Business

Production growth stable in August

By means of Beatriz Marie D. Cruz, Reporter

FACTORY ACTIVITY in the The Philippines grew steadily in August amid a “modest” improvement in business conditions FIrms is ramping up production, S&P Global said.

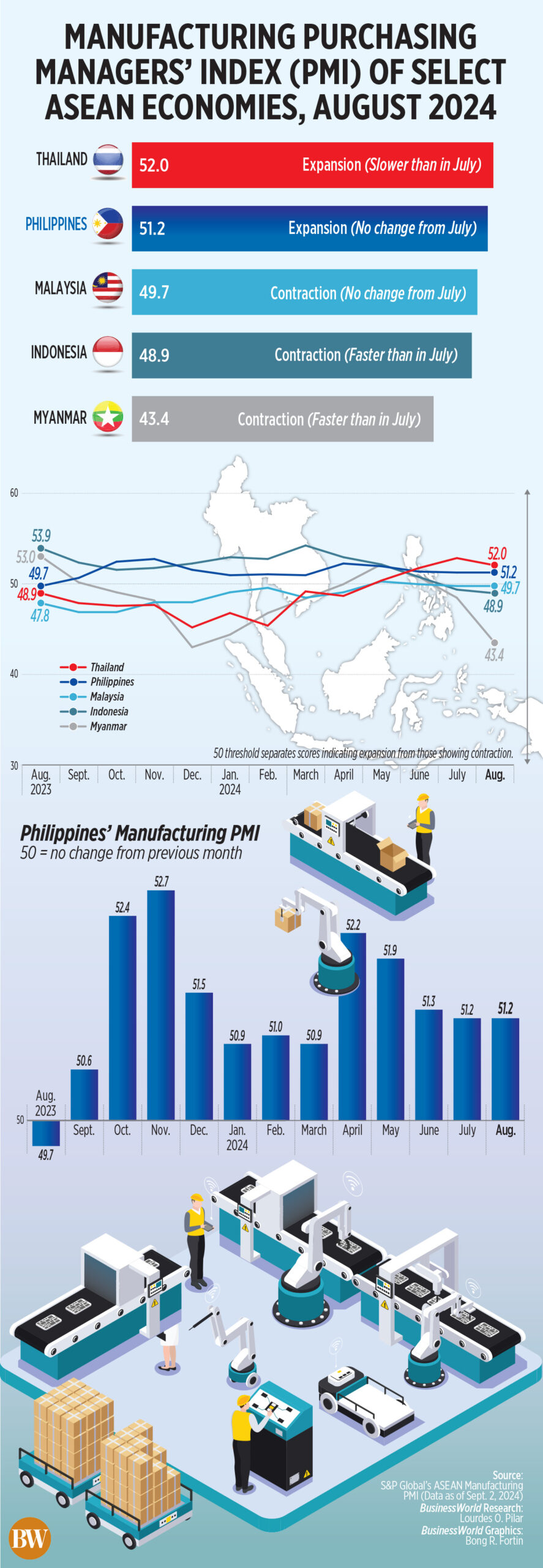

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) stood at 51.2 in August, the same figure in July.

A PMI reading above 50 indicates improved business conditions compared to the previous month.

“The Philippine manufacturing sector showed sustained and modest gains in mid-third quarter. “Output growth and new orders accelerated this month, highlighting improving demand trends,” S&P Global Market Intelligence economist Maryam Baluch said in a report.

“However, employment fell and purchasing activity cooled, suggesting manufacturers remain cautious about growth prospects,” she added.

Based on the latest PMI data, the Philippines had the second highest outcome Ffive Southeast Asian countries, second only to Thailand (52). Meanwhile, Malaysia (49.7), Indonesia (48.9) and Myanmar (43.4) all showed contractions.

At the time of publication, there was no data for Vietnam and Singapore.

The headline PMI measures production conditions through the weighted average of Ffive indices — new orders (30%), production (25%), employment (20%), supplier delivery times (15%) and purchasing inventories (10%).

For the Philippines, S&P Global data showed that overall new orders growth was the strongest in three months.

“However, demand from foreign customers faltered in August as sales of new export products fell for the first time since the start of the year. Thus, the data suggests that demand was domestically driven,” the report said.

The pace of production accelerated in August from the four-month low in July.

S&P Global noted that growth in business needs prompted manufacturers to ramp up purchasing activity in August, although the pace of increase was slowest in Ffive months.

“The slowdown in purchasing activity was reFcaused by a softer build-up of pre-production inventories at manufacturers. The rebound was small and the weakest in the current six-month accumulation period,” the report said.

Post-production inventories fell for the first time since February after five consecutive months of inventory build-up, the company added.

Philippine manufacturers have been hesitant to hire new workersFf in August, reversing the July rebound.

“Contractions have now been observed in three of the past four research periods. Furthermore, the tenacity of goods manufacturers to complete workloads efficiently despite workforce reductions has been sufficiently demonstratedFicient capacity,” said S&P Global.

InFPressure on the economy eased in August as input costs rose moderately, the report said.

“Sales prices for goods increased at a softer and only slight pace, which is indicative FIRMs partially absorb costs in an effort to boost sales and remain competitive,” the company said.

There were still delays in supplier inputs, with supplier performance deteriorating for the fourth month in a row. However, S&P Global said the recent delays were the “least outspoken” since May.

“The (production) slowdown can be partly attributed to the ghost month, bad weather that led to some work and production disruptions,” said Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp..

Looking ahead, S&P Global said Philippine producers expect production to increase further over the next 12 months, with the PMI reading likely to remain well above 50.

However, the latest data showed a dip in the Firms’ level of conFidentity.

“Confidence also fell in the last survey period, reaching a four-month low, further confirming that expectations around the production outlook have softened,” Baluch said.

The central bank’s recent rate cut and expected easing in the fourth quarter will boost factory activity in coming months, Security Bank Corp. chief economist Robert Dan J. Roces said.

“The August 15 interest rate cut and the expected 25 basis points (bp) cut in the fourth quarter could have a positive impact on purchasing activity in the coming months as it could encourage companies to invest in their businesses, which could lead to increased demand for materials and supplies,” he said in a Viber message.

The Monetary Board cut rates by 25 basis points at its August meeting, bringing the benchmark rate to 6.25%, down from a 17-year high of 6.5%.

Bangko Sentral ng Pilipinas Governor Eli M. Remolona Jr. has also said the central bank may cut interest rates by another 25 basis points before the end of the year.

Lower borrowing costs could also boost consumer spending, increasing demand for industrial goods, Mr. Roces added.

Mr. Ricafort said further policy easing by the Philippine and U.S. central banks could lead to cheaper credit for manufacturers and strengthen trade and investment activity.

Markets widely expect the US Federal Reserve to start cutting interest rates this month.