Business

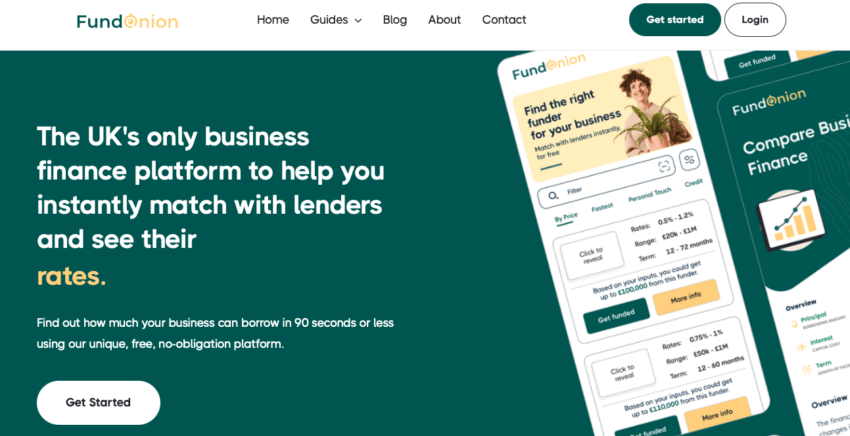

FundOnion is aiming for a funding target of £1 billion in a bid to close the funding gap for businesses

AI-powered business finance comparison site FundOnion has announced plans to facilitate more than £1 billion in funding to help up to 25,000 SMEs grow over the next four years.

The plans come as the small business financing platform continues to work to consolidate a historically fragmented small business lending market.

It is estimated that Britain faces a £22 billion SME funding gap, stifling growth and limiting opportunities for a group of businesses that are vital to the UK economy but poorly served by traditional financing routes. Combined with a time-consuming and opaque application process and a return to higher interest rates, there is a clear need for businesses to have clarity about the financing options available to them.

FundOnion’s platform enables companies to quickly compare the costs of business loans from more than 30 providers and secure financing in a faster and more transparent way. This world first in corporate finance has led to an unprecedented pace of delivery, with FundOnion’s fastest loan being granted in just 19 minutes.

This funding has already been seismic for thousands of businesses in Britain. One family business recently received a £500,000 growth finance loan through the FundOnion platform and was able to quadruple its turnover in just twelve months.

James Robson, CEO and co-founder of FundOnion, said: “Britain’s small business community has been chronically underfunded for more than a decade as institutional lending has dried up, hampering growth, creativity and the economy. We’re flipping the script by providing the small business community with a platform dedicated to fueling their expansion and resilience. We are also aware that our £1 billion target is just the start of our ambitions to create the country’s best-known business finance marketplace. Let’s be clear: we’re not here to play small.”

“While our core focus is currently on corporate lending, we are adapting our technology and the infrastructure of our capital partners to offer a whole range of financial products to SMEs, across trade finance, invoice finance, asset finance and a whole universe of Asset Based Lending (ABL). ). We are rewriting the playbook on how we can provide capital to UK SMEs while making a positive and meaningful difference to the UK economy.”