Finance

Philadelphia Fed President Harker calls for an interest rate cut in September

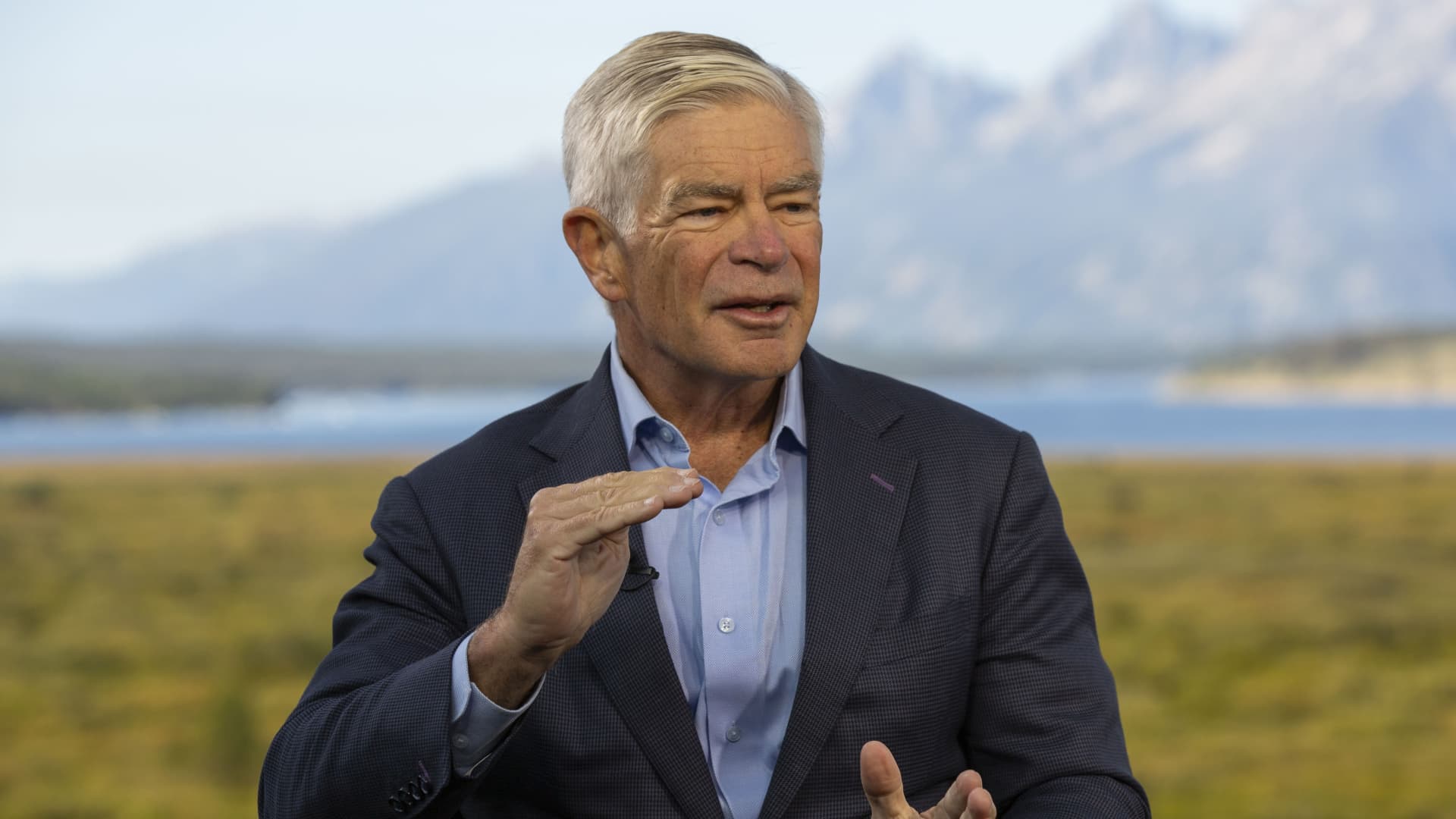

Philadelphia Federal Reserve President Patrick Harker on Thursday expressed strong support for a September rate cut.

Speaking to CNBC at the Fed’s annual retreat in Jackson Hole, Wyoming, Harker offered the most direct statement yet from a central bank official that an easing of monetary policy is almost a certainty if officials have less then meet again in a month.

The stance comes a day after minutes of the latest Fed policy meeting gave a solid indication of a future cut, as officials gain confidence about the direction of inflation and try to head off any weakness in the labor market.

“I think this means we need to start a process in September to bring rates down,” Harker told CNBC’s Steve Liesman during an interview with Squawk on the Street. Harker said the Fed should “ease methodically and send signals well in advance.”

With markets pricing in a 100% certainty cut of a quarter of a percentage point, or 25 basis points, and a roughly 1 in 4 chance of a 50 basis point cut, Harker says it’s still a matter of doubt in his view.

“Right now I’m not in the camp of 25 or 50. I still need to see a few more weeks of data,” he said.

The Fed has kept its key overnight interest rate in a range of 5.25%-5.5% since July 2023 to address a lingering inflation problem. Markets briefly rallied after the July Fed meeting, when officials said they still hadn’t seen enough evidence to start cutting rates.

However, policymakers have since recognized that easing will soon be appropriate. Harker said the policy will be made independently of political concerns as the presidential election looms in the background.

“I am very proud to work at the Fed, where we are proud technocrats,” he said. “That’s our job. Our job is to look at the data and respond appropriately. As a proud technocrat, when I look at the data, it’s time to start cutting rates.”

Harker will not have a vote on the rate-setting Federal Open Market Committee this year, but will still have input at meetings. Another nonvoter, Jeffrey Schmid, president of the Kansas City Fed, also spoke to CNBC on Thursday and offered a less direct look at the future of the policy. Still, he tended to take the lead.

Schmid noted that rising unemployment is a factor in where things go. A serious mismatch between supply and demand in the labor market had fueled inflation, pushing up wages and raising inflation expectations. However, in recent months, employment indicators have cooled and the unemployment rate has risen slowly but steadily.

“It helps to cool the job market a bit, but there is work to be done,” Schmid said. “I really believe you have to look at it a little harder compared to where this 3.5% [unemployment] number was and where it is now in the low 4s.”

However, Schmid said he believes banks have held up well in the high interest rate environment and that he does not believe monetary policy is “too restrictive.”

Harker will vote in 2026, while Schmid will vote next year.