Finance

British trading app Freetrade says CEO Adam Dodds should resign

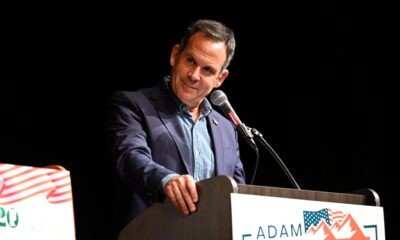

Adam Dodd, co-founder of wealth technology app Freetrade, is stepping down as CEO.

Free trade

LONDON – The boss of British stock trading service Freetrade is stepping down and leaving the company with immediate effect, the company told CNBC exclusively on Monday.

Adam Dodds, who co-founded the company in 2016 with business partners Davide Fioranell and Viktor Nebehaj, will be replaced by Nebehaj, currently Chief Operating Officer of Freetrade, as CEO, pending customary regulatory approvals.

Dodds remains Freetrade’s largest individual shareholder, owning a stake of about 12%, according to company filings. He will no longer be involved in the company’s day-to-day operations from now on, but a Freetrade spokesperson said he will continue to support the company’s evolution from the ‘outside’.

‘We almost died so many times it’s hard to count’

Dodds felt it was the right decision to leave the company and let Nebehaj take the reins as it enters the next phase of its growth trajectory, which includes plans to launch new products including bonds and mutual funds, tax papers and its web platform. and grow the profitable core of the UK user base.

The Freetrade logo on a smartphone screen.

Rafael Henrique | Sopa images | Light rocket | Getty Images

“When you think about the journey from idea to over a million users with billions in assets, you get through the tough times you remember most,” Dodds said in a commentary shared with CNBC. “We’ve almost died so many times it’s hard to count.”

“Now, having completed our first profitable quarter and the business is on strong sustainable footing, it’s time to hang up my skates. Freetrade is alive and well and ready to take on the established platforms in the UK with a self-sustaining growth.” Dodds said.

Dodds added: “I’m very pleased to say that Viktor will be taking over as CEO. I will do everything I can to support him and the company from the board. As for me, I’m looking forward to it out to get to know my kids better, annoy my wife on the farm and eventually get my pilot’s license.”

Nebehaj, Freetrade’s new CEO, applauded Dodds’ eight years as CEO, saying that “it is normal that different stages of a company’s growth require different leaders.”

“With our first profitable quarter behind us, I am excited about the magnitude of the opportunity ahead,” Nebehaj said in a statement. “Our talented and high-quality team builds the right product for our customers.”

Perry Blacher, chairman of Freetrade, said Nebehaj is “ideally positioned to make Freetrade go from strength to strength.”

Wild few years

Dodds’ departure follows a wild ride for the company in recent years. Dodds took Freetrade from a scrappy early-stage startup trying to disrupt the wealth management world to a company with 150 employees and more than 1.4 million users.

In 2020, Freetrade introduced thousands of users per day as retail trading activity boomed in the wake of the GameStop stock trading saga, in which a community of hardcore fans of the US video game retailer drove up the price of the company’s stock.

More recently, the country has been forced to tighten its belt as the reality of a bleaker macroeconomic environment sets in. In 2022, Freetrade announced measures to lay off 15% of its workforce to boost profitability.

The following year, Freetrade raised £2.3 million ($2.9 million) in a crowdfunding round on Crowdcube at a valuation of £225 million – a 65% discount to its previous valuation of £650 million. At the time, Freetrade blamed a “different market environment,” plagued by higher interest rates and inflation.

More recently, the company had some news to cheer about. Freetrade reported its first-ever earnings quarter in the three months through March, according to unaudited financial statements shared with CNBC in April. Preliminary sales were £6.7 million for the quarter.

Freetrade still generated an annual loss of £8.3m in 2023, compared to the £28.8m loss the year before, while revenues rose 45% to £21.6m over the same period.