Business

The BoP position in July fluctuates towards a surplus

By means of Luisa Maria Jacinta C. Jocson, Reporter

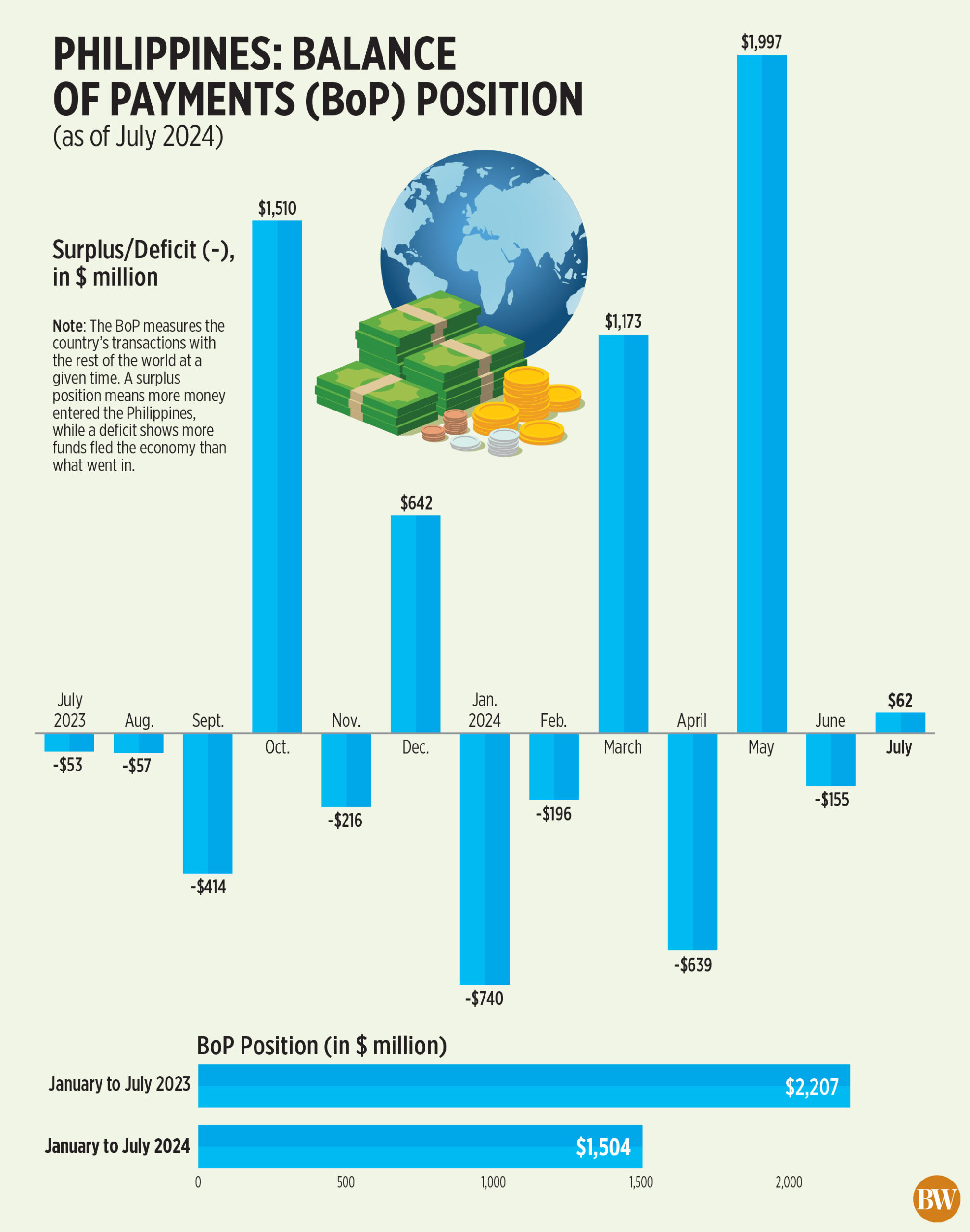

The balance of the country of The payments position (BoP) turned to surplus in July, data from the Bangko Sentral ng Pilipinas (BSP) showed.

The $62 million surplus was a reversal from the $53 millionFicit a year ago and the $155 million theFIT in June.

“The BoP surplus in July 2024 reflected the inflow mainly from the net income from BSP investments abroad and net foreign currency deposits of the National Government with the BSP,” the central bank said in a statement.

The BoP measures a country’s transactions with the rest of the world. A surplus shows that more money has come to the Philippines, while a theFicit means there is more money left.

At the end of July the BoP was reFread one FThe final gross international reserve (GIR) level was $106.7 billion, slightly higher than the $105.2 billion at the end of June.

The dollar reserves were sufficient to cover 6.1 times the country’s short-term foreign debt based on the original maturity and 3.8 times based on the remaining maturity.

It also corresponded to 7.9 months of imports of goods and payments for services and primary income.

An ample level of foreign exchange buffers protects an economy from market volatility and guarantees the country’s ability to service debt in the event of an economic downturn.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the BoP surplus in July was due to “persistence inFlow points of the overseas Filipino worker remittances, revenue from business process outsourcing, foreign tourism revenue, foreign direct investment (FDI) and other structural US dollars inFlow points of the country.”

Earlier data from the BSP showed remittances grew 2.5% to a six-month high of $2.88 billion in June. This brought remittances from January to June to $16.25 billion, up 2.9% from a year ago.

Net foreign direct investment inflows rose 15.8% to $4.024 billion in the first five months, compared to $3.475 billion in the same period a year ago.

PERIOD OF 7 MONTHS

Meanwhile, the country’s BoP position showed a surplus of $1.504 billion in the January to July period. This was lower than the surplus of $2.207 billion a year ago.

“Based on preliminary data, this cumulative BoP surplus mainly reflected the narrowing trade in goods deficit, in addition to continued net inflows from personal remittances, net foreign direct investment, trade in services, net foreign borrowing from the NG, and net foreign portfolio investments.” the BSP said.

In the first half of the year, the trade deficit fell by 9.5% to $25 billion. The country’s trade balance in goods has been in deficit for nine years, or since it hit a surplus of $64.95 million in May 2015.

Mr Ricafort said the BoP position in the January-July period was lower than a year ago due to higher proceeds from global bond sales last year.

The government raised $3 billion from the sale of dollar bonds in January 2023. This year she raised $2 billion from her double tranche dollar bond offering in May.

“While the surplus this year is lower than in 2023, the country’s GIR of $106.7 billion remains ample,” said Robert Dan J. Roces, chief economist at Security Bank Corp. in a Viber message.

“A narrowing trade deficit and consistent inflows from remittances, foreign direct investment and portfolio investments contribute to a cautiously optimistic outlook for the Philippine economy,” he added.

Looking ahead, Mr Ricafort said the BoP position could improve further amid expected foreign bond supply for the rest of the year.

The government wants to raise about $5 billion this year from issuing global bonds. Treasury chief Ralph G. Recto has said they may offer dollar or samurai bonds.

For 2024, the BSP expects the country’s BoP position to end up at a surplus of $1.6 billion, equivalent to 0.3% of GDP.