Finance

All 31 banks pass the annual exercise

Michael Barr, Federal Reserve Board vice chairman for oversight, testifies before a House Financial Services Committee hearing on the response to the bank failures of Silicon Valley Bank and Signature Bank, on Capitol Hill in Washington, DC, on March 29, 2023.

Kevin Lamarque | Reuters

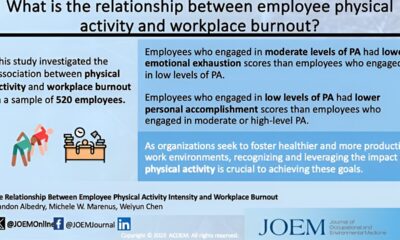

The Federal Reserve said Wednesday that the largest banks operating in the U.S. could weather a severe recession scenario while maintaining their ability to make loans to consumers and businesses.

Each of the 31 banks that participated in this year’s rulemaking cleared the hurdle of being able to absorb losses while maintaining more than the minimum required capital level, the Fed said in a statement.

The stress test assumed that unemployment would rise to 10%, commercial real estate values would fall by 40% and house prices would fall by 36%.

“This year’s results show that large banks would suffer a total of nearly $685 billion in hypothetical losses under our stress scenario, and still have significantly more capital than their minimum common stock requirements,” said Michael Barr, the Fed’s vice chairman for oversight. “This is good news and underlines the usefulness of the additional capital that banks have built up in recent years.”

The Fed’s stress test is an annual ritual that forces banks to maintain sufficient buffers for bad loans and determines the size of share buybacks and dividends. This year’s version featured giants such as JPMorgan Chase And Goldman Sachscredit card companies included American Express and regional lenders such as Truist.

Although no bank appeared to be seriously affected by this year’s exercise, which had roughly the same assumptions as the 2023 test, the group’s overall capital level fell by 2.8 percentage points, which was worse than last year’s decline year.

That’s because the sector is holding more consumer credit card loans and more downgraded corporate bonds. According to the Fed, lending margins have also come under pressure compared to last year.

“While banks are well positioned to withstand the specific hypothetical recession we tested them against, the stress test also confirmed that there are some areas we should pay attention to,” Barr said. “The financial system and its risks are constantly evolving, and during the Great Recession we learned the costs of not recognizing evolving risks.”

The Fed also conducted what it called an “exploratory analysis” of the funding problems and a trade crisis that only affected the eight largest banks.

In this exercise, the companies appeared to avoid disaster despite a sudden increase in deposit costs coupled with a recession. In a scenario where five major hedge funds implode, the big banks would lose between $70 billion and $85 billion.

“The results showed that these banks have significant hedge fund exposure but can withstand various types of trading book shocks,” the Fed said.

The banks are expected to announce their latest share buyback plans on Friday.