Finance

SNPS Stock: Synopsys Beats Fiscal Q3 Targets

Chip design software company Synopsis (SNPS) late Wednesday beat analyst estimates for the fiscal third quarter and topped expectations for the current period. SNPS shares rose in extended trading.

↑

X

What’s next after a powerful week?

The Sunnyvale, California-based company earned adjusted earnings of $3.43 per share on revenue of $1.53 billion in the quarter ended July 31. Analysts polled by FactSet expected earnings of $3.28 per share on revenue of $1.52 billion. On a year-over-year basis, Synopsys’ revenues rose 27%, while sales rose 13%.

For the current quarter ending Oct. 31, Synopsys forecast adjusted earnings of $3.30 per share on revenue of $1.63 billion. That’s based on the midpoint of his prospects. Wall Street had modeled earnings of $3.25 per share on revenue of $1.62 billion for the fiscal fourth quarter.

“Our strong third quarter results and expectations for a record year continue to demonstrate the resilience of Synopsys’ business,” CEO Sassine Ghazi said in a press release. press release.

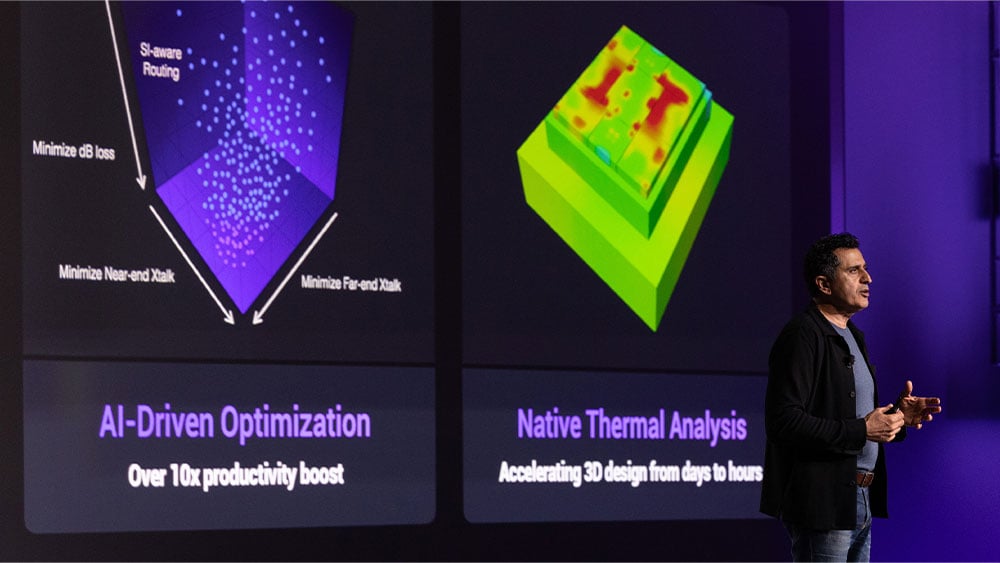

He added: “The complexity and pace of technology innovation is increasing as silicon and systems companies race to capitalize on AI in this era of ubiquitous intelligence. Synopsys is critical to technology innovation and our customer base is expanding as more companies in more industries define and optimize system performance at the silicon level.”

SNPS Stock is a long-term leader

In after-hours trading on the stock market today, SNPS stock rose 0.8% to 569. During the regular session Wednesday, SNPS stock rose 1.4% to close at 564.68.

Synopsys provides silicon-to-system design solutions, from electronic design automation (EDA) to silicon intellectual property and system verification and validation.

Meanwhile, Synopsys is in the process of acquiring an engineering simulation software company Ansys (ANSWER) for about $35 billion. That deal is expected to close in the first half of 2025, pending regulatory approval.

SNPS shares are in the IBD Long-Term Leaders Portfolio.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer tech, software and semiconductor stocks.

You might also like:

Chipmaker Analog Devices beats estimates amid nascent market recovery

AMD strengthens Nvidia rivalry with $4.9 billion acquisition

Chip Gear Giant Applied Materials Delivers Beat-And-Raise Earnings Report

Stocks to buy and watch: top IPOs, large and small caps, growth stocks

View stocks on the leader list near a buy point