Finance

Fed Governor Waller wants “a few months” of good inflation data before cutting rates

Christopher Waller, Governor of the U.S. Federal Reserve, during a Fed Listens event in Washington, DC, on Friday, September 23, 2022.

Al Drago | Bloomberg | Getty Images

Fed Governor Christopher Waller said Tuesday he doesn’t think further rate hikes will be necessary, citing a series of data showing inflation appears to be easing.

However, the policymaker added that he will need some convincing before backing cuts anytime soon.

“Central bankers should never say never, but the data suggests that inflation is not accelerating, and I think further increases in the policy rate are probably not necessary,” said Waller, who has been hawkish recently, meaning he wants a tighter monetary policy supports.

The comments came in prepared remarks for an appearance before the Peterson Institute for International Economics in Washington.

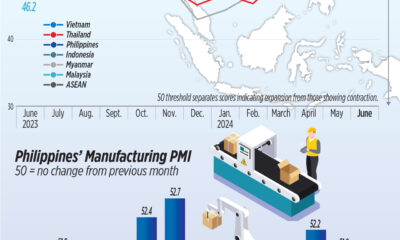

Waller pointed to a range of recent data, from flattening retail sales to cooling in both manufacturing and services sectors, that suggests the Fed’s higher interest rates have helped alleviate some of the demand that contributed to the highest inflation rates in over 40 years. .

While wage gains have been solid, internal measures such as the rate at which workers leave their jobs show that the ultra-tight labor market that has driven up wages has recently reached levels consistent with the Fed’s 2% inflation target . relax, he added.

Still, Waller, who as governor is a permanent voting member of the rate-setting Federal Open Market Committee, said he is not ready to support rate cuts.

“The economy now appears to be moving closer to expectations,” he said. “Nevertheless, in the absence of a significant weakening in the labor market, I need several more months of good inflation data before I feel comfortable supporting an easing of monetary policy.”

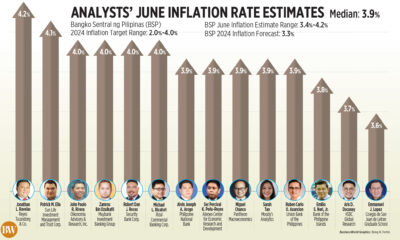

April’s consumer price index showed inflation of 3.4% from a year ago, down slightly from March, with the monthly increase of 0.3% slightly lower than what Wall Street economists expected.

The Labor Department’s report was “a welcome relief,” Waller said, although he added that “the progress was so modest that it did not change my view that I need to see more evidence of moderating inflation before I do any monetary easing.” policy can support. He gave the report a C-plus grade.

Markets have had to adjust their expectations regarding monetary policy this year.

In the early months, futures market traders have priced in at least six interest rate cuts this year starting in March. However, a series of higher-than-expected inflation data changed that outlook towards the first cut not expected to come until September – with up to two quarter-percentage-point cuts before the end of the year. according to the FedWatch from CME Group Tool.

Waller made no expectations about the timing or size of the cuts, saying he would “keep that to myself for now” about the specific progress he wants to see in future inflation reports.