Finance

Dow Jones Futures: Fed’s Inflation Gauge Expired After Biden Stumbles in Vs. Debate Trump

Dow Jones futures moved higher early Friday, while S&P 500 futures and Nasdaq futures rose after President Joe Biden faltered in Thursday night’s debate with former President Donald Trump. The Fed’s favorite inflation gauge hits the market early Friday.

↑

X

Nasdaq makes three in a row, eyeing 18,000; Meta, Monday.com, ServiceNow in focus

The stock market rally on Thursday saw small gains across the major indices, with small caps leading the way. Software stocks stood out with strong moves, continuing their month-long recovery.

monday.com (MNDY), Zeta (ZETA), CyberArk software (CYBR), Data hound (DDO), Service now (NOW), AppLovin (APP) And AppFolio (APPF) flashed buying signals.

In the meantime, Metaplatforms (META) broke out on Thursday. Amazon.com (AMZN) And Tesla (TSLA) extended Wednesday’s breakouts.

Nike (NKE) topped the earnings views Thursday night. But sales lagged and Nike lowered revenue growth expectations. Nike stock fell 15% early Friday. The Dow component has been struggling since late 2021.

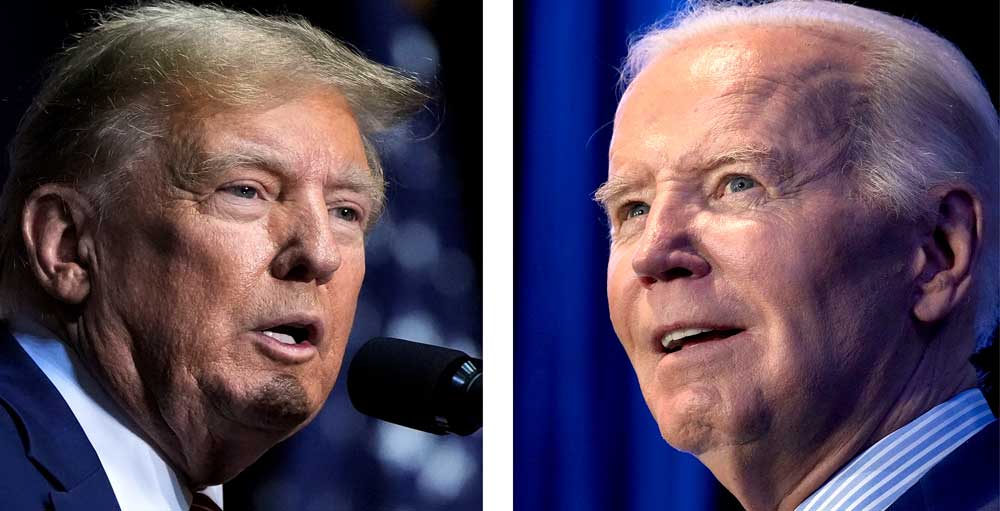

Presidential debate: Trump vs. Biden rematch

Heading into the first presidential debate of 2024, polls suggested that former President Trump was the modest favorite to return to office, ousting the current incumbent, President Biden.

Biden’s debate performance on Thursday night was widely reported, with stumbling and mumbling in his answers. Even some sympathetic commentators argued that the president should drop out of the race. Trump was largely seen as making no mistakes.

Biden’s chances of winning the Democratic nomination plummeted overnight on the prediction markets.

Fed inflation gauge

The Commerce Department will release the May PCE Price Index at 8:30 a.m. ET as part of its revenue and expenditure report. The overall PCE price index rose by 0.1% compared to April, with PCE inflation cooling slightly to 2.6% compared to a year earlier.

The core PCE price index, the Fed’s preferred inflation gauge, also rose 0.1% from April. Core PCE inflation should slow to 2.6% from 2.8% in April.

Dow Jones futures today

Dow Jones futures were slightly above fair value, despite Nike stock disappointing. S&P 500 futures rose 0.4%. Nasdaq 100 futures rose 0.5%.

The yield on ten-year government bonds rose to 4.31%.

Crude oil futures rose slightly, above $82 a barrel.

Dow futures recovered minor losses during the Trump-Biden debate on Thursday evening. PCE inflation headlines are likely to tip futures and government bond yields ahead of the open.

Remember, overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading during the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock market rally

The stock market rally reversed the earnings collapse Micron technology (MU) and a modest decline in Nvidia (NVDA).

The Dow Jones Industrial Average and S&P 500 rose 0.1% in stock trading on Thursday. The Nasdaq index rose 0.3%.

Market breadth was modestly positive.

The small-cap Russell 2000 rose 1% to close just above the 50-day line for the first time since June 13.

A few days ago the market seemed to be moving away from Nvidia and AI towards financial and industrial services. The former appear to be finding their footing, while the financial and industrial sectors have retreated somewhat. Now software and megacaps are taking the lead.

US crude oil prices rose 1% to $81.74 per barrel.

The yield on ten-year government bonds fell by three basis points to 4.29%.

ETFs

Of the growth ETFs, the iShares Expanded Tech-Software Sector ETF (IGV) rose 2.1% with ServiceNow, CrowdStrike and many others in IGV. The VanEck Vectors Semiconductor ETF (SMH) fell by 0.8%.

Reflecting more speculative story stocks, ARK Innovation ETF (ARKK) advanced 1% and ARK Genomics ETF (ARKG) fell by 0.2%. Tesla stock is the #1 stock in Ark Invest’s ETFs.

SPDR S&P Metals & Mining ETF (XME) retreated 0.6%. SPDR S&P Home Builders ETF (XHB) and the Energy Select SPDR ETF (XLE) rose by 0.2%. The Healthcare Select Sector SPDR fund (XLV) lost 0.2%.

The Industrial Select Sector SPDR fund (XLI) rose by 0.1%. The Financial Select SPDR ETF (XLF) fell by 0.1%.

Time the market with IBD’s ETF market strategy

Megacap Stocks in Buy Range

Meta shares rose 1.3% to 519.56, clearing a 514.01 cup-with-handle buy point. Since earlier this week, shares were able to take action after breaking the handle’s downtrend.

Amazon shares rose 2.2% to 197.85, moving into the buy zone after Wednesday’s 3.9% pop crossed the flat-base buy point of 191.70.

Tesla shares rose 0.5% to 197.42. The EV giant rose 4.8% on Wednesday, breaking out from a buy point of 191.08. TSLA stock is still below the 200-day line.

Software stocks

Software struggled from early February before finally bottoming out in late May following a Salesforce-led selloff. Since then, the software sector has recovered, with big gains Thursday.

Shares of Monday.com rose nearly 3% to 236.28, reversing a downtrend in what appears to be a mini double bottom alongside another consolidation. That extends a recent rebound from the 50-day line. MNDY stock has an official buy point of 239.54, which roughly coincides with the previous base entry of 239.22.

Zeta shares also broke a downtrend in an emerging mini-double bottom base while extending a 50-day recovery. Shares rose 5.5% to 17.32. Investors could also use 17.58 as a buy point.

AppLovin stock rose 3.3% to 83.12, crossing a tight trendline and a short-term high of 82.66. The official flat-based buy point is 88.50.

AppFolio shares fell 3.8% to 248.89, above an early entry of 243.04 and an extension of a 50-day line bounce. It is working on a buy point with a flat base at 256.73.

Shares of CyberArk rose 2.9%, ServiceNow 2.7% and Datadog 4.3%, all breaking trend lines in consolidations dating back to early February.

Leaders love CrowdStrike (CRWD) showed strength, while some stragglers such as Salesforce.com (CRM) returned.

Meanwhile, IGV stock looks a lot like ServiceNow, CyberArk, and Datadog. That’s a way to play the broad sector movement with many names out of position. SwingTrader added IGV as a holding company on Thursday.

The Amplify Cybersecurity ETF (HACK) and GlobalBEAST) also look doable, with the latter more focused on pure-play cybersecurity stocks.

What to do now

The stock market rally continues to work well, with the weekly charts showing little change or fractional gains in the major indices.

Although the market is lackluster at best, investors have quality names from a variety of sectors to consider. While this article focused on software and a few megacaps, be sure to pay attention to leaders in the discount retail, financial, travel, industrial, medical, and more sectors.

Investors can make new purchases, adding exposure or swapping losers and laggards in your portfolio. But if you’re heavily invested, holding on is also a good strategy.

The Fed’s inflation gauge will be crucial on Friday, while the presidential debate between Biden and Trump will be a wild card.

Nvidia, Amazon and Meta stock are active IBD rankings. Amazon Stocks, Meta Platforms and CrowdStrike are on SwingTrader. Nvidia stock is on the list IBD50, along with AppFolio, Monday.com and ServiceNow. Amazon was the IBD stock of the day on Thursday.

Read The Big Picture every day to stay informed about market direction and the most important stocks and sectors.

Follow Ed Carson on Threads at @edcarson1971 and X/Twitter on @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why this IBD tool simplifies the search for top stocks

Best growth stocks to buy and watch

MarketSurge: research, charts, data and coaching all in one place

IBD Digital: Unlock IBD’s premium stock lists, tools and analysis today