Finance

Buffett sells Apple shares. The reason why is eye-opening.

Warren Buffett and his team Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) have been almost synonymous with Apple (NASDAQ: AAPL) since taking a position in the stock in 2014. The investment (and all the stock they bought along the way) turned out to be smart and netted Berkshire a significant profit.

However, Berkshire has started selling Apple shares despite the company’s belief in the company. At one point, Apple represented more than half of Berkshire’s investment portfolio; now it has fallen to less than 40%.

Why is Berkshire cutting its stake in one of Buffett’s favorite companies? The answer may surprise you.

Berkshire’s unrealized gains in Apple are a major reason for the sales

Buffett is a value investor, but he’s also someone who will hold a stock when it’s gaining. This is an excellent strategy, and it is one that many should emulate. However, there is one disadvantage: taxes.

If an investor has held a stock for more than a year, any gain they make will be taxed at the long-term capital gain rate. For individual investors, this is up to 20%, depending on your income. For companies it is a flat 21%. This means that for every dollar of profit Berkshire makes from Apple shares, $0.21 goes to the US government.

At Berkshire Hathaway’s 2024 annual meeting, Buffett said they don’t mind paying taxes, but the writing is on the wall. Buffett said that not long ago this percentage was 35% and earlier in his career it was as high as 52%. After looking at the current political climate, he doesn’t see those taxes going down, but most likely they will go up.

In the most recent State of the Union address, President Joe Biden called for raising the corporate tax rate to 28%, so Buffett’s assessment appears valid.

As a result, Berkshire is taking action and capturing some of those profits before it is forced to pay higher taxes.

During the meeting, Buffett reiterated several times that Apple would remain his largest holding even if it continued to sell shares. However, I don’t think selling Apple stock is a bad idea, especially after this past quarter.

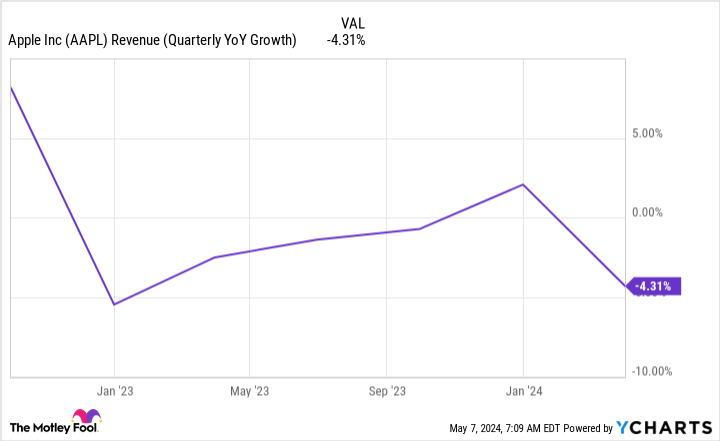

Buffett may be selling for taxes, but you may want to sell for another reason

Apple’s business is not what it once was. Consumers don’t upgrade their products that often and Apple struggles to launch a new popular product. The Apple Vision Pro virtual reality headset, for example, isn’t flying off Apple Store shelves. iPhone sales are also falling. As a result, Apple’s revenue fell from $94.8 billion in the second quarter of fiscal 2023 to $90.8 billion (ended March 30) in fiscal 2024. This decline is just a continuation of a pattern that has been present since early 2023.

Despite this, Apple has been able to improve its gross profit, which has trickled down to the bottom line, and it has done so retained earnings per share (EPS) flat compared to last year.

It’s clear that Apple’s core businesses (besides the services division) are struggling, but Apple’s management is a world-class team, so the company’s profits don’t reflect these problems.

Despite this, Apple’s shares still trade at a premium valuation: 28 times forward earnings.

With the S&P500 index trading at a much less expensive 21 times forward earnings, it’s clear the market still holds Apple in high regard.

I’m less convinced, and until Apple’s core business starts to improve, I don’t want to get anywhere near the stock.

Should You Invest $1,000 in Apple Right Now?

Before you buy shares in Apple, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has one disclosure policy.

Buffett sells Apple shares. The reason why is eye-opening. was originally published by The Motley Fool