Finance

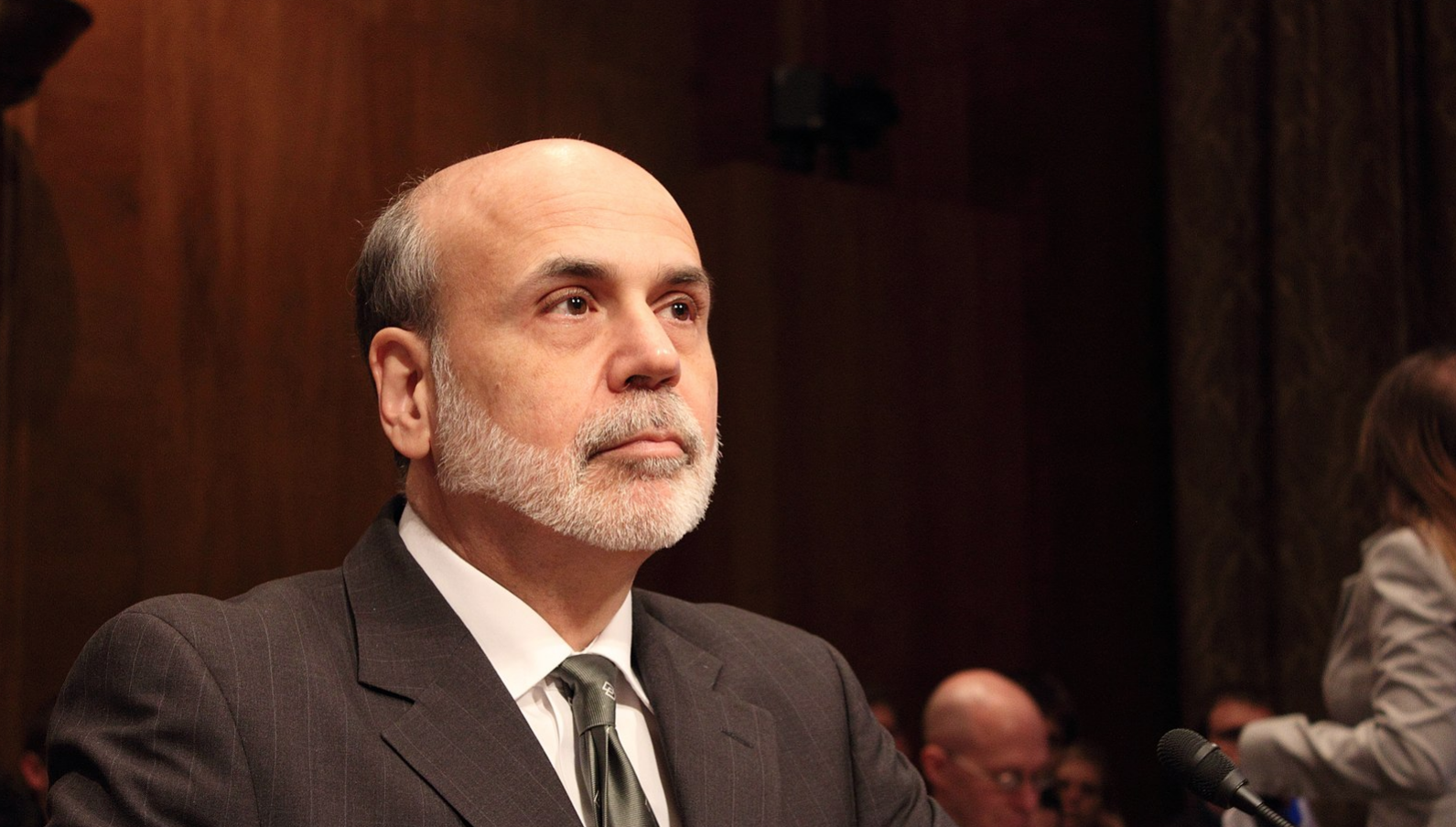

Bernanke on forward guidance – Econlib

The economist has an article discussing the issue of forward guidance in monetary policy. Here’s an excerpt:

Ultimately, to manage expectations credibly, officials must implement the changes they indicate. The dilemma is deciding what to do when conditions change, as they have since the Powell turn, with inflation pressures stronger than expected, making rate cuts less appropriate. Staying the course may no longer be appropriate; Changing this risks harming central bankers’ ability to pressure investors in the future. . . .

Ben Bernanke, former Fed chairman, once warned that such considerations could quickly degenerate into a “hall of mirrors.” If policymakers mimic market expectations, which shift as a result, endless disruptions are possible. Mr Bernanke’s more recent work assessing the Bank of England’s approach to forecasting appropriately offers a way out, suggests Michael Woodford of Columbia University. One crucial recommendation was that the bank should publish its projected policy rate based on a range of different economic scenarios, rather than just its central forecast. This would allow investors to understand how policymakers would respond to different circumstances, allowing them to change course in response to new data without losing face.

In my opinion, making interest rate forecasts dependent on macroeconomic conditions is an improvement over unconditional forward guidance. Unfortunately, it is difficult to predict how changing macroeconomic conditions could affect future movements in the natural rate of interest.

An alternative would be to provide more specific guidance regarding the Fed’s policy objectives. For example, you could imagine a nominal GDP target that calls for annual growth of 4%, with additional policies to correct any short-term deviations from this trend line. This type of policy regime is called “NGDP level targeting” because it focuses on the level of NGDP, and not the growth rate.

By specifying, even more precise guidelines could be provided the exact nature of the makeup policy. For example, the Fed could indicate that the replenishment would occur at a rate of 1% per year, back to the trend line. So if an error pushes the NGDP 1% above its target path, the Fed would target 3% growth over the next twelve months. If an error pushed the NGDP 2% above target, the Fed would target NGDP growth of 3% over the next two years. If NGDP were to fall 1.5% below target, the Fed would target NGDP growth of 5% over the next eighteen months.

An advantage of this type of policy regime is that it makes it easier to interpret the information in the interest rate futures markets. Today, policymakers don’t know whether an abnormal move in Fed Funds futures reflects expectations about what kind of future rates would be needed to achieve 4% NGDP growth, or a lack of confidence that the Fed is actually trying to maintain an NGDP -achieve growth of 4%. grow. To make the point more concretely, if Fed Funds futures show rates falling to 3.5% over the next year, is it because markets expect a weaker economy, or is it because markets expect accommodative monetary policy will bring about a stronger economy?

I have advocated a “guardrail” approach, in which the Fed would take unlimited short positions on 5% NGDP growth futures contracts and unlimited long positions on 3% NGDP growth futures contracts. But even if this market-driven policy regime is politically infeasible, a clearer statement of the Fed’s desired path for NGDP growth would create an environment in which existing financial markets could provide a rich source of information to policymakers grappling with the ask where they should take their course. their interest rate target.

I believe that setting a clear target at the NGDP level would lead to much less volatility in NGDP growth over time. An NGDP-level regime with a clearly specified catch-up rule would likely have allowed us to avoid a severe recession in 2008-2009 and a serious inflation overshoot in 2021-2022.