Finance

How Magnificent 7 affects stock market concentration in the S&P 500

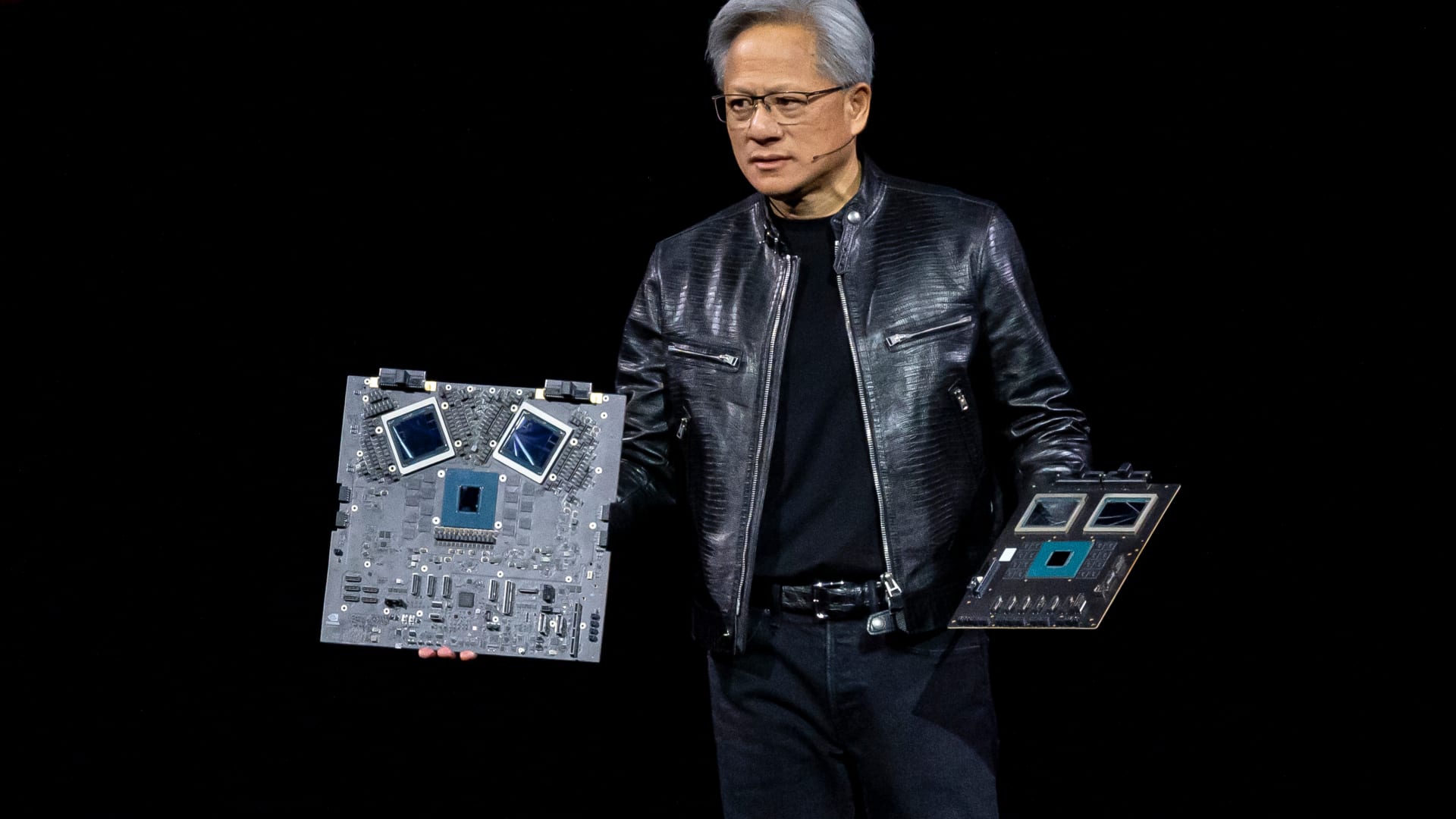

Jensen Huang, co-founder and CEO of Nvidia Corp., shows off the new Blackwell GPU chip during the Nvidia GPU Technology Conference on March 18, 2024.

David Paul Morris/Bloomberg via Getty Images

The US stock market has been dominated by a handful of companies in recent years. Some experts wonder whether this “concentrated” market is putting investors at risk, though others think such fears are probably exaggerated.

Let’s take a look at the S&P500the most popular benchmark for American equities, as an illustration of the dynamics at play.

The top 10 stocks in the S&P 500, the largest by market capitalization, accounted for 27% of the index at the end of 2023. almost double the share from 14% a decade earlier, according to a recent Morgan Stanley analysis.

In other words, for every $100 invested in the index, about $27 was funneled into the stocks of just ten companies, compared to $14 a decade ago.

That pace of concentration increase is the fastest since 1950, according to Morgan Stanley.

It has risen even further in 2024: The top 10 stocks accounted for 37% of the index as of June 24, according to FactSet data.

The so-called “Magnificent Seven” – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia And Tesla – make up about 31% of the index, the report said.

‘A little riskier than people realize’

Some experts fear that America’s largest companies have outsized influence over investors’ portfolios.

For example, shares of the Magnificent Seven would account for more than half of the S&P 500’s gains by 2023, according to Morgan Stanley.

Just as these stocks helped boost overall returns, a downturn in one or more of these stocks could put a lot of investor money at risk, some said. Nvidia, for example, lost more than $500 billion in market value after a recent three-day sell-off in June, sending the S&P 500 into a multi-day losing streak. (The stock has recovered somewhat since then.)

The S&P 500’s concentration “is a little riskier than people realize,” says Charlie Fitzgerald III, a certified financial planner based in Orlando, Florida.

‘Almost a third of it [the S&P 500] is in seven stocks,” he said. “You don’t diversify if you concentrate so much.”

Why stock concentration does not have to be a problem

The S&P 500 tracks the share prices of the 500 largest listed companies. This is done on the basis of market capitalization: the greater a company’s share valuation, the greater its weighting in the index.

The euphoria of tech stocks has helped increase concentration at the top, especially among the Magnificent Seven.

Collectively, shares of Magnificent Seven are up about 57% over the past year, as of the market close on June 27 – more than double the 25% return of the entire S&P 500. Chipmaker Nvidia’s stock alone is tripled in that time.

More from Personal Finance:

Americans are struggling to shake off “vibecession.”

Retirement “super savers” have the largest 401(k) balances

Households have seen their purchasing power grow

Despite the sharp increase in stock concentration, some market experts believe the concerns may be overblown.

First, many investors are diversified outside of the U.S. stock market.

For example, it is “rare” for 401(k) investors to own only a U.S. stock fund, according to one recent analysis by John Rekenthaler, vice president of research at Morningstar.

Many invest in target date funds.

A Vanguard TDF for near-retirees has a roughly 8% weighting against the Magnificent Seven, while one for younger investors who plan to retire in about three decades has a 13.5% weighting, Rekenthaler wrote in May.

There is a precedent for this market concentration

Moreover, the current concentration is not unprecedented by historical or global standards, according to Morgan Stanley’s analysis.

Research by finance professors Elroy Dimson, Paul Marsh and Mike Staunton shows that the top 10 stocks made up about 30% of the U.S. stock market in the 1930s and early 1960s, and about 38% in 1900.

The stock market was just as concentrated (or more so) around the late 1950s and early 1960s, a period when “stocks were doing just fine,” says Rekenthaler, whose research has examined markets since 1958.

“We’ve been here before,” he said. “And when we were here before, it wasn’t particularly bad news.”

When there have been major market crashes, they generally don’t seem to have been linked to stock concentration, he added.

Compared to the world’s 12 largest stock markets, the U.S. market was the fourth most diversified at the end of 2023 – better than Switzerland, France, Australia, Germany, South Korea, the United Kingdom, Taiwan and Canada, Morgan Stanley said.

‘Sometimes you can be surprised’

Large U.S. companies also generally appear to have the profits to support their current high valuations, unlike during the height of the dot-com bubble in the late 1990s and early 2000s, experts say.

The current market leaders generally have that higher profit margins and return on equity” than those in 2000, according to a recent report from Goldman Sachs Research.

The Magnificent Seven are “not pie in the sky”: they generate “tremendous” income for investors, says Fitzgerald, director and co-founder of Moisand Fitzgerald Tamayo.

“How much more gain can be achieved is the question,” he added.

You don’t diversify if you focus like that.

Charlie Fitzgerald III

certified financial planner based in Orlando, Florida

Concentration would be a problem for investors if the largest companies had related businesses that could be negatively impacted at the same time, at which point their shares could fall at the same time, Rekenthaler said.

“It’s hard for me to imagine what would hurt Microsoft, Apple and Nvidia at the same time,” he said. “They are in different aspects of the tech market.”

“To be honest, sometimes you can be surprised: ‘I didn’t see that kind of danger coming,’” he added.

A well-diversified stock portfolio will include the stocks of large companies, such as those in the S&P 500, as well as those of mid-sized and small U.S. companies and foreign companies, Fitzgerald said. Some investors might even move into real estate, he said.

A good, simple approach for the average investor would be to buy a target date fund, he said. These are well-diversified funds that automatically change asset allocation based on the investor’s age.

His firm’s average portfolio of 60-40 equity bonds currently allocates about 11.5% of its total holdings to the S&P 500 index, Fitzgerald said.