Finance

Buy this high-yield dividend stock instead

ExxonMobil (NYSE:XOM) is a fine and worthy dividend candidate for investors looking for exposure to oil, but it is not traded Devon Energy‘S (NYSE: DVN) cash flow valuation. While ExxonMobil shares are up almost 19% this year, Devon shares are flat this year and offer excellent value for investors. This is why.

Devon Energy continues to make progress

Devon Energy’s recent second-quarter results included several positive numbers that helped validate the investment case for the stock, including the company’s improved production target. In a year where management decided to focus investments on core assets in the Delaware Basin, it is reasonable to expect an improvement in well productivity and overall production. Management started the year by forecasting a 10% improvement in well productivity and production of 650,000 barrels of oil equivalent per day (Boe/d) by 2024.

The good news is that management has reaffirmed its productivity improvement target and, for the second time this year, upgraded the full-year production target to a new range from 677,000 Boe/d to 688,000 Boe/d – an upgrade of 5%. of the original purpose. This is an even better result when you consider that oil prices started the year around $70 per barrel, but have spent most of it above $75 per barrel.

Cash flow valuation

As noted above, Devon Energy trades at a more attractive valuation than many other oil stocks. For example, Wall Street analysts expect ExxonMobil to generate $34.7 billion free cash flow (FCF) in 2024. Based on ExxonMobil’s current market cap of $527.5 billion, that FCF equates to 6.6% of the company’s market cap.

It’s an attractive cash flow yield, but Devon’s is even higher. Based on the company’s market capitalization of approximately $26.8 billion at the time of results, Devon management believes it will trade at an FCF yield of 9% in 2024 at an oil price of $70 per barrel, and 11% at $80 per barrel. % at $90 per barrel. Looking at the current market cap, these numbers work out to approximately 8.5% at $79 per barrel, 10.3% at $80 per barrel, and 12.2% at $90 per barrel.

With the current oil price of $76 per barrel, Devon is clearly trading at a very attractive FCF valuation.

A takeover is not in the figures

Devon management expects to complete the acquisition of Grayson Mill Energy’s Williston Basin business for $5 billion ($3.25 billion in cash and $1.75 billion in stock) by the end of the third quarter. Investors should note that neither the upgraded production forecast nor the FCF yield calculations assume a contribution from this acquisition in 2024.

Capital allocation policy

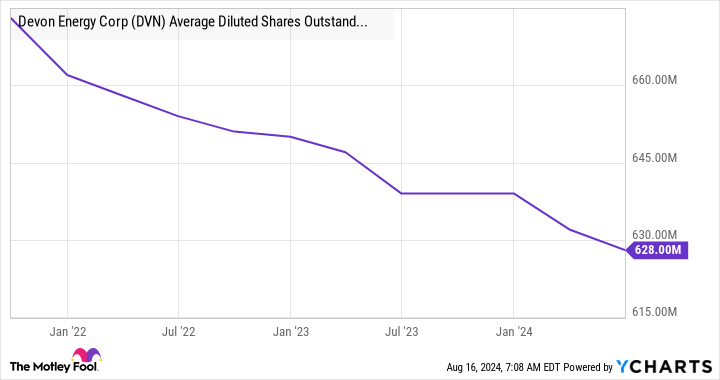

Devon Energy’s capital allocation policy is to use 30% of free cash flow to support the balance sheet, partly in connection with the acquisition. (Devon will begin a $2.5 billion debt reduction program.) The remaining 70% will be used for stock buybacks, a fixed quarterly dividend of $0.22 per share, and a variable dividend.

The total dividend in the first quarter was $0.35 per share, and $0.44 per share in the second quarter, with management prioritizing share buybacks over the variable dividend. While some investors may not like that, it reduces the number of shares outstanding is increasing the claim of existing shareholders on future cash flow.

Putting things into perspective, the aforementioned FCF yields make it clear that Devon could potentially pay significantly higher dividends if he wanted to. However, the idea of investing in a company is that management can generate a better return on investment than an investor. So it makes sense to let them do that by withholding cash to add value.

A share to buy

Devon’s FCF generation (which will be boosted by the Q3 acquisition) and its policy of returning cash to shareholders in the form of share buybacks and dividends means investors can look forward to significant returns in the coming years of Devon, provided that the oil price remains relatively high.

Should you invest $1,000 in Devon Energy now?

Before buying shares in Devon Energy, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 12, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has one disclosure policy.

Forget ExxonMobil: buy these high-yield dividend stocks instead was originally published by The Motley Fool