Health

H5N1 bird flu vaccine, Cytokinetics, Gilead

Want to stay up to date on the science and politics driving biotechnology today? Sign up to receive our biotech newsletter in your inbox.

Good morning. Wall Street reacted strongly yesterday to the news of the H5N1 bird flu. Was it justified? We’ll discuss that today.

What you need to know this morning

US in talks with makers of mRNA vaccines about bird flu

While there is currently no indication that the US government plans to order mass production of vaccines against the H5N1 avian flu, Dawn O’Connell, assistant secretary for preparedness and response at HHS, said yesterday that there are some additional steps are undertaken.

Nearly 5 million doses of H5 vaccine stored in bulk in the national pre-pandemic flu vaccine stockpile will be put into vials in the coming months in case they are needed. Discussions are also underway with makers of messenger RNA vaccines about enabling batches of H5 vaccine that can be tested and stored; O’Connell said she hopes to have a decision on who the government will work with “very soon.”

STAT’s Helen Branswell reports that Moderna has confirmed it is involved in negotiations for its H5 vaccine candidate, mRNA-1018, which it began testing in a Phase 1/2 trial last summer. The vaccine targets the exact group of the virus responsible for the outbreak in dairy cattle. “We remain committed to using our mRNA platform to respond to public health concerns,” Moderna said in an emailed statement. The company will not disclose the doses it is testing because it has withheld that information from a public register of the process “for competitive reasons.”

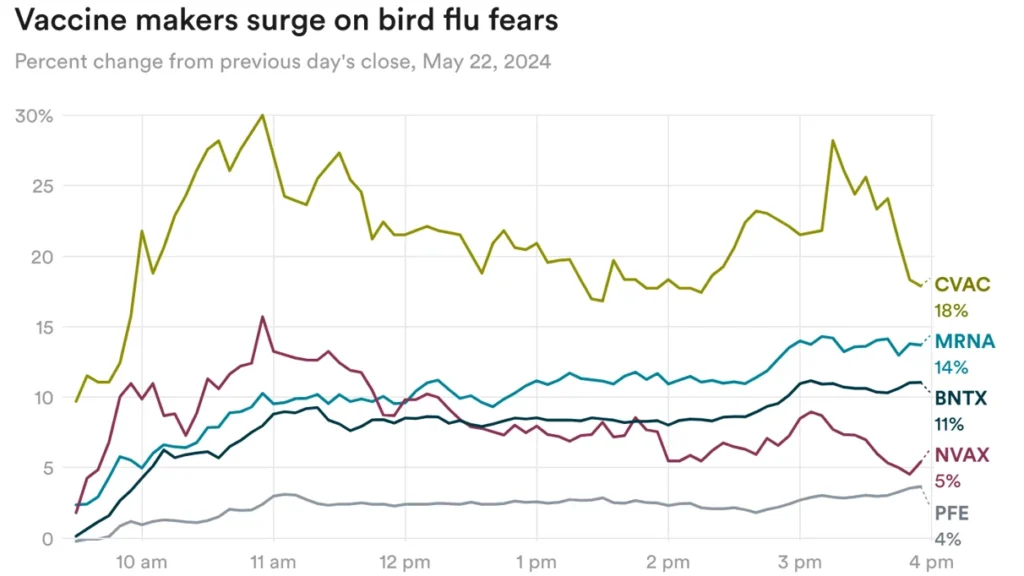

Wall Street, meanwhile, appears to be paying attention. Yesterday, Australia reported the first human case of H5N1 bird flu – in a child who contracted the virus in India – and Michigan also reported a case, sending shares of vaccine makers CureVac, Moderna, BioNTech, Novovax and Pfizer soaring.

Are these reactions exaggerated? Mizuho analyst Jared Holz wrote that he “expected these storylines to die down unless tensions became more powerful, leading to more severe reactions.”

“It would be very surprising that unless many more cases are reported, the use of Covid-like vaccines will be ubiquitous enough to sharply change the revenue numbers of the likes of MRNA or other players and see the price action as unsustainable,” he said. .

A Cytokinetics takeover now seems more unlikely

Cytokinetics said yesterday it agreed to pay Royalty Pharma a higher royalty for a heart drug expected to hit the market soon, in exchange for up to $575 million.

Shares of Cytokinetics fell in post-market trading as investors viewed the deal as lowering the chances of the biotech being acquired by a major pharmaceutical company. Investors are skeptical that Cytokinetics can independently market its heart drug, called aficamten, because it conflicts with a similar treatment sold by pharmaceutical giant Bristol Myers Squibb.

Read more from Matt Herper and me.

Gene silencing is the latest target for obesity drug developers

ILLUSTRATION BY MARIAN F. MORATINOS

Every quarter, my colleague Allison DeAngelis and I meticulously scour company publications and clinical trial information to gather all the details about the latest obesity drugs in development.

In the latest update to our obesity drug tracker, we now list around 115 treatments in development, a sign of how fierce the competition is in the obesity space. We’ve also noticed an emerging trend: Some companies are now trying to use RNA interference to develop treatments that could have longer-lasting weight-loss effects than Wegovy or Zepbound.

Regeneron, Alnylam, Wave and Arrowhead are conducting studies on preclinical RNAi candidates, and even Novo Nordisk sees potential in this mechanism.

Learn more about the genetic targets these companies are pursuing, and check out our updated obesity drug tracker. (We’ve added some new features that make it easier to sort medications by stage of development and route of administration.)

Combining GLP-1s with software treatments

Click, a digital therapy company, is trying something new with GLP-1 drugs: It is acquiring the assets of another company called Better Therapeutics, which has developed a software-based treatment for diabetes, and will try to adapt the technology for use alongside GLP-1 medications.

Better’s software, called AspyreRx, is a prescription app that delivers cognitive behavioral therapy and has been shown to lower A1c levels in people with type 2 diabetes. Although this technology was approved by the FDA, it was slow to gain commercial attention, and Click hopes to revive it by combining it with drugs.

Read more from STAT’s Mario Aguilar.

Gilead’s coronavirus antiviral drug shows promise in mice

In a new mouse study, a small antiviral molecule from Gilead called obeldesivir was found to be effective against a range of coronaviruses, including ones that have so far only been identified in animal populations and could potentially spread to humans.

Even with effective vaccines, there remains a need for new antiviral drugs against the coronavirus to protect people who have weakened immune systems or have not been vaccinated. It remains to be seen how obeldesivir will perform in humans.

Read more from STAT’s Annalisa Merelli.

Read more

- FDA about to release clinical trial diversity guidelines, STAT

- FDA’s Marks and Woodcock Talk Regulatory Flexibility for New Drugs for Rare Diseases Endpoints

- Opinion: Advocating for Fair Compensation in Clinical Trials, STAT