Finance

Costco Stock, Nvidia Chipmaker and Mag 7-member Amazon are bought by funds

Costco shares – along with Taiwanese semiconductor manufacturing (TSM), what chips are made for Nvidia (NVDA) – and Magnificent Seven member Amazon.com (AMZN) headline Wednesday’s Screen Of The Day, a column created based on the IBD stock screener.

↑

X

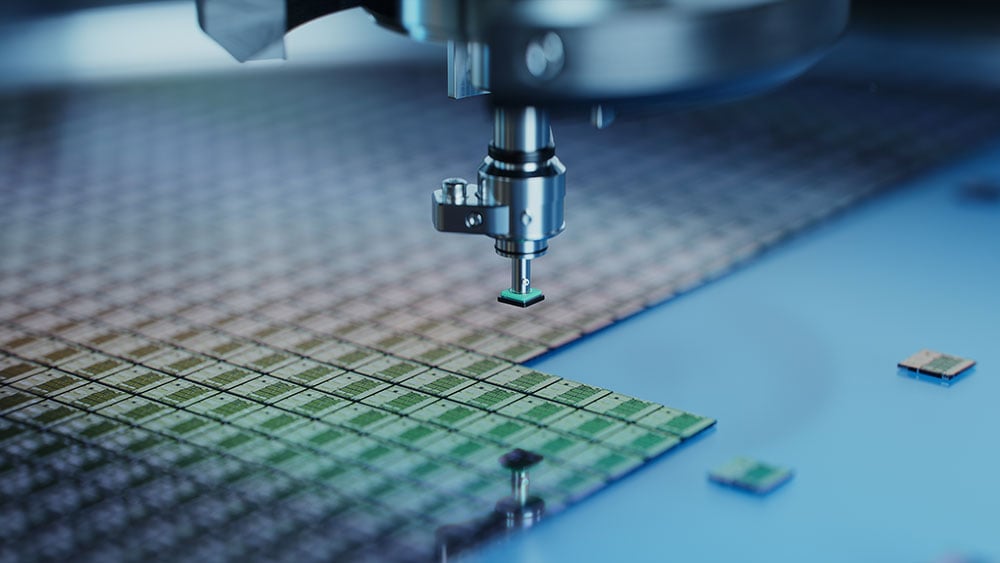

AI is going to the next level: in the chips that power Nvidia stock

Wednesday’s picks come from the Stocks Funds Are Buying screen, which identifies companies with increasing fund ownership in recent quarters.

Nvidia Chipmaker Eyes Buy Point

Taiwan Semiconductor, better known as TSMC, is the world’s largest chip foundry. Major customers include: Apple (AAPL), Nvidia, Advanced micro devices (AMD), Qualcomm (QCOM) And Broadcom (AVGO).

Forget Amazon and Tesla. This non-magnificent seven share is rising.

Taiwan Semi forms a cup-with-handle base that reflects a buy point of 175.45 per unit IBD market wave. Stocks Fight for Support Around the 50-Day Moving Average; they fell 0.7% on Wednesday afternoon.

In the latest quarter, TSMC surpassed second-quarter estimates and led expectations for the current period. The company earned $1.47 per U.S. share on revenue of $20.7 billion in the June quarter. Analysts polled by FactSet expected earnings of $1.41 per share on revenue of $20.33 billion. On a year-over-year basis, TSMC’s revenues rose 31%, while sales rose 34%.

Nvidia’s earnings will be announced late Wednesday. These results will certainly have an impact on TSMC, along with much of the technology sector. According to FactSet, Wall Street expects Nvidia to earn 65 cents per share on revenue of $28.7 billion.

Find the best stocks to buy and watch with IBD Stock Screener and IBD Screen of the Day

Costco shares are coming in

Retail giant Costco is trying to push past a buy point of 896.67 in the cup base after Tuesday’s advance. The 5% buy zone moves up to 941.50. Costco shares fell 2.3% on Wednesday afternoon, back below the buying trigger.

Bullishly, the stock’s relative strength line reached a new high on the breakout day. This confirms Costco shares as the market leader.

Next, Costco will report August sales figures on September 5. The next quarterly earnings report will be released on September 26. Wall Street expects the company to earn $5.07 per share on revenue of $80.2 billion.

Amazon faces resistance

Amazon’s Magnificent Seven stock fell below its 50- and 200-day lines on August 2, following the company’s second-quarter earnings report. After recovering for several weeks, shares found resistance at their 50-day line on August 21. Now the shares are retesting their 200-day moving average.

Amazon stock is building a new base, but there’s no clear buy point right now. If the stock can move further to the right of the base, it would provide more clarity on the stock’s prospects.

Amazon shares fell 1.5% Wednesday afternoon.

Follow Scott Lehtonen on Twitter at @IBD_SLehtonen to learn more about Arm stock, other best stocks to buy and watch, and the Dow Jones Industrial Average.

You might also like:

Check out IBD’s new exposure levels to help you keep up with the market trend

Top Growth Stocks to Buy and Watch

Learn how to time the market with IBD’s ETF market strategy

Find the best long-term investments with IBD Long-Term Leaders

Discover buy points and sell signals with MarketSurge pattern recognition