Finance

Chubb is Warren Buffett’s secret stock pick in Berkshire Hathaway

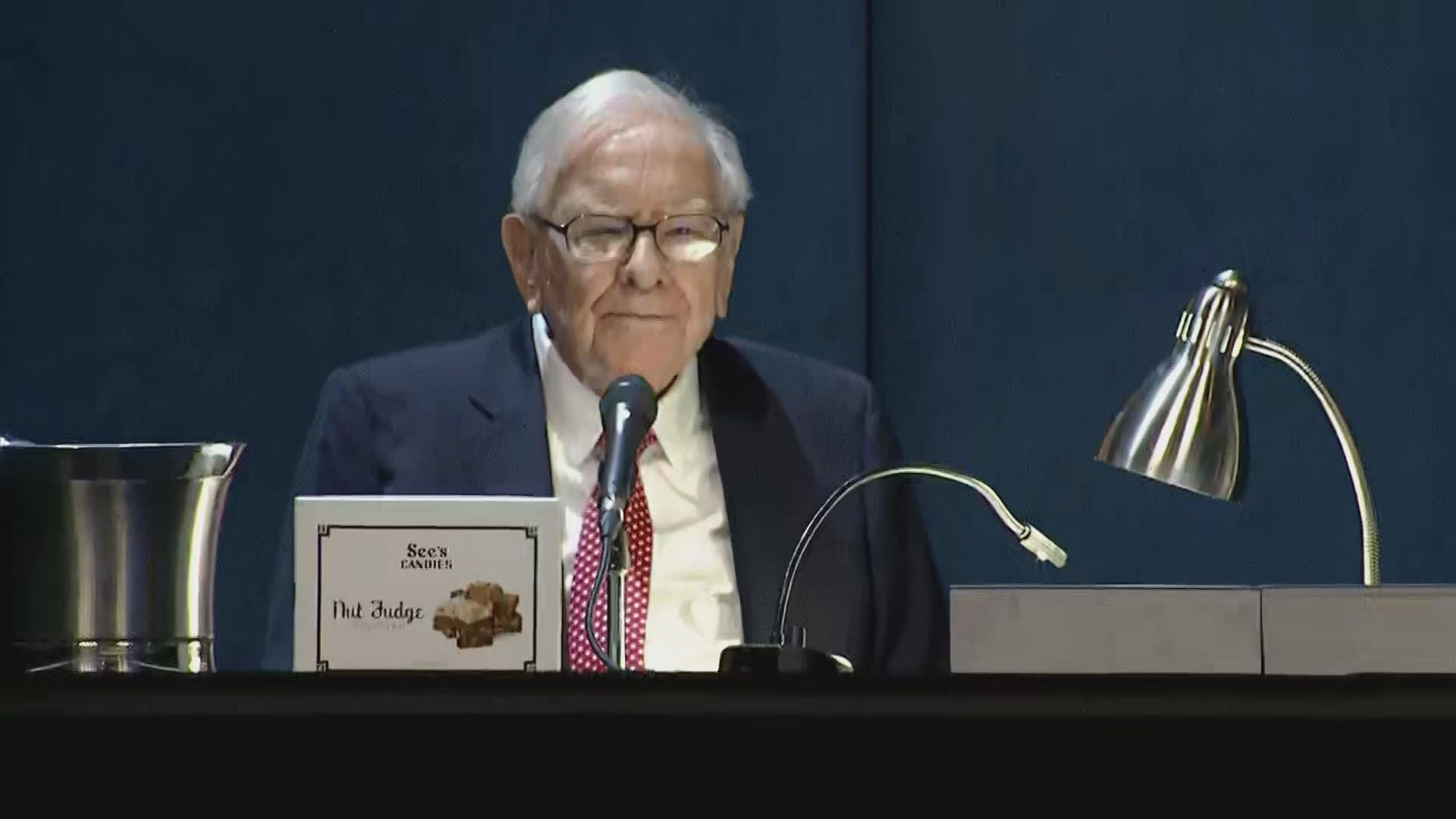

Warren Buffett speaks during the Berkshire Hathaway annual shareholder meeting in Omaha, Nebraska on May 4, 2024.

CNBC

Warren Buffett finally revealed his secret stock picks in a new filing to regulators, and his insurer Chubb.

His conglomerate Berkshire Hathaway has purchased nearly 26 million shares of Zurich-based Chubb for a stake of $6.7 billion. The non-life insurer became Berkshire’s ninth largest holding company at the end of March.

Shares of Chubb rose nearly 7% in extended trading after news of Berkshire’s stake. The stock is up about 12% year to date.

Insurer Ace Limited acquired the original Chubb in 2016 for $29.5 billion in cash and stock, and the combined company adopted the Chubb name. Chubb CEO Evan Greenberg is the son of Maurice Greenberg, the former chairman and CEO of insurance giant American International Group.

Chubb stock over the past year.

Omaha-based Berkshire has a large footprint in the insurance industry, from crown jewel auto insurers Geico to reinsurance giant General Re and a host of home and life insurance services. The conglomerate also acquired insurance company Alleghany for $11.6 billion in 2022.

Berkshire recently exited his positions in Markel And Globe life in the same industry.

Mystery revealed

Berkshire has kept this purchase secret for two quarters in a row. Berkshire was granted confidential treatment to keep the details of one or more of its stock holdings confidential.

The topic of this mysterious holding company did not come up during Berkshire’s annual meeting in Omaha earlier this month.

Many had speculated that the secret purchase could be a bank stock, as the conglomerate’s cost base for equity investments in “banking, insurance and finance” rose $1.4 billion in the first quarter, following a $3.59 billion increase in the second half of last year. according to Berkshire separately files.

It is relatively rare for Berkshire to request such treatment. The last time it kept a purchase confidential was when it bought Chevron And Verizon in 2020.