Health

Eli Lilly, Pfizer, Interius, UniQure latest

Want to stay up to date on the science and politics driving biotechnology today? Sign up to receive our biotech newsletter in your inbox.

Good morning. STAT this morning published an investigation into the untold story of the Human Genome Project and ethical concerns surrounding the ambitious project. Check it out here.

The must-know this morning

- Pfizer Chief Scientific Officer and R&D Chief Mikael Dolsten is leaving the company after 15 years. The search for his successor is expected to last until early next year, the pharmaceutical giant said.

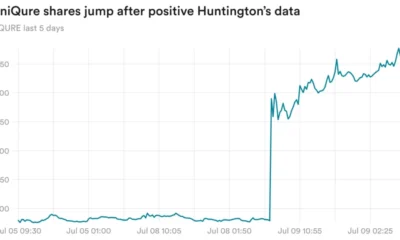

- UniQure said its experimental gene therapy called AMT-130 slowed the progression of Huntington’s disease by 80% compared to an external control group in a mid-stage clinical trial.

Interius starts the very first in-vivo clinical CAR-T study

Interius Biotherapeutics will soon begin the world’s first clinical trial of in vivo CAR-T therapy. Patients receive an IV infusion designed to convert their immune cells in their bodies into cancer killers.

Traditional CAR-T therapy is ‘ex-vivo’, meaning the immune cells are manipulated outside the body. It is a complicated and expensive process that involves taking the cells from the patient, sending them to a specialized facility for processing, and then reinserting the cells into the patient.

Traditional CAR-T is out of reach for many patients, and researchers hope the new in-vivo approach can provide a cheaper and more scalable option.

Read more from STAT’s Jason Mast.

Pharma loses friends on Capitol Hill

Pharma’s position in Washington has already weakened in recent years, as underscored by the passage of the Inflation Reduction Act, which allowed Medicare to negotiate drug prices. The industry’s influence will decline even further as some of its closest allies leave Capitol Hill.

My colleague Rachel Cohrs Zhang reports that at least six key pharma-friendly lawmakers are expected to have left their seats by early next year, and that their likely replacements are less friendly to the industry and less interested in healthcare.

One example is Senator Bob Menendez of New Jersey, home to pharmaceutical giants Johnson & Johnson, Merck and Bristol Myers Squibb. Menendez is currently on trial for bribery, and the Democrat vying to replace him, Rep. Andy Kim, supports the party’s more ambitious drug pricing plans.

Read more about the other allies Pharma will lose.

Lilly’s obesity drug appears more powerful than Novo’s in observational research

In the pivotal Phase 3 study, Eli Lilly’s tirzepatide (marketed as Mounjaro/Zepbound) led to more weight loss than what was seen in the study with Novo Nordisk’s semaglutide (marketed as Ozempic/Wegovy). However, it has been difficult to directly compare the two drugs because there are no results from head-to-head studies yet, but a new observational study suggests that Lilly’s drug may indeed lead to more weight loss.

The study, published yesterday in JAMA Internal Medicine, analyzed the health records of more than 18,000 people and found that those who took tirzepatide had about 15% weight loss after one year, while those who took semaglutide had about 8%. In addition, 42% of patients receiving tirzepatide achieved greater than 15% weight loss, compared with 18% of patients receiving semaglutide.

Because it is a retrospective observational study, there are many limitations. For example, patients may have experienced deficiencies and been unable to take their medications consistently. Patients may also have followed different diets and exercise regimens.

We will look at the results of a randomized head-to-head study which Lilly is participating in and is expected to be completed in November this year.

A private equity approach to investing in neuromedicines

Investors have long been reluctant to invest in drug programs for neurological disorders. There is a history of failed trials and many trial endpoints are subjective and difficult to measure.

Bruce Leuchter, CEO of Neurvati Neurosciences, a portfolio company of Blackstone Life Sciences, argues in a new op-ed that investors should adopt a “private equity model” to invest in neurology drug candidates.

This means looking at molecules later in the development life cycle rather than early stage drugs that are the focus of the classic business model. Although the cost of acquiring a later-stage drug will be higher, investors could better investigate the program and confirm the rationale behind the drug’s mechanism, Leuchter writes.

Read more.

Read more

- When can pharmaceutical companies correct online misinformation? FDA explains, Endpoints

- AI leads the way as health tech financing moves toward post-pandemic stability, STAT

- Trump’s 2024 platform abandons calls to cut Medicare, broadly restrict abortion, STAT

- New study sparks debate over whether the H5N1 virus in cows has been modified to better infect humans, STAT