Finance

Do tariffs increase prices? – Ecolib

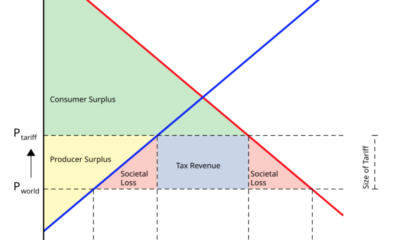

The argument that tariffs increase the prices of imported goods is exactly the same as the argument that gasoline taxes increase gasoline prices.

You might object that it is theoretically possible for a given tariff not to raise prices. That’s true. It is also theoretically possible that an increase in the gasoline tax will not increase gas prices. In both cases, the seller can pay 100% of the tax. The chances of this happening in the real world are extremely slim, especially when it comes to tariffs that apply to all countries.

Matt Yglesias recently retweeted a tweet from Scott Lincicome and added a comment:

I think Yglesias is vastly exaggerating the extent of the disagreement at this point. That may seem like a strange statement considering he uses the phrase “very few disagreements” and refers to a study showing only 5% of disagreements. Nevertheless, I still believe he greatly exaggerates the level of disagreement, which I suspect is actually well below 1%.

The poll asked about the effect of tariffs on “overall economic prosperity.” A few economists (not many) favor tariffs because they think they can increase prosperity. But that’s almost certainly not because they think tariffs will prevent a price increase. For example, suppose an economist thought that the loss of blue jobs due to imports was a bigger problem than higher prices. It’s not a nonsensical statement, even though I think it’s wrong, partly for reasons in my previous post. (I don’t believe this would save jobs.)

The small number of economists who favor protectionism do so precisely because they believe in a tariff would increase prices. If it did not raise prices, if it did not protect domestic industry from cheaper imports, it would fail to protect jobs in import-competing industries.

You might think I’m making a mountain out of a molehill, and making too much of the difference between a 5% minority and something like a 0.5% minority. But I worry that people might assume that a statement is almost certainly true if 95% of economists believe it to be true. If 50 out of 1000 economists have a heterodox opinion on a particular issue, it is certainly not that unlikely that they could be right – at least much more than 5%. Consider a case where 95% of economists thought it was 75% likely that X was true, and 5% of economists thought it was only 25% likely that X was true. When questioned, you might see that 95% of economists say they believe X to be true, but in fact it would only be 75% likely that X is true. even if the 95% were completely right.

I am among a small percentage of economists who believe the Fed caused the 2008 recession with tight monetary policy. But even if a poll shows that 99% of economists believe I’m wrong, that doesn’t mean there’s a 99% chance I’m wrong. In fact, I doubt that many of those economists who disagree with me would accept a bet where they could win a paltry $102 on a $100 bet on whether an alternative monetary policy in 2008 would prevent the big drop in NGDP could have been avoided, especially considering that we were not even at the zero lower bound yet! (Yes, this would be hard to test, but imagine if there was a test.)

Survey economists certainly tell us so something useful about what experts believe. But it is important not to overstate the importance of a strong majority of economists siding with one side of an issue. It’s not pointless, but it’s not final either.

P.S. It is also possible that a poll on whether tariffs raise prices would also yield the same heterodox 5%, in which case there may be a small number of economists who are simply very eccentric. But I still believe this figure would be well under 5%, especially if the two questions were asked back-to-back, reminding the economists being surveyed that they are two different questions.

PPP. Less than an hour after finishing this post, I was reading The Economist and came across the following story about the Russian economy:

Russian GDP will rise by more than 3% in real terms this year, continuing the fastest growth spurt since early 2010. Economic activity “increased significantly” in May and June, the central bank said. Other “real-time” measures of activity, including one published by Goldman Sachs, a bank, suggest the economy is accelerating (see Chart 1). Unemployment is close to a historic low. Inflation is too high – in July prices rose 9.1% year on year, above the central bank’s target of 4% – but with cash incomes growing 14% year on year, Russians’ purchasing power is rising rapidly . Unlike people in almost all other countries, Russians feel good about the economy.

I estimate that in 2022, far more than 95% of economists (myself included) were wrong about how the war in Ukraine and the resulting sanctions would affect the Russian economy. More often than not, 95% of economists will be right. But in a disturbing number of cases, this is not the case.