Entertainment

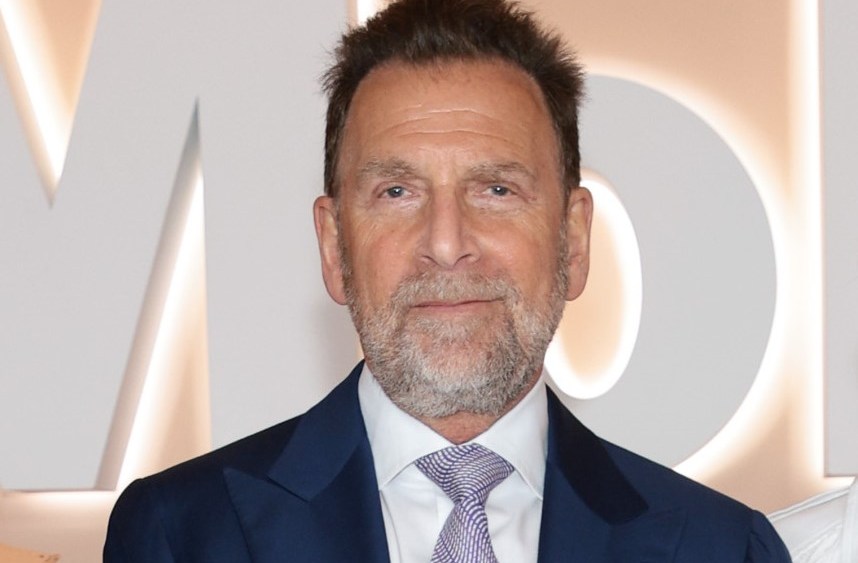

Edgar Bronfman is considering a $2.5 billion bid for Shari Redstone’s NAI

Shari Redstone may have another offer on the table to buy National Amusements Inc., Paramount Global’s controlling shareholder — the latest twist in the months-long merger and acquisition drama swirling around the troubled media conglomerate.

Former media mogul Edgar Bronfman Jr. is working with investment firm Bain Capital to put together a bid of up to $2.5 billion for Redstone’s National Amusements, sources confirm. NAI owns 77% of the voting stock in Paramount.

At this time, Bronfman and Bain have not made a formal offer to purchase NAI; it is unclear what their plan for Paramount would be if they were to succeed in acquiring National Amusements. The potential offer from Bronfman and Bain Capital was the first indicated by the Wall Street Journal.

Representatives Bain Capital, National Amusements and Waverley Capital (the venture capital firm for which Bronfman is chairman and general partner) declined to comment.

The report that Bronfman is interested in acquiring NAI comes as Redstone continues to negotiate with Skydance and its backers, RedBird Capital and KKR, on their latest merger offer submitted last week. Under those terms, the Skydance consortium would pay Redstone about $2 billion for NAI; current Paramount Class B shareholders (who have no voting rights) would be offered to cash in nearly half of their shares for $15 per share. The Skydance group would own two-thirds of Paramount’s stock and Paramount would remain public.

Bronfman served as chairman and CEO of Warner Music Group from 2004 to 2012, stepping down after it was acquired by Len Blavatnik’s Access Industries. Before WMG, he was CEO of Seagram before selling that company to Vivendi. Currently, Bronfman is executive chairman of Fubo, the sports-focused streaming pay television provider, and executive chairman of Global Thermostat LLC, a company designed to develop and commercialize a direct carbon dioxide capture technology.

Others reportedly interested in acquiring NAI include producer and filmmaker Steven Paul, who was behind the “Baby Geniuses” film franchise and is actor Jon Voight’s manager. Paul has been trying to secure financing to make a $3 billion bid for NAI, according to a magazine report last month.

Sony Pictures and private equity firm Apollo Global Management emerged as joint bidders for Paramount Global, making an offer of $26 billion (including assumption of debt). Since then, Sony and Apollo have reported that they have backed out of a deal for Paramount as a whole.