Finance

Fed Governor Bowman says an additional rate hike may be necessary if inflation remains high

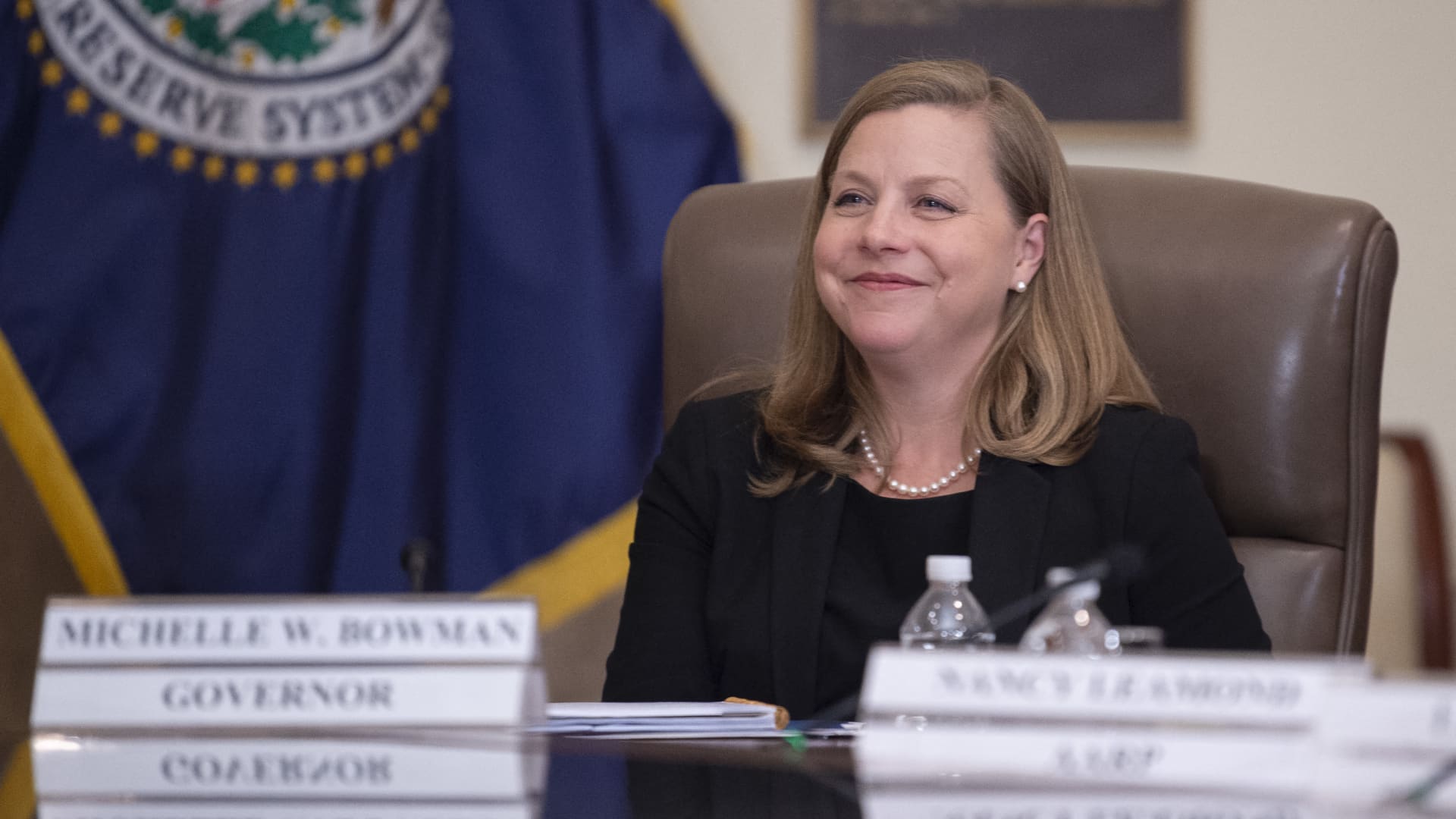

U.S. Federal Reserve Governor Michelle Bowman attends a “Fed Listens” event at Federal Reserve Headquarters in Washington, DC on October 4, 2019.

Eric Baradat | AFP | Getty Images

Federal Reserve Governor Michelle Bowman said Friday that rates may need to rise to keep inflation in check, rather than the cuts that her fellow officials have signaled are likely and that the market expects.

Bowman points to some potential upside risks to inflation and says policymakers should be careful not to ease policy too quickly.

“While this is not my baseline outlook, I continue to see the risk that we will have to raise the policy rate further at a future meeting if inflation stagnates or even reverses,” she said in prepared remarks for a speech to a group of Fed watchers in New York. “Cutting our policy rate too early or too quickly could result in a rebound in inflation, requiring further future policy rate increases to bring inflation back to 2 percent over the longer term.”

As a member of the Board of Directors, Bowman is a permanent voting member of the rate-setting Federal Open Market Committee. Since taking office in late 2018, her public speeches have placed her on the more hawkish side of the FOMC, meaning she favors a more aggressive stance on curbing inflation.

Bowman said her most likely outcome remains that “it will eventually become appropriate to cut rates,” although she noted that “we are still not at the point” of cutting rates because “I still see some upside risks to inflation see.”

The speech before the Shadow Open Market Committee has markets on edge about the near-term future of Fed policy. Statements this week from several officials, including Chairman Jerome Powell, indicate a cautious approach to interest rate cuts. Atlanta Fed President Raphael Bostic, an FOMC voter, told CNBC he is likely to see only one cut this year, and Minneapolis Fed President Neel Kashkari indicated no cuts could happen if inflation does not slow further.

Futures traders are pricing in three cuts this year, although things have gotten tough between June and July when they start. FOMC members also listed three cuts for this year in March, although an unidentified official indicated in the dot plot that there would be no cuts until 2026 and there was otherwise significant division over how aggressively the central bank would move.

“Given the risks and uncertainties surrounding my economic outlook, I will continue to monitor the data closely as I assess the appropriate path of monetary policy, and I will remain cautious in my approach to considering future changes in the policy stance,” Bowman said. .

Considering inflation risks, she said supply-side improvements that contributed to the decline in figures this year may not have the same impact in the future. Moreover, she cited geopolitical risks and fiscal stimulus as other upside dangers, in addition to persistently higher house prices and tight labor markets.

“Inflation figures over the past two months suggest that progress will be uneven or slower going forward, especially for core services,” Bowman said.

Fed officials will get their next look at inflation data Wednesday, when the Department of Labor releases the March Consumer Price Index report.