Finance

Is Costco the next big stock split after Chipotle and Nvidia? (And should you care?)

Stock splits are experiencing a renaissance. For the past fifteen years, we’ve been in the middle of a raging bull market with minimal interruptions, resulting in big winning stocks trading at sky-high prices. To make it easier to gift stock options to employees and for retail investors to purchase shares, companies have begun implementing more stock splits. Amazon, NvidiaAnd Chipotle are recent examples of stock splits, but there are many more.

Investors have built the narrative that stock splits generate value. There is an idea that by trading a stock at a lower price, but with a greater total number of shares outstanding, the stock is somehow cheaper. Does this story hold up in reality? Let’s look at a candidate for a stock split — Costco (NASDAQ: COST) — to explore this phenomenon and whether you should buy ahead of a possible stock split announcement.

Costco’s upcoming one-comma milestone

Costco stock is up about 650% over the past five years, recently surpassing $900 per share. If it rises by just over 10%, it will reach the $1,000 mark. Costco is a true testament to the sustainable growth of the low-cost membership model and is now one of the largest companies in the United States with a market capitalization of $400 billion.

The stock has delivered a total return of 150,000% since it went public more than 40 years ago (total returns include dividend reinvestment), making it one of the best-performing stocks ever. For every investor who has held shares since the beginning, a $1,000 investment would now be worth $1.5 million.

Along the way, Costco has gone through two stock splits due to its rising stock price. One in 1993 and one in 2000. With the stock approaching four figures, investors are likely expecting Costco to implement another stock split soon. When a stock price rises above $1,000 per share, management teams will typically try to split the stock to make it more affordable for investors with small amounts of money and to have more flexibility to give employees smaller chunks of stock as a form of income.

Examples of recent stock splits around $1,000 or higher include Chipotle, Nvidia and Broadcom. If you look at history, Costco may be overdue for a stock split at this point.

A thriving company with a premium valuation

Let’s forget about stock splits for a moment. How’s Costco’s business going? Well, fine and dandy, thanks for asking. In the most recent quarter ending in May, revenue grew 9.1% year over year to $57.4 billion. Growth was strong across the board, but especially internationally, where same-store sales grew 8.5% year-on-year, adjusted for gasoline prices. E-commerce growth was also solid, up 21% in the quarter.

The international runway for growth looks strong. For example, a Costco recently opened in Okinawa, Japan, and had to wait five hours to get in on the first day. Costco has a fantastic brand abroad, perhaps even stronger than in the United States, where it competes more heavily Amazon And Walmart. Management just increased membership pricing as well. The premium membership now costs $130 per year, compared to $120 previously.

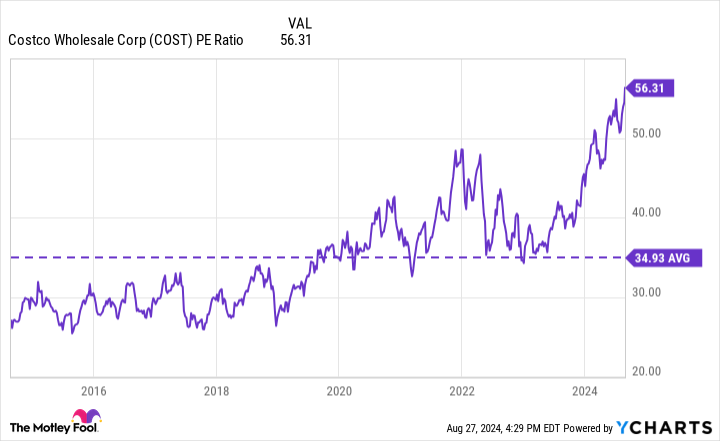

While this is all great, the shares are trading at quite a premium valuation. Compared to the last twelve months’ earnings, the stock has a price-to-earnings ratio (P/E) of 56. The stock’s average over the last ten years is 35, and this P/E is close to an all-time high. . Also remember that Costco was a much smaller company ten years ago.

COST PE ratio data Ygraphs

Does a stock split mean you have to buy the shares?

Let me cut to the chase: No one but Costco employees (who can get more flexible option packages) should worry about a potential stock split. For investors today, the stock split is meaningless, even if it means you can buy a larger number of shares. This is especially true when we look at the rise of fractional tradingwhere brokers allow you to buy less than one stock at a time when the price is sky high, like at Costco.

A stock split is pointless because it does not change the underlying business operations. If I give you a whole pizza and call it “one” slice, will there magically be more pizza if I cut it into 12 slices? No, and the same logic applies to a stock split. Don’t buy Costco because of a possible stock split, even if one is coming.

Instead, investors should focus on the company and the stock’s valuation based on its earnings power. Costco is a great company, there’s no denying that. But it trades at a higher price-to-earnings price and will grow only slowly over the next 10 to 20 years due to its huge revenue base. For this reason, investors should avoid buying the stock at the current price.

Should You Invest $1,000 in Costco Wholesale Now?

Consider the following before buying shares in Costco Wholesale:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool holds positions in and recommends Amazon, Chipotle Mexican Grill, Costco Wholesale, Nvidia, and Walmart. The Motley Fool recommends the following options: Short September 2024 put $52 on Chipotle Mexican Grill. The Motley Fool has one disclosure policy.

Is Costco the next big stock split after Chipotle and Nvidia? (And should you care?) was originally published by The Motley Fool