Finance

Asian stocks are wary; Wall St is unfazed as Biden takes a bow

By Wayne Cole

SYDNEY (Reuters) – Asian shares turned cautious on Monday ahead of a week of corporate earnings that should test the sky-high valuations of technology stocks, while investors hope a key indicator of U.S. inflation will improve the chances of a rate cut in September will shrink.

Investors seemed well prepared for the news that US President Joe Biden had withdrawn from the election race and endorsed Vice President Kamala Harris for the Democratic ticket.

Online betting site PredictIT showed the price for a Donald Trump victory fell 3 cents to 61 cents, while Harris rose 11 cents to 38 cents. California Governor Gavin Newsom, another possible Democratic challenger, was at 4 cents.

Markets followed the news at ease, with stock futures on the S&P 500 rising 0.3% while Nasdaq futures rose 0.5%. Futures on 10-year government bonds rose 3 ticks, while 10-year government bond yields fell 2 basis points to 4.22%.

“As Trump’s poll numbers have improved, markets have favored positions that anticipate more trade barriers and possibly higher inflation,” ANZ analysts said.

“Some polls show Harris outperforming Biden against Trump, and Democrats are hoping that the next polls will show a Harris-led surge.”

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.2%, after losing 3% last week amid a general risk offsetting. Japan’s Nikkei lost 0.6%, and South Korea’s benchmark index fell 0.4%.

US second-quarter earnings figures are set to dominate the week, with Tesla and Google parent Alphabet kicking off the season for the mega-cap stock group “Magnificent Seven”.

Others reporting include General Electric, General Motors, Ford and Lockheed Martin.

The technology sector is expected to increase profits by 17% year-over-year, while profits for the communications services sector will increase by around 22%.

Such gains would exceed the estimated 11% increase for the S&P 500 as a whole, according to LSEG IBES.

A busy week for economic news will culminate with the release of the Federal Reserve’s preferred inflation measure on Friday. The core personal consumption expenditure index rose 0.1% in June, lowering the annual pace slightly to 2.5%.

Markets are betting heavily that a favorable outcome will underline the case for a rate cut in September, with futures pricing a 97% chance.

Gross domestic product figures are also expected to show growth picking up to 1.9% annualized in the second quarter, up from 1.4% in the first.

The closely watched Atlanta Fed GDPNow indicator points to 2.7% growth, indicating some upside risk.

The Bank of Canada meets on Wednesday and is believed to be almost certain to cut rates by a quarter of a percentage point to 4.5%.

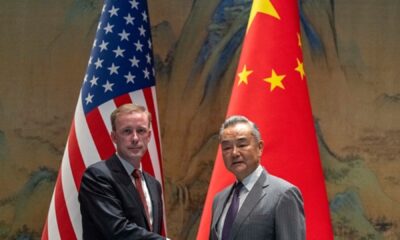

China is expected to leave its one- and five-year prime rates unchanged later on Monday.

Beijing released a policy document on Sunday outlining its noted ambitions, from developing advanced industries to improving the business environment, but showed no signs of looming structural shifts in the world’s second-largest economy.

In currency markets, the dollar gave back some of last week’s safe-haven gains, while the euro rose 0.2% to $1.0900. The dollar also fell 0.2% against the Japanese yen to 157.21.

In commodity markets, gold was trading at $2,410 an ounce, not far off last week’s record high of $2,483.60. [GOL/]

Oil prices rose slowly with little sign of progress on a ceasefire in Gaza as Israeli forces battled Palestinian fighters in the southern city of Rafah on Sunday. [O/R]

Brent rose 39 cents to $83.02 a barrel, while U.S. crude rose 42 cents to $80.55 a barrel.

(Reporting by Wayne Cole; Editing by Jamie Freed)