Business

GDP growth picked up in the second quarter – poll

By means of Karis Kasarinlan Paolo D. Mendoza

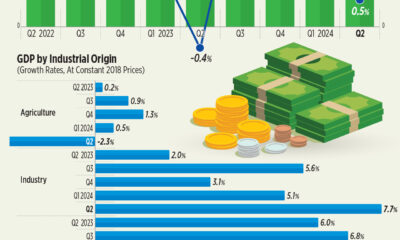

PHILIPPINE ECONOMIC GROWTH probably increased in the second quarter, as higher government spending may be oFdetermine the impact of El Niño on agriculture, analysts say.

a Business A poll of 19 economists and analysts conducted late last week found average annual gross domestic product (GDP) growth of 6% for the period April to June.

If this is achieved, it would be faster than the preliminary growth of 5.7% in the US Ffirst quarter and the 4.3% clip in the second quarter of 2023.

This would also bring first-half growth to an average of 5.9%, below the 6-7% growth target for the year.

The Philippine Statistics Authority will release second quarter GDP data on Thursday (August 8).

“The main driver of growth was probably government spending. In contrast to last year’s underspending, the utilization rate of the 2024 budget has fallen significantlyFimproved significantly,” economist Aris D. Dacanay of HSBC ASEAN (Association of Southeast Asian Nations) said in an email.

In an email, Sarah Tan, an economist at Moody’s Analytics, said government spending and “robust” goods exports are expected to be the bright spots in the second quarter.

Data from the Bureau of the Treasury (BTr) shows that government spending rose 14.6% year-over-year to $2.76 trillion in the second quarter.

Mr Dacanay said the strong labor market may also have helped maintain household spending despite highFand high interest rates.

The country’s employment rate reached 95.9% in May, slightly higher than 95.7% a year ago. The unemployment rate also fell from 4.3% in May 2023 to 4.1% in June.

Victor A. Abola, an economist at the University of Asia and PaciFHigh employment, “very high” government spending and better-than-expected remittances have also contributed to faster growth.

Overseas remittances rose 3% to $13.37 billion from January to May, compared with $12.98 billion a year ago.

EL NIño

Meanwhile, El Niño’s impact on agriculture and slower household consumption may have limited growth in the second quarter, analysts said.

Emilio S. Neri Jr., chief economist of the Bank of the Philippine Islands, said El Niño was likely a drag on the economy early on, both on the demand and supply sides. Ffirst quarter.

Ruben Carlo O. Asuncion, chief economist of Union Bank of the Philippines, Inc., said El Niño had a “scorching impact” on agricultural employment and rural incomes.

“Apart from the severe El Niño-related drought impacts that have reduced agricultural production, employment and incomes and contributed to higher food costs, BSP (Bangko Sentral ng Pilipinas) sentiment likely reeked of more pessimism among households and business respondents. translated into moderate spending during the quarter,” he said in an email.

Mr Asuncion said “price-conscious” households may have postponed purchasing expensive consumer items until incomes fully recover.

Head inFInflation fell to 3.7% on an annual basis in June. For the FIn the first six months of 2024, headline inflation averaged 3.5%, slightly higher than the central bank’s full-year 3.3% forecast.

The BSP kept its key interest rate stable at 6.5% in June, the highest level in more than seventeen years.

“Private consumption and investment are likely to slow compared to the previous quarter as high borrowing costs continue to weigh on their budgets andFidentity,” Ms Tan said.

For the rest of the year, analysts expect growth to continue as inflation declines.

“We are hopeful that inflation will slow down [the second semester] will help further increase consumer confidence. Slower rice inflation should help free up some of the Filipino consumer’s budget to boost demand for non-food consumer items. We also expect spending on the midterm elections to rise even faster in the second semester, which will boost public sector spending,” Neri said.

BSP Governor Eli M. Remolona Jr. previously said he expects inflation to ease in the second half with the introduction of lower tariffs on rice.

Last month, President Ferdinand R. Marcos Jr. signed Executive Order No. 62, which reduced tariffs on rice imports to 15%, helping to dampen rice prices.

“We expect year-on-year growth to decline [the second semester] as the favorable base effects diminish. Nevertheless, we expect sequential growth to still be strong, especially when rice prices start to fall, freeing up a large part of household budgets and boosting private consumption,” Dacanay said.

However, Ms Tan expects full-year economic growth to be below the government’s target of 6-7%.

“In 2024, the Philippine economy is expected to grow by 5.9%, outperforming many of its regional economies. An acceleration in exports from 2023 will see this come to fruition, while private consumption will be the weakest link, meaning the economy will fall short of the government’s 6-7% growth target for this year. Still, a relatively tight labor market and healthy inflows of remittances will ease some of that pain,” she said.