Entertainment

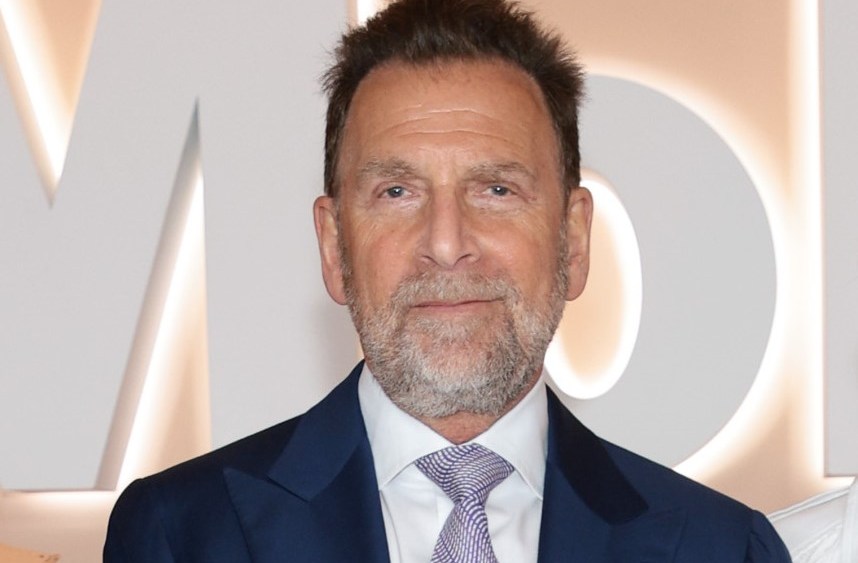

Paramount Global Ends ‘Go-Shop’ Period as Edgar Bronfman Jr. stops

Edgar Bronfman Jr. has abruptly dropped its eleventh-hour bid for Paramount Global, with the clock ticking on the time frame his group had to complete a stiff bid that could be a viable alternative to Skydance Media’s impending takeover deal.

Late Monday, Paramount Global’s special committee, which handled the lengthy merger and acquisition process, released a statement closing the door on the company’s “go-shop” period and expressing its intention to move forward with the Skydance Media deal. The committee noted in a statement that it had “contacted more than 50 third parties” to see if there was interest in bidding for the legendary owner of Paramount Pictures, CBS, MTV, Nickelodeon, BET, VH1, Comedy Central and more.

“On behalf of the Special Committee, we thank Mr. Bronfman and his investor group for their interest and efforts,” said Charles E. Phillips, Jr., chairman of the Paramount Global Special Committee.

“After thoroughly exploring the actionable opportunities for Paramount for nearly eight months, our Special Committee continues to believe that the transaction we agreed to with Skydance delivers immediate value and the potential for continued participation in value creation in a rapidly evolving industry landscape,” said Phillips.

Paramount Global said the Skydance deal is expected to close in the first half of 2025, as the company noted earlier this month with its second-quarter results, which were weak and underscored the urgency of the transaction. When reporting second-quarter earnings on Aug. 8, Paramount Global removed nearly $6 billion in value from its books to reflect the diminished prospects of its linear cable network group.

Earlier on Monday evening, Bronfman acknowledged the end of his attempt.

“Tonight, our bidding group informed the special committee that we will be exiting the go-shop process. It was a privilege to take part in this,” Bronfman said in a statement Monday evening.

“We continue to believe that Paramount Global is an extraordinary company, with an unparalleled collection of great brands, resources and people. While there may have been differences, we believe that everyone involved in the sales process is united in the belief that Paramount’s best days lie ahead. We congratulate the Skydance team and thank the special committee and the Redstone family for their involvement during the go-shop process,” said Bronfman.

Bronfman’s group threw a wrench in Skydance Media’s plan to complete its takeover deal for Paramount Global, which is valued at about $8 billion. Skydance and Paramount Global have been doing the M&A tango since the end of last year. A number of industry players, from Apollo Global Management to individual operators such as Byron Allen and Steven Paul, have made a lot of noise over the past eight months about attempts to buy Paramount. Bronfman went the furthest in the final days of the go-shop window built into the Skydance-Paramount acquisition deal with the special committee of the Paramount Global board charged with handling the tumultuous merger and acquisition process.

Clearly, Bronfman and his supporters concluded Monday that they did not have the time necessary to hammer out the complicated financial and governance agreements needed to present the Paramount Global committee with a robust counterproposal. Clearly, they also received no signals from Paramount that there was any will to pursue another extension with Skydance to allow for discussions. Skydance reluctantly baked in a six-week “go-shop” period, allowing Paramount Global to seek superior offers for the final deal it struck last month after months of on-and-off negotiations.

The go-shop provision was a must for the seller as it is an attempt to protect Paramount Global’s controlling shareholder, Shari Redstone, from shareholder lawsuits as the terms of the Skydance transaction are generally more favorable to her are then for owners of the company’s common shares. . Paramount Global’s special committee voted last week to extend that go-shop period for another 15 days, until September 5. The move irritated Skydance Media CEO David Ellison, who targeted Paramount Global’s board with a brief legal brief that was dismissed on August 22. , the day after the original expiration of the go-shop period.

Like the Murdochs, the Redstones have been one of the last remnants of the media baron families who once controlled the country’s biggest studios, networks and publishing giants, through ownership of preferred stock that gave them almost ironclad control over their companies gifts. The Skydance transaction will mark a milestone as the Redstone family largely exits the media and entertainment sector.

A Skydance representative had no comment on Bronfman’s withdrawal.