Health

Bipartisan efforts to legislate pharmaceutical patent reform are heating up

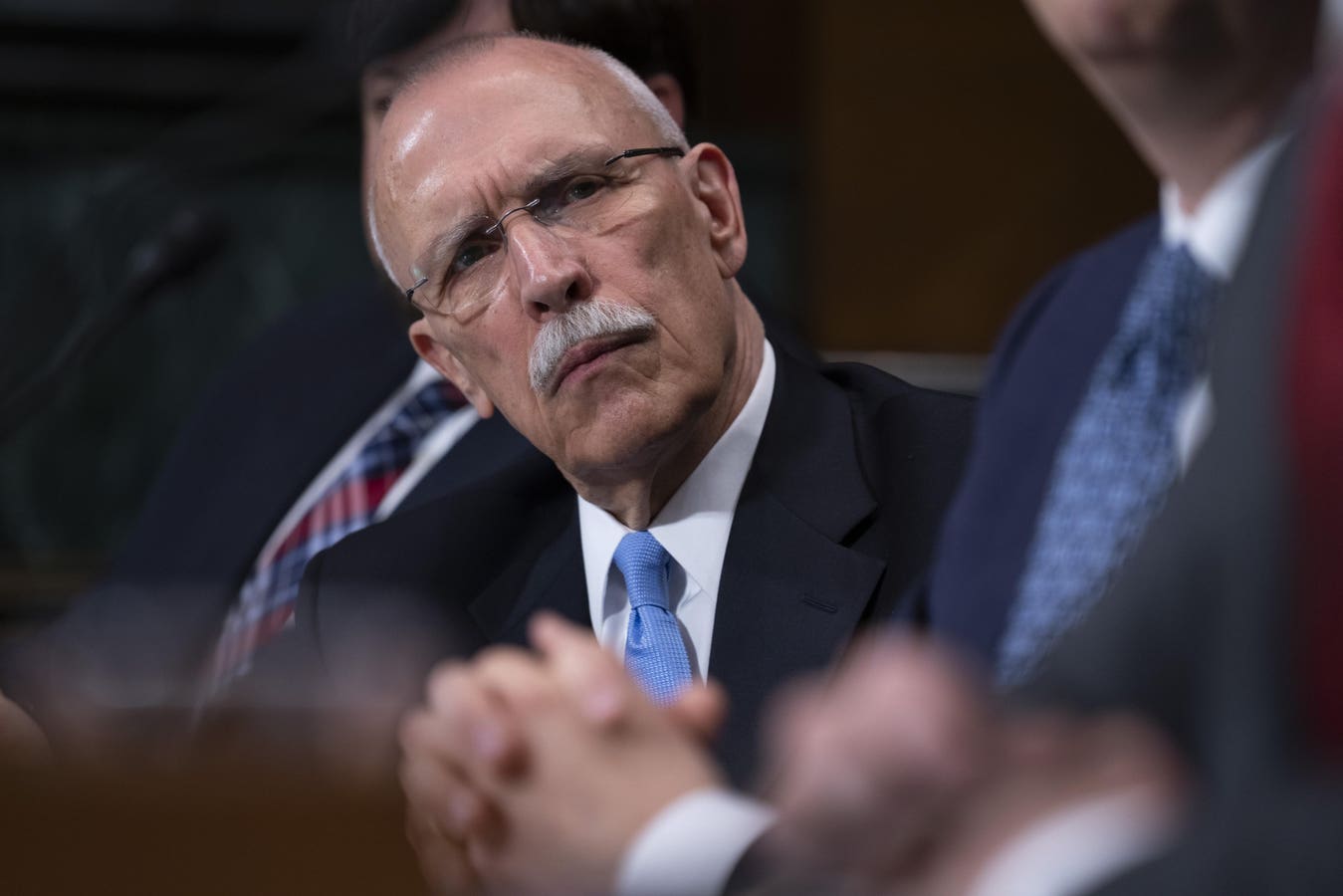

David Mitchell, president and founder of Patients for Affordable Drugs, listens during a Senate hearing … [+]

It’s difficult to find bipartisan consensus among lawmakers in Congress these days. But there is broad agreement on calls for pharmaceutical patent reform. The steep prices of brand-name drugs in the United States may be due in part to potentially anti-competitive tactics used by pharmaceutical manufacturers to expand their monopoly pricing power and prevent cheaper generics and biosimilars from entering the market.

Former Food and Drug Administration Commissioner Scott Gottlieb, a Trump appointee, proclaimed in 2018, the need to “end the tricks” that prevent generic and biosimilar products from reaching the market.*

Today, several bipartisan bills have been introduced that aim to curb the various ways pharmaceutical companies abuse the patent system. Federal Trade Commissioner Lina Khan did this agreed while targeting “inappropriate or inaccurate patent citations…that keep brand name prices artificially high.”

According to Bloomberg News, between 2005 and 2015 74% of new drug patents issued were for medicines that were already on the market. And of the approximately 100 best-selling drugs examined in another study nearly 80% received an additional patent to extend their monopoly period beyond the original intent.

David Mitchell, founder of Patients For Affordable Drugs NOW and a cancer patient, testified before the U.S. Senate Judiciary Committee on May 21 about what he views as anti-competitive tactics used by pharmaceutical companies to expand monopolies on branded products.

Mitchell urged bipartisan reforms that strike an “appropriate balance” between ensuring patents reward true innovation while facilitating timely competition to make prescription drugs more affordable for patients.

At Mitchell’s testimonyhe highlighted how pharmaceutical companies manipulate the patent system to extend their monopolies and prevent cheaper generic and biosimilar competition from entering the market. He pointed to strategies such as product hopping, patent cropping and pay-for-delay deals. Product hopping is when a company switches a patient population from a branded product whose patent expires, and therefore faces threatened competition, to a different formulation of the original drug whose patent later expires. A patent forest refers to the numerous patents that pharmaceutical companies can file to create barriers to market entry for potential generic or biosimilar competitors. In a pay-for-delay situation, brand-name drug manufacturers cause competitors to delay sales of a generic or biosimilar version of a drug.

A good example of a very long-term monopoly is the arthritis drug Enbrel, which was first approved by the FDA in 1998. Due to a slew of patent filings and lawsuits, there will be no more biosimilar competition in the US until 2029, despite there being two approved biosimilars: Erelzi in 2016 and Eticovo in 2019. Meanwhile, Enbrel has faced biosimilar competition in Europe since 2017, where patent battles are much less common.

In defending intellectual property rights, the pharmaceutical industry continues to maintain that patent reforms are not necessary. It cites the fact that more than 90% of prescriptions in the US are for generics or biosimilars.

Nevertheless, the existence of certain long-term monopolies is not in question, along with the associated potential barriers to market entry for competitors.

Mitchell expressed strong support for a package of bipartisan bills in the Senate aimed at controlling alleged abuses.

The bills before the Senate are intended to close the loopholes in the patent system. For example, S. 150, or the Affordable Prescriptions for Patient Act, cracks down on patent crops and product hopping. The legislation authorizes the Federal Trade Commission to enforce and impose restrictions on patent litigation involving prescription drugs.

In this context, the bill provides that product hopping has occurred when a pharmaceutical manufacturer, after receiving notice that the FDA is processing an application to market a competing generic or biosimilar, takes certain actions, such as withdrawing it from the market of the branded drug and the selling of a drug. follow-up product.

A drug manufacturer can of course rebut these presumptions by demonstrating that its conduct was not intended to restrict competition.

The S.150 law also aims to limit the number of patents that a manufacturer of original biological products can claim in a patent infringement lawsuit against a company that wants to sell a biosimilar version. But S.150 has been stuck in the Senate for more than 15 months, according to Axios.

There is also a bill that aims to do that improve information sharing between the FDA and the U.S. Patent and Trademark Office: S.79, or the Interagency Patent Coordination and Improvement Act. Here, lawmakers want the PTO to help the FDA ensure that “irrelevant patents” are never listed. Orange Book, which lists all approved drugs with therapeutic equivalence evaluations. The Orange Book contains all related patent and exclusivity information. With the introduction of S.79, lawmakers appear to want to systematize patent reform and interagency information sharing in the future. But this proposal is also in limbo, as it was also introduced more than fifteen months ago.

Parallel to what Congress is proposing, the FTC is directly challenging drugmakers on what it thinks it is incorrectly cited patents in the Orange Book, regarding twenty branded medicines, including the diabetes and slimming medication Ozempic. The FTC sent warning letters to ten drug manufacturers in late April. Companies that received such letters had until a few days ago to respond by revoking or updating their patent lists, or by declaring that they are legitimate. It has not been publicly announced whether or how the companies decided to respond.

In short, as bipartisan efforts to legislate or otherwise effect pharmaceutical patent reform continue to intensify, it is not yet clear if or when material changes will be implemented.