blockbuster drugs. And with an estimated market size of at least $100 billion and little competition, it’s hard to imagine Lilly experiencing significant weight loss disadvantages.

As the diabetes and obesity care markets continue to evolve, I think investors with a long-term horizon would be wise to consider a position in Eli Lilly.

Should You Invest $1,000 in Eli Lilly Right Now?

Consider the following before purchasing shares in Eli Lilly:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 12, 2024

Adam Spatacco has positions at Eli Lilly and Novo Nordisk. The Motley Fool holds positions in and recommends Goldman Sachs Group. The Motley Fool recommends Novo Nordisk. The Motley Fool has one disclosure policy.

Forget Mounjaro: Eli Lilly’s next big blockbuster has arrived was originally published by The Motley Fool