Finance

Berkshire is cutting investments in Apple by about 13%, Buffett hints that this is for tax reasons

OMAHA, Nebraska – Warren Buffett’s Berkshire Hathaway has suffered its massive loss Apple bet in the first quarter as the “Oracle of Omaha” continued to downsize his one-time favorite bet.

In its first-quarter earnings report released Saturday, Berkshire Hathaway said the Apple bet was worth $135.4 billion, representing about 790 million shares. That would mean a decrease in stake of approximately 13%. Apple was still by far Berkshire’s largest holding at the end of the quarter.

Warren Buffett speaks before Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska on May 3, 2024.

David A. Grogen | CNBC

This marks the second quarter in a row that the Omaha-based conglomerate has cut its stake in the iPhone maker. The company sold about 10 million Apple shares (just 1% of its massive stake) in the fourth quarter. This filing, taking into account the change in Apple’s stock price, would imply that Berkshire sold approximately 116 million shares.

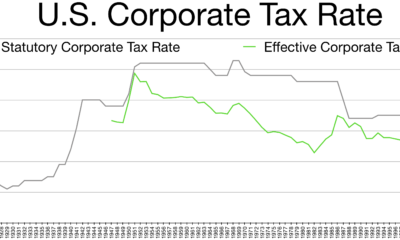

While answering shareholder questions at Berkshire’s annual meeting in Omaha, Buffett suggested the sale was made for tax reasons after significant gains. He also suggested the sale could be related to him wanting to avoid a higher tax bill later if rates go up to finance a ballooning U.S. budget deficit.

“It doesn’t bother me at all to write that check and I really hope that despite all that America has done for all of you, it shouldn’t bother you that we’re doing it and if I do it at 21%, And we do “I don’t think you’ll mind that we sold a little bit of Apple this year,” Buffett said at the meeting.

Buffett became a big fan of Apple after one of his investment managers Ted Weschler or Todd Combs convinced him to buy the stock years ago. Buffett even called the tech giant his second most important company, after Berkshire’s cluster of insurers.

Apple

Many had speculated that the 93-year-old investment icon had cut his favorite stake due to valuation concerns. Shares of Apple gained as much as 48% in 2023, while mega-cap tech stocks led the market rally. At its peak, Apple grew Berkshire’s stock portfolio, taking up 50% of it. The shares trade at more than 27 times forward earnings.

But Buffett continued to praise Apple at the meeting, saying it was “very likely” Apple will remain Berkshire’s largest holding at the end of 2024.

The iPhone maker’s shares got a big boost last week after the company announced that its board of directors had authorized a $110 billion share buyback, the largest in the company’s history. However, Apple posted a decline in overall sales and iPhone sales. Shares are down more than 4% so far this year on concerns about how this will revive growth.

Even with the sale, Berkshire is still Apple’s largest shareholder outside of exchange-traded fund providers.