Entertainment

Edgar Bronfman Jr. makes a $4.3 billion bid for Paramount Global

The book on Paramount Global’s months-long merger and acquisition epic is not yet closed.

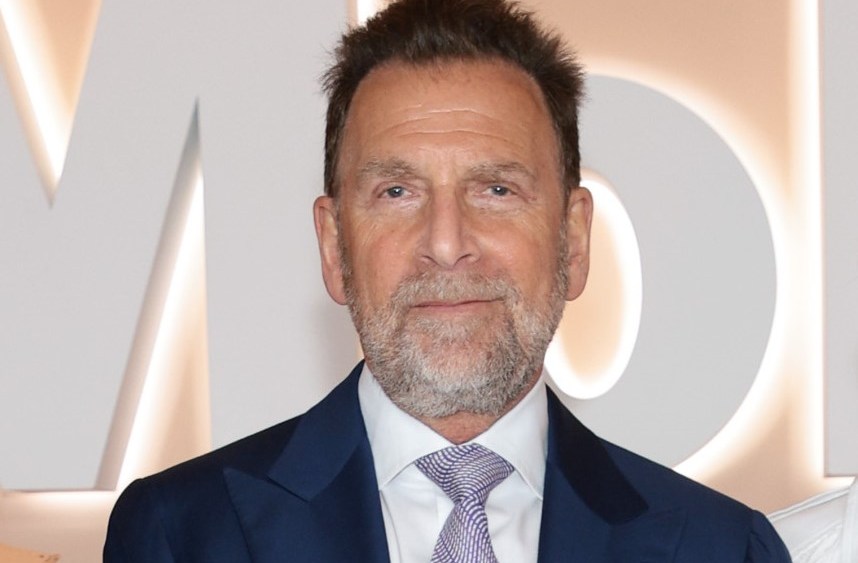

On Monday (August 19), billionaire media mogul Edgar Bronfman Jr. submitted a $4.3 billion bid to acquire Shari Redstone’s National Amusements Inc., the controlling shareholder of Paramount Global. Variety has confirmed.

Bronfman’s bid is an attempt to rival that of David Ellison’s Skydance Media and its backers, which last month signed a binding deal worth more than $8 billion for NAI and Paramount Global, whose properties include CBS, Paramount Pictures, Showtime/MTV Entertainment Studios. and Paramount Media Networks.

Bronfman’s offer was submitted to the special committee set up by Paramount Global’s board to review M&A offers. This committee is expected to assess the offer on Wednesday. Representatives for NAI, Bronfman and Skydance declined to comment; representatives of the Paramount board’s special committee did not respond to a request for comment.

Bronfman’s bid for NAI came first The Wall Street Journal reports this.

Bronfman’s offer includes $2.4 billion for NAI (approximately $1.75 billion net of debt); a $1.5 billion investment earmarked for Paramount’s balance sheet to pay down debt; and $400 million for the termination fee that Paramount would have to pay to the Skydance group if Paramount chooses Bronfman’s offer.

On July 7, Paramount Global and Skydance Media announced a two-part transaction that would result in Skydance acquiring Shari Redstone’s National Amusements Inc. would acquire and then merge with Paramount. Under a “go-shop” provision in that agreement, Paramount Global has the right to request a better offer within a 45-day period ending at 11:59 PM ET on August 21. If Paramount Global is in discussions with a potential bidder that the board’s Special Mergers and Acquisitions Committee has determined “in good faith will result or could reasonably be expected to result in a superior proposal” under the terms from Skydance, the company may extend the go-shop period until September 5, 2024, per an SEC filing.

What Bronfman would do with Paramount Global if he gains control of NAI is not clear, but it is possible that he would try to sell off its divisions (for example, Paramount Pictures, CBS or the cable networks). In the second quarter, Paramount Global took a nearly $6 billion writedown on the value of its cable networks.

Currently, Bronfman is executive chairman of Fubo, the sports-focused streaming pay TV provider that won a legal victory last week over Disney, Warner Bros. Discovery and Fox Corp.’s Venu sports streaming joint venture, when a federal judge issued a ruling. preliminary injunction, barring Venu’s launch and siding with Fubo’s antitrust arguments. Bronfman was chairman and CEO of Warner Music Group from 2004 to 2012, stepping down after it was acquired by Len Blavatnik’s Access Industries. Before WMG, he was CEO of Seagram before selling that company to Vivendi.

With the merger and acquisition drama still unresolved, Paramount is undergoing significant layoffs due to revenue declines in its TV and film businesses. The company said it will cut 15% of its U.S. workforce by the end of 2024 — eliminating about 2,000 jobs — as part of efforts to cut $500 million in costs annually. According to Chris McCarthy, head of Showtime/MTV Entertainment Studios and Paramount Media Networks and one of Paramount Media Networks, the job losses will be mainly in the marketing and communications departments, with some “right sizing” in other areas, including legal, financial and other business functions. Global’s three co-CEOs.

Skydance’s cost savings targets are even more aggressive. Jeff Shell, the former CEO of NBCUniversal who would become president of the combined Skydance-Paramount, has said Skydance aims to realize at least $2 billion in annualized cost synergies at Paramount.