Finance

Consider these 2 millionaire maker stocks to buy instead

Nvidia (NASDAQ: NVDA) has made many millionaires in the past year as its share price skyrocketed 225%. The company gathered investors as it became the epitome of an artificial intelligence (AI) boom, gaining an estimated 90% market share in AI chips.

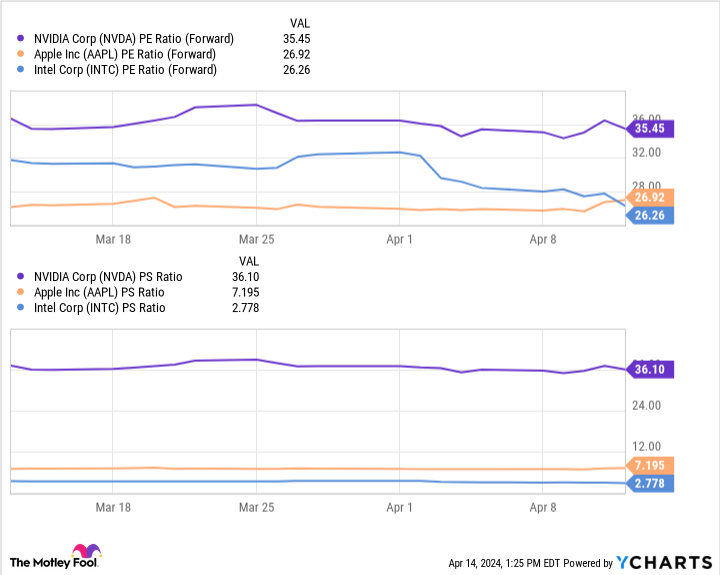

However, the chart above shows that Nvidia’s meteoric rise has made it an expensive option compared to other tech stocks. Nvidia’s price-to-earnings (P/E) and price-to-sales (P/S) ratios are significantly higher than the same figures for Intel (NASDAQ: INTC) And Apple (NASDAQ: AAPL).

The forward price-to-earnings ratio is calculated by dividing a company’s current stock price by its estimated future earnings per share. Meanwhile, P/S divides its market capitalization by the last twelve months’ revenue. These are useful valuation metrics because they take into account the financial health of a company in addition to the share price.

For both, the lower the number, the better the value. As a result, Intel and Apple are trading at a bargain compared to Nvidia.

So forget Nvidia and consider these two millionaire stocks instead.

1. Intel

Shares of Intel have risen more than 135% since its initial public offering in 1971, creating many millionaires over time.

However, the company has hit a number of roadblocks in recent years. The stock price has fallen about 45% over the past three years, following declining market share in central processing units (CPUs) and the end of a more than decade-long partnership with Apple.

Intel responded to the recent headwinds by making significant structural changes that could pay off in the coming years. Last June, Intel announced a “fundamental change” to its operations, introducing an in-house foundry model that it believes will help the company save $10 billion by 2025. This would make it adopt a similar model Taiwanese semiconductor manufacturingand became a major provider of foundry capacity in North America and Europe.

Additionally, Intel is entering AI, a market valued at around $200 billion last year and expected to reach nearly $2 trillion by 2030.

In December 2023, the company debuted a series of AI chips, including Gaudi 3, a graphics processing unit (GPU) designed to challenge similar offerings from market leader Nvidia. Intel also showed off new Core Ultra processors and Xeon server chips, which include neural processing units to run AI programs more efficiently.

Intel’s price-to-earnings ratio of 26 makes it one of the best-valued AI chip stocks today, with Nvidia at 35 and AMD‘s even higher at 45. As a result, the company’s shares are a lower-risk way to invest in the AI chip industry and an excellent option to hold for the long term.

2. Apple

Apple stock has a long reputation for delivering consistent and significant profits to investors. In fact, Warren Buffett’s holding company, Berkshire Hathaway, has dedicated 43% of its portfolio to Apple. Meanwhile, shares of the iPhone company have risen 571% since Berkshire first invested in 2016.

Apple has made many millionaires in its time, and this is unlikely to stop as the company continues to dominate consumer technology and expand into emerging sectors like AI.

Shares in Apple fell 4% on April 11, marking their best performance in almost a year. The rally came after a Bloomberg report revealed that the company will overhaul its Mac computer lineup to focus on AI capabilities.

Apple dominates consumer technology, with leading market shares in most of its product categories. The immense brand loyalty of consumers could make the company a major growth driver in public adoption of AI, helping Apple gain a lucrative position in the market. As a result, the news that future products will place a stronger focus on the generative technology is promising.

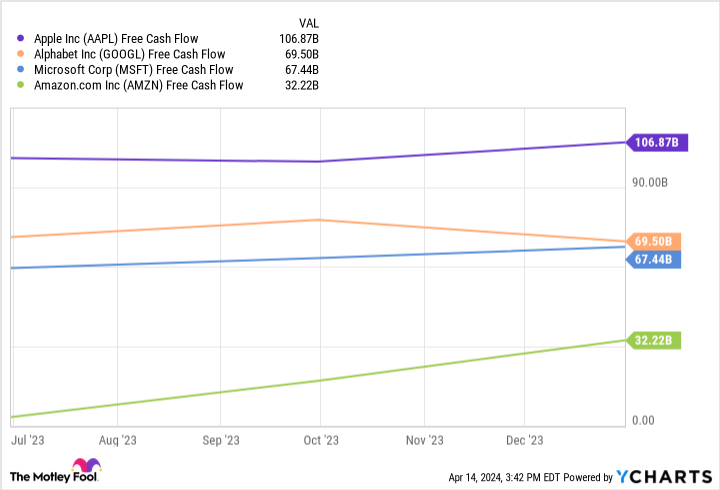

Furthermore, despite recent headwinds, Apple has raked in $107 billion free cash flow significantly more last year than rivals like Microsoft, Amazonor Alphabet. The figure indicates that Apple has the financial resources to continue investing in its business and overcome potential headwinds.

With significant financial resources, a growing position in AI, and a relatively low price-to-earnings ratio, Apple stock is worth considering over Nvidia right now.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $526,933!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft , and briefly May 2024 $47 calls on Intel. The Motley Fool has one disclosure policy.

Forget Nvidia: Consider These 2 Millionaire Maker Stocks to Buy Instead was originally published by The Motley Fool