Business

Fastest in five months: Cash transfers rose 3.6% in May – BSP

By means of Luisa Maria Jacinta C. Jocson, News reporter

MONEY SENT HOMESeas Filipino workers (OFWs) increased 3.6% in May, the fastest pace in May FThis is evident from data from the Bangko Sentral ng Pilipinas (BSP).

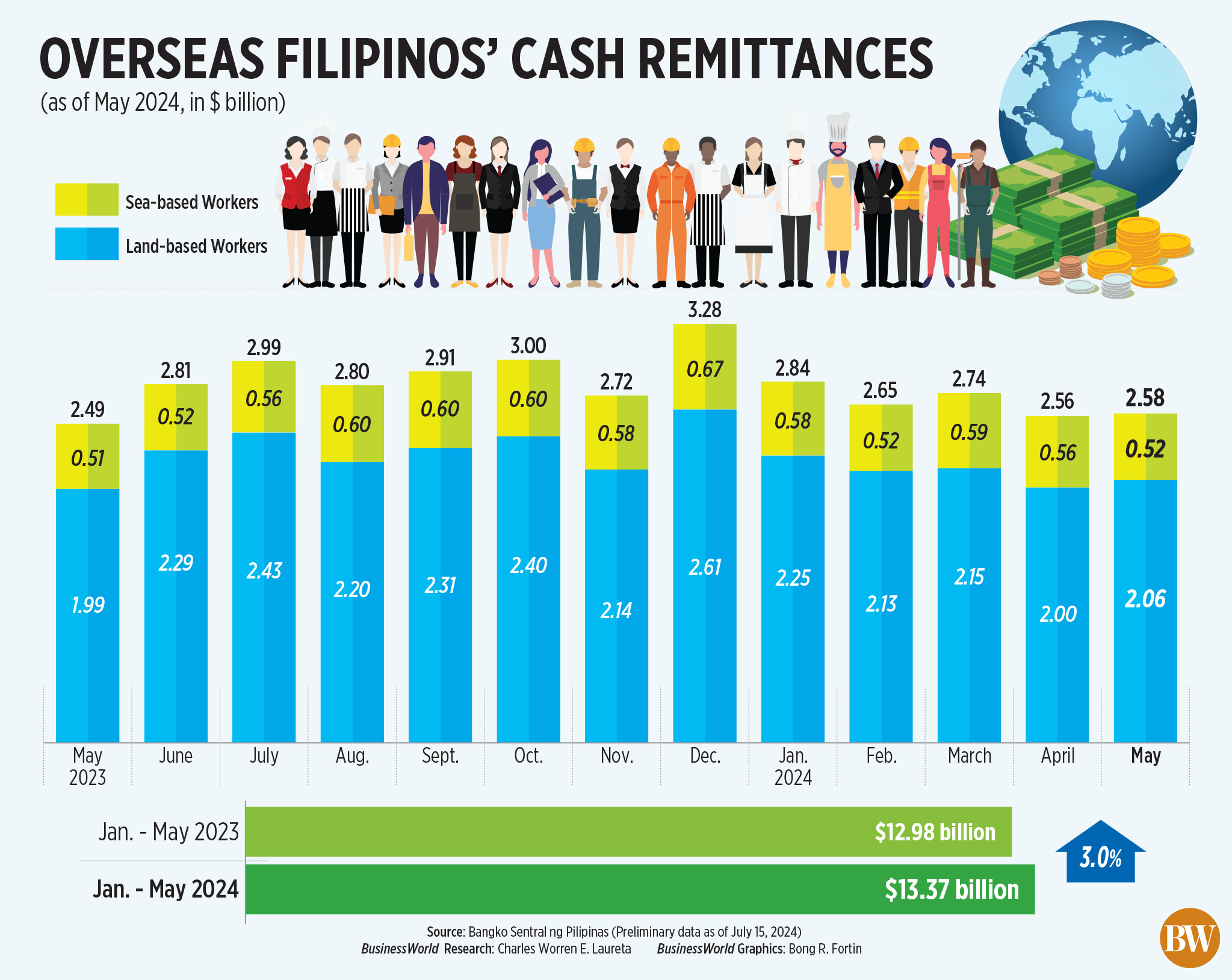

The BSP said on Monday that remittances through banks rose 3.6% to $2.58 billion in May, compared with $2.49 billion in the same month a year ago.

The growth in the number of remittances was fastest in 2011 Ffive months or since the 3.8% recorded in December 2023.

Month on month, remittances rose 0.8%, compared to $2.56 billion in April.

“The increase in remittances in May 2024 was due to the growth in receipts of both agricultural and maritime workers,” the BSP said in a statement.

Remittances sent home by workers on land rose 3.8% to $2.06 billion, while money sent home by workers at sea grew 2.6% to $519.373 million.

In the January to May period, remittances rose 3% to $13.365 billion, compared to $12.981 billion a year ago.

This was also the fastest annual growth rate in a year or since the 3.1% recorded in May 2023.

“The growth in remittances from the United States, Saudi Arabia and Singapore mainly contributed to the increase in remittances in January-May 2024,” the central bank said.

In the Ffirst FFor five months, the United States accounted for 40.9% of total remittances.

This was followed by Singapore (7.2%), Saudi Arabia (6.1%), Japan (5.1%), the United Kingdom (4.7%), the United Arab Emirates (4%), Canada (3.4%), Korea (2.8%), Qatar (2.8%) and Taiwan (2.7%).

“This increase of 3.6% (in May), to $2.58 billion, indicates a combination of positive factors. Economic growth in major remittance-generating countries such as the US, Saudi Arabia and Singapore could put more money in the pockets of OFWs,” said Security Bank Corp. Chief Economist Robert Dan J. Roces. in a Viber message.

Mr Roces said rising wages of OFWs could also be another factor behind the faster growth in remittances.

“Finally, favorable exchange rates encourage sending more money back as this translates into a greater increase in Philippine pesos received,” he added.

In May, the peso fell to the level of P58 per dollar for the FFirst time since November 2022.

“Nevertheless, sustained growth is still a good signal for the economy as a whole as a major growth driver, especially in terms of consumer spending, which accounts for about 74% of the Philippine economy,” said Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort. said in a Viber message.

Mr Ricafort also notes that there is a seasonal increase in remittances due to the summer holidays.

Meanwhile, personal remittances rose 3.7% this month from $2.78 billion to $2.88 billion. This brought personal remittances to $14.89 billion at the end of May, up 3% from $14.46 billion in the same period a year ago.

“The increase in personal remittances in May 2024 was due to remittances from agricultural workers with employment contracts of one year or more and maritime and agricultural workers with employment contracts of less than one year,” the BSP added.

In the coming months, Mr. Ricafort said he expects modest growth in remittances as OFW families “still face relatively higher prices locally, which would require sending more remittances.”

For the Ffirst six months of the year, head onFaverage 3.5%. This was slightly higher than the central bank’s full-year 3.3% forecast.

Mr Ricafort also noted that there is a seasonal increase in remittances during the July-August period due to the need to pay school fees.

The central bank expects remittances to grow by 3% this year.