Business

Amro lowers PHL’s growth expectations

THE ASEAN+3 Macroeconomic Research OffIce (AMRO) lowered its Philippine economic growth forecasts for this year and into 2025, amid slowing external demand.

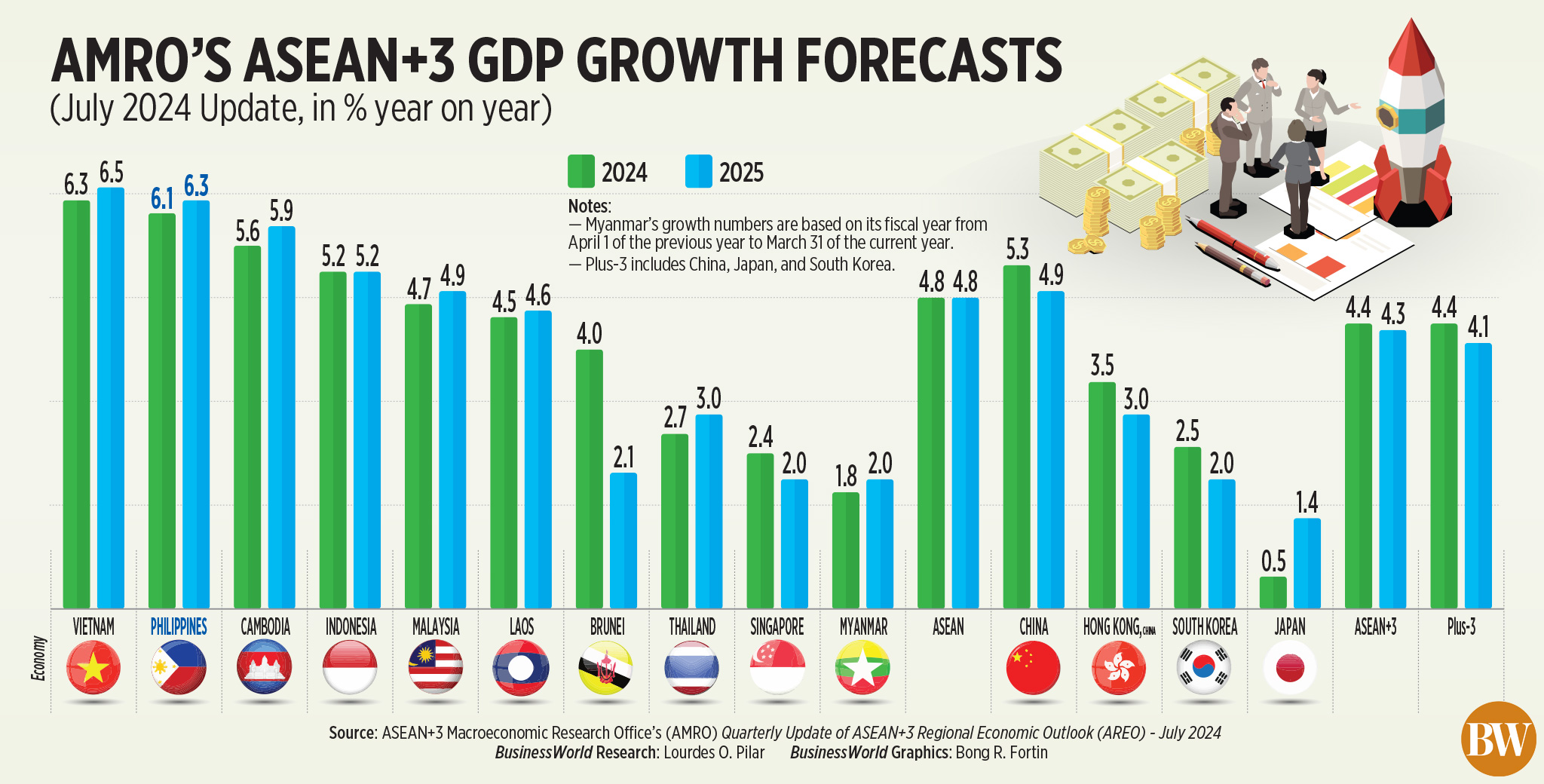

In its latest update, Amro expects the Philippine gross domestic product (GDP) to grow 6.1% this year, slightly lower than the 6.3% in the April report.

Despite the downgrade, this is still faster than GDP growth of 5.5% in 2023, and within the government’s target of 6-7% for this year.

“We have shaved off growth not just for the Philippines but for many of the countries in the region. The recovery in the external sector was weaker than expected,” Hoe Ee Khor, chief economist of Hoe Ee Khor, said in a virtual letter.Fon Tuesday.

“We may adjust it in the second half if the data shows the economy is strengthening,” Mr Khor said.

Amro has also lowered its GDP growth forecast for 2025 from 6.5% in the previous report to 6.3%. This falls within the government’s target of 6.5-7.5% for next year.

Mr. Khor said Philippine growth has been weakened by gaps in infrastructure.

“I think the government is very aware of that and is trying to do that Fsick the gap. Unfortunately, FIscal space has been used up to some extent during the pandemic,” he said.

The Philippine government plans to spend $1.47 trillion on infrastructure this year. The Marcos government has committed to maintaining high infrastructure investment, around 5-6% of GDP, between 2024 and 2025.

To supplement domestic savings, the Philippines still has “modest business space” to attract more foreign investment. However, the economy remains one of the most restrictive in the region, Mr Khor said.

“We believe the government’s policy measures will continue to attract more investments, and also help improve the Philippines’ growth potential with the improvement of the infrastructure gap,” he said.

Amro has also lowered its entry levelFThe forecast for the Philippines rose to 3.3% for this year, up from 3.6% in the April report. The country raised its inflation projection to 3.1% for 2025 from 2.9% previously.

Amro said the BSP can maintain tight monetary policy until a downward trend emerges in the eurozoneFlation is maintained.

Despite this, the Philippines is still expected to be the second-fastest growing economy among Association of Southeast Asian Nations (ASEAN) members this year, behind only Vietnam (6.3%).

Philippine growth is expected to be higher than that of Cambodia (5.6%), Indonesia (5.2%), Malaysia (4.7%), Laos (4.5%), Brunei (4%), Thailand (2.7%), Singapore (2.4%), and Myanmar (1.8%).

Amro expects the ASEAN+3 region, which includes China, Hong Kong, Japan and South Korea, to grow 4.4% this year and 4.3% in 2025.

The ASEAN region is expected to grow 4.8% this year and next.

“External trade is expected to return to positive territory this year, complementing strong domestic consumption and the ongoing recovery in tourism,” Amro said in the report.

The global economy is expected to continue to stabilize next year, with monetary easing expected to resume in major economies.

The think tank lowered its inflation forecast for ASEAN+3 (excluding Laos and Myanmar) to 2.1% for this year, compared to 2.5% previously “due to softer-than-expected food prices in several economies and lower imported inflation.”

“Higher cost pressures could emerge in 2025 as economic momentum gains momentum, but are unlikely to trigger a major spike in ASEAN+3 inflation in the base case,” the report said.

According to Amro, the overall risk balance for the outlook has improved since April, but there are also several risks such as a spike in commodity and shipping prices and tighter-than-expected US monetary policy.

Other risks include a sharp slowdown in the US and Europe, weaker growth in China and possible negative spillover effects from the US presidential election.

“The bad news is that the prospects for the region next year could be significantly affected by the outcome of the US elections. The good news is that the region has weathered similar shocks before,” Mr Khor said.

The American presidential elections will be held on November 5.

Amro also says that geopolitical tensions are becoming “more pressing” for the ASEAN+3 economies.

“The threat of geo-economic fragmentation continues to emerge as more economies announce trade controls or protectionist measures, following recent US tariff measures against China. “Ongoing shifts in global trade – including longer supply chains – could exacerbate the negative impact of these trade frictions, especially for the ASEAN+3 economies, which are highly integrated into global trade,” Amro said. — Beatriz Marie D. Cruz