Health

BridgeBio Pharma, Annexon Biosciences, Delfi

Want to stay up to date on the science and politics driving biotechnology today? Sign up to receive our biotech newsletter in your inbox.

Good morning. Today, FDA advisors are meeting to discuss Lykos Therapeutics’ MDMA-assisted psychotherapy for people with PTSD. It’s a pivotal meeting: MDMA could be the first Schedule I psychedelic believed to have a medical use. Our reporters Olivia Goldhill and Meghana Keshavan will be live blogging about the meeting all day – tune in here.

What you need to know this morning

- It’s kind of a read-out of a clinical trial, starting with Viking Therapeutics and its MASH treatment, called VK2809, with Interim results.

- BridgeBio Pharma reports this long-term results from a study of the drug infigratinib for the treatment of achondroplasia, a form of dwarfism.

- Annexon Biosciences announced the result of a phase 3 study in Guillain-Barré syndrome.

AZ’s CAR-T therapy shows promise in early liver cancer research

A next-generation CAR-T therapy from AstraZeneca significantly shrank tumors in patients with liver cancer in a small phase 1 trial. This data is part of a big display from AstraZeneca at ASCO this year – the company already had two plenary presentations.

Although the results of this study – with an overall response rate of 56.5% and a response rate of 75% at the highest dose – were impressive, it is important to keep in mind that promising early results do not always manifest at a later stage. come. studies, an outside researcher noted.

Read more from STAT’s Angus Chen.

Novartis is showing warning signs on its newly acquired drug

Last weekend, Novartis Chief Medical Officer Shreeram Aradhye was speaking at the company’s ASCO investor event when he was asked about pelabresib, the myelofibrosis treatment the Swiss pharmaceutical giant picked up when it acquired MorphoSys.

One would expect Aradhye to reiterate the company’s plans to submit the drug to the Food and Drug Administration for approval. But that’s absolutely not what Aradhye did.

Instead, his response caught the attention of STAT’s Adam Feuerstein, who now believes the plans for pelabresib have run into serious trouble. Asked for comment, Novartis declined.

Read more.

Delfi reveals new data on lung cancer test

Delfi Diagnostics announced key data yesterday about its liquid biopsy test for lung cancer: its test’s sensitivity (the frequency with which it will flag positive when cancer is actually present) is 80%, and its specificity (how often the test is negative when there is no cancer detectable) is 58%.

Delfi’s strategy is different from other liquid biopsy companies such as Grail because it focuses specifically on lung cancer, which has an established method of screening via low-dose CT scans. Delfi’s idea is to use a blood test to further divide people already eligible for screening into higher and lower risk groups, motivating some to actually get the CT scans they already have eligible and others feel comfortable skipping it.

Read more from STAT’s Matt Herper.

Biotechnology is unlikely to return to its ‘sugar high’ days anytime soon

From STAT’s Jonathan Wosen: A report Yesterday by Ernst & Young highlights the stark contrast in market performance between early-stage and late-stage biotech companies.

Publicly traded US and European biotech companies with experimental drugs in phase 1 trials lost 19% of their stock value between December 2021 and March 2024, while companies with assets in late-stage trials saw their shares rise more than 20%.

A parallel trend was seen in the field of venture capital. While a select number of biopharmaceutical companies raised huge rounds from VC firms last year, including mega-rounds of $270 million for RNA startup Orbital and $273 for Generate Biomedicines, the number of early-stage rounds in 2023 fell 12%.

The report notes that lower interest rates could spark a broader industry revival, but warns that the sector is unlikely to return to the ‘sugar high’ days of 2020 and 2021, when companies with early-stage data could easily make huge amounts of profit to generate. money at high valuations.

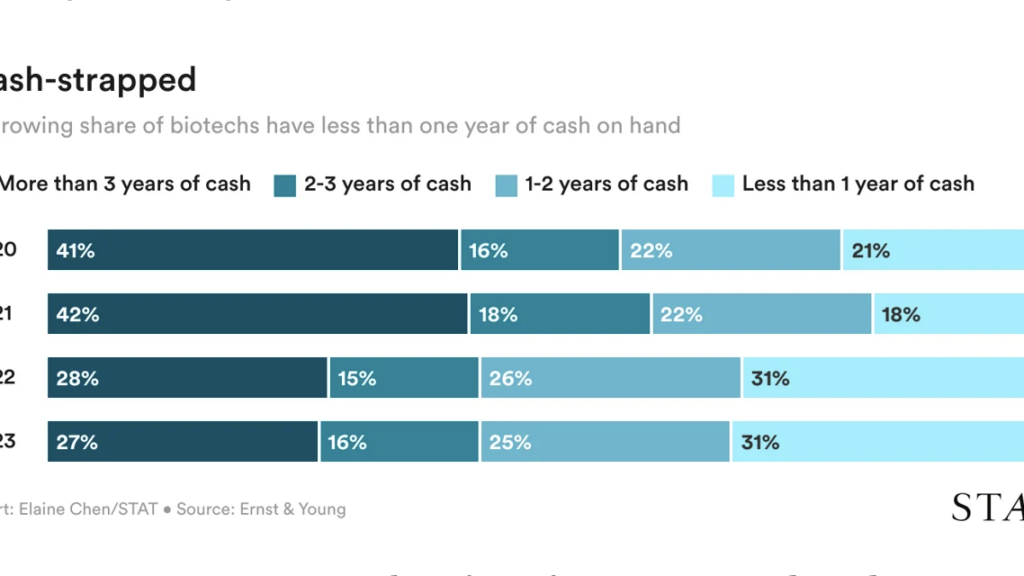

The financial sector overall is in a more precarious financial position, with the percentage of companies with less than a year’s worth of cash on hand rising from 18% in 2021 to 31% in 2023.

Operation Warp Speed but for rare diseases

From STAT’s Jason Mast: The FDA said last week that it had selected the first participants in a program that top official Peter Marks once labeled Operation Warp Speed for rare diseases. The agency did not reveal which groups were singled out, but a few companies announced their involvement Monday morning, including Denali Therapeutics and Neurogene.

The project is technically known as ‘Support for Clinical Trials Advancing Rare Disease Therapeutics Pilot Program’, or START – a less sexy name to distance the effort from the politics surrounding the Covid vaccine effort and perhaps to reflect the dramatically reduced scope of reflect the program.

Instead of massive cash flows, companies will have the opportunity to communicate more easily with regulators so they can get better advice in designing studies and pursuing approval. To be selected, sponsors had to participate in clinical trials of a gene or cell therapy or a more conventional drug targeting neurodegeneration. Denali is developing a novel enzyme replacement for Sanfilippo syndrome, a fatal neurodegenerative disorder, while Neurogene is developing a gene therapy for Rett syndrome. Grace Sciences, a company developing a gene therapy for NGLY1 deficiency, an extremely rare condition that affects its founder’s daughter, also said it had been selected.

Read more

- How a device manufacturer flooded pain patients with unwanted batteries and unexpected bills, STAT

-

Illumina’s board agrees to spin off Grail as divestiture plans move forward, STAT

- Elevance PBM’s president out as customers complain about prescription chaos, STAT

- Akeso, Summit’s victory in Keytruda generates ‘explosive’ interest at ASCO. But what does Merck think? Fierce pharmacy

- GSK shares plummet 9% after 70,000 Zantac lawsuits were allowed to proceed Reuters