Finance

Bank of America outlines the exact scenario that could ultimately burst the AI stock market bubble

-

Bank of America says the ongoing ‘anything but bonds’ bull market has led to a very top-heavy stock market.

-

The company is monitoring real 10-year yields and credit spreads for signals on when the AI-led rally might end.

-

BofA says higher rates and tighter spreads could set off recession alarms and fuel a stock sell-off.

Bank of America has coined a term for what’s happening in the markets right now, calling it an “everything but bonds” bull run.

The company notes that equities and crypto led the way in the fourth quarter of 2023. In the first three months of 2024, it was commodities and… well, still crypto. And so far in the second quarter, it has been the US dollar’s time to shine.

While this has been lucrative for well-positioned traders across all asset classes, BofA warns that this is a byproduct of immense government spending, and could eventually disappear if a few key conditions are met.

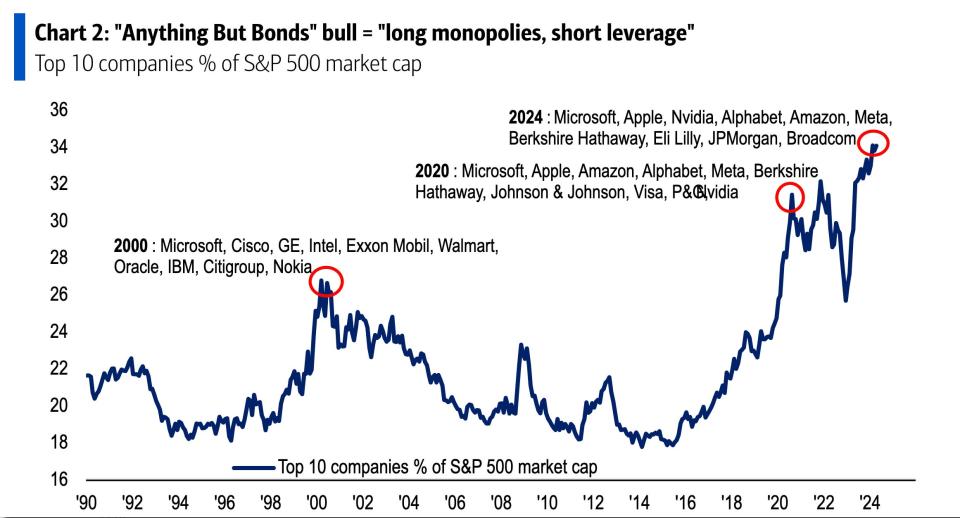

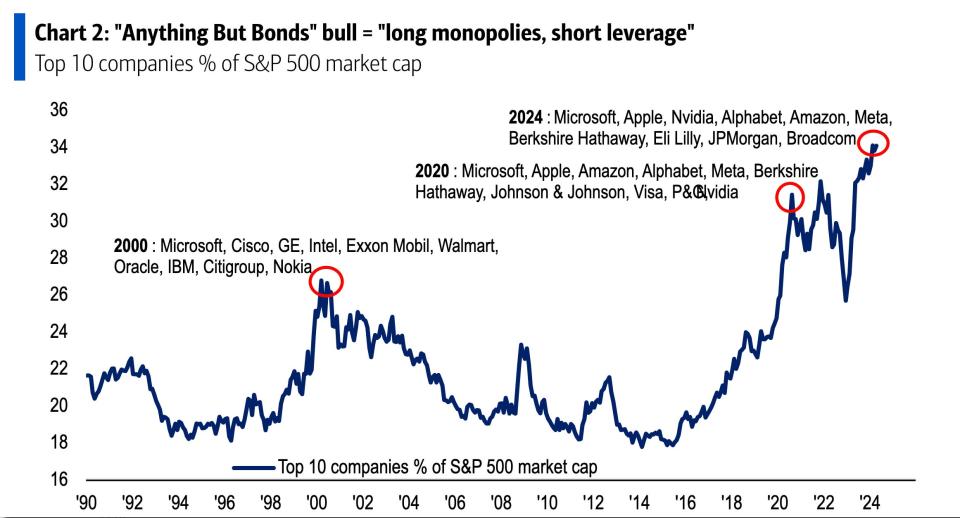

The most important part is the cohort of mega-cap tech companies that have long dominated stock market performance, largely because of their ties to AI. BofA says the ‘anything but bonds’ rally has created a particular fire among the market’s biggest stocks, with the top 10 accounting for a record 34%. S&P500 market capitalization, as shown in the chart below.

But BofA doesn’t see this high-flying bull run lasting forever. The firm lays out a scenario that could derail the rally and ultimately erode the leadership of mega-cap growth stocks: real 10-year yields rise into the 2.5% to 3% range, and/or higher rates combine with higher credit spreads to drive up interest rates. fear of a recession.

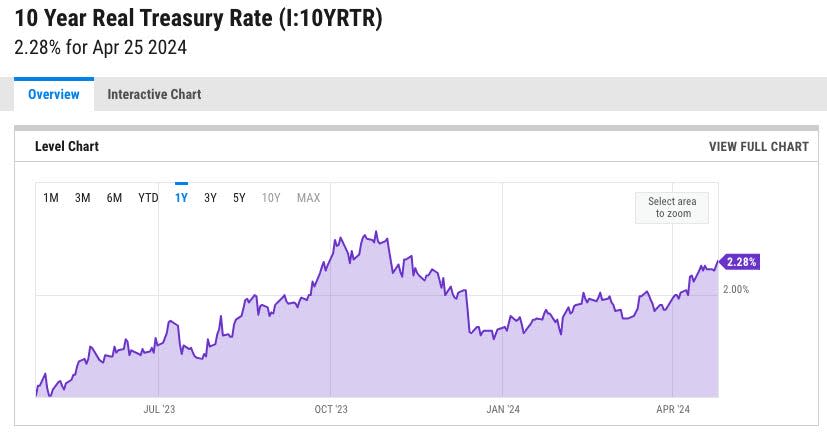

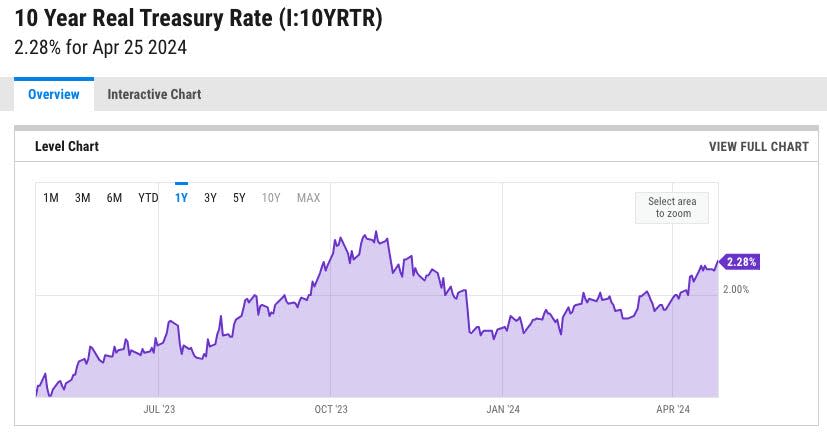

The real ten-year yield is currently at 2.28%, meaning there is still some way to go before there will eventually be a sell-off of the types of mega-cap names that are heavily weighted in the major indexes. According to the chart below, it has not risen above 2.5% since October 2023, and even then only briefly.

There’s also the consideration that megacap tech is no longer moving higher like an ever-unstoppable monolith. There has been split in the AI-focused Magnificent Seven shares while Tesla and Apple have had a rough start to 2024, while major companies like Nvidia and Microsoft have shown no signs of slowing down. Then there’s Meta, which is up over 40% this year and was on track for profits, but took a significant share price drop because it isn’t growing fast enough to satisfy investors.

These differences have reduced concentration risk in a way that could dampen any potential sell-off. In the meantime, if you subscribe to BofA’s view, you should look at real 10-year yields for a signal about when such a downturn is coming.

Read the original article Business insider